Since the unfolding of the banking crisis, the market has been in “buy the dip mode.” Why? We have no idea. The risks are tangible, yet the market keeps pressing higher. It’s very hard to be a bear these days, and as we have indicated many times, the loaded side of the trade, rarely gets the spoils.

Last weekend we discussed this at length, yet the steady drumbeat of bearish sentiment rolls on. There is no shortage of bearish retail folk on Twitter ready to pounce on every bullish statement we make. Yet here we are. The SPX is above the pre SVB shutdown high and has rolled over bears every time they press their chance to push the stock market lower.

We have been telling our readers all year that the market is likely stuck in a big range, and will frustrate bears and bulls, who chase every swing. This is for now, an active trader’s market (buy weakness and sell strength). The only index that has managed to make real headway is the Nasdaq. This was not the case last year and rarely does the market reward the same trade twice.

Back on Oct 9th, we posted this on Twitter about considering buying the large cap FANG names, and the vitriol that was spewed was incessant, rude and loud.

Fast forward to today, and this index is now up +28% vs the rest of the major indexes only up +10 to +12%. Quite the outperformance.

We cleaned up on this trade as did our readers. $NVDA was one of our standouts, trading up over +80%. Twitter is an amazing sentiment tool, and only increases our conviction when the cheap seat comments are overconfident and boisterous.

Interestingly enough, the banking crisis has only emboldened them to bark louder. We are not going to tell you why this is happening, as the macro is undoubtedly worsening, but we know sentiment can be very powerful. Couple that with very positive seasonality, and very offside institutional positioning, and you have a cocktail to surprise the masses. Put simply, the pain trade is higher.

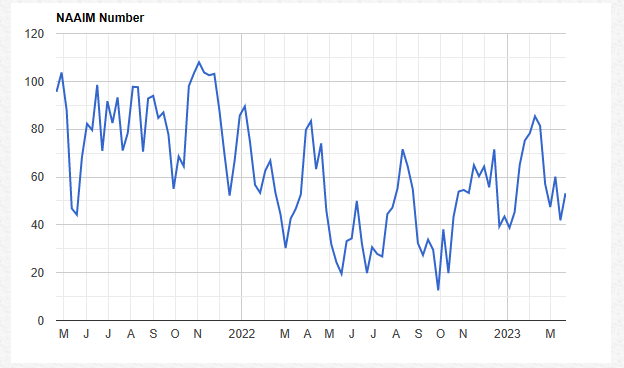

We were very bullish coming into the year and sold all of our tactical long exposure into the Feb peak, right before the institutions decided to gross up their long exposure. “Sold to you,” we guess. This is evidenced in the NAIIM exposure, which currently went from 85% long to 42%, just 2 weeks ago. Basically, they cut their exposure in half, and historically, this is a very low number which corroborates our statement above, regarding institutions being offsides.

Since the Feb peak we have been mainly index neutral, trading the swings both short and long. We drive our ultimate exposure on a weight of the evidence approach. When we get alignment and confluence, we swing big. When we only get a few pieces of the puzzle, we trade less and smaller. This has served us and our readers well, as we avoid getting chopped up in a trendless market, but we clean up on the biger moves.

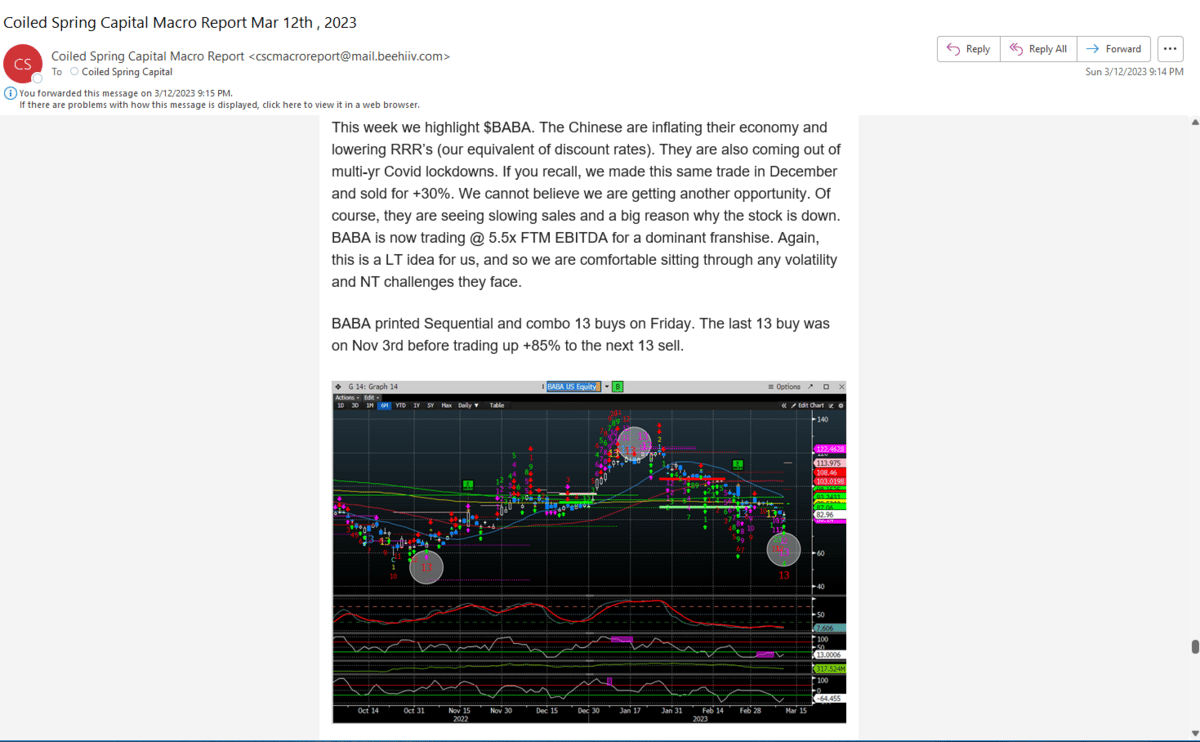

Just in the last week, we have recorded +15% on $GOOGL, +4.5% on $IWM, +9% on $USO, and most recently +22% on $BABA.

Here is an excerpt from our Mar 12th report on $BABA.

Bottom line, we still find ways to add value despite being in a very tricky and directionless market. We will suggest another single stock idea in this report.

Please consider becoming a premium member below to read more.