Due to our heavy international schedule, this publication will be truncated and succinct.

Did the market just top? We have been looking for momentum breaches since early Feb and they have been almost non-existent. The indexes have been powering forward and ignoring the negative divergences and DeMark sell signals. We do not follow any signal blindly, and we certainly do not look at any signal in isolation. We attempt to paint the mosaic of the market and weigh the evidence.

Last week we saw the Russell breakout from an almost 2-year consolidation. 2-year consolidation breaks are nothing to ignore. Something that has spent so much time under a level, failed multiple times and then breaks out, implies we need to take notice. Should we interpret this break as a handing of the torch from large cap leading to laggard rotation. It certainly has felt like that recently.

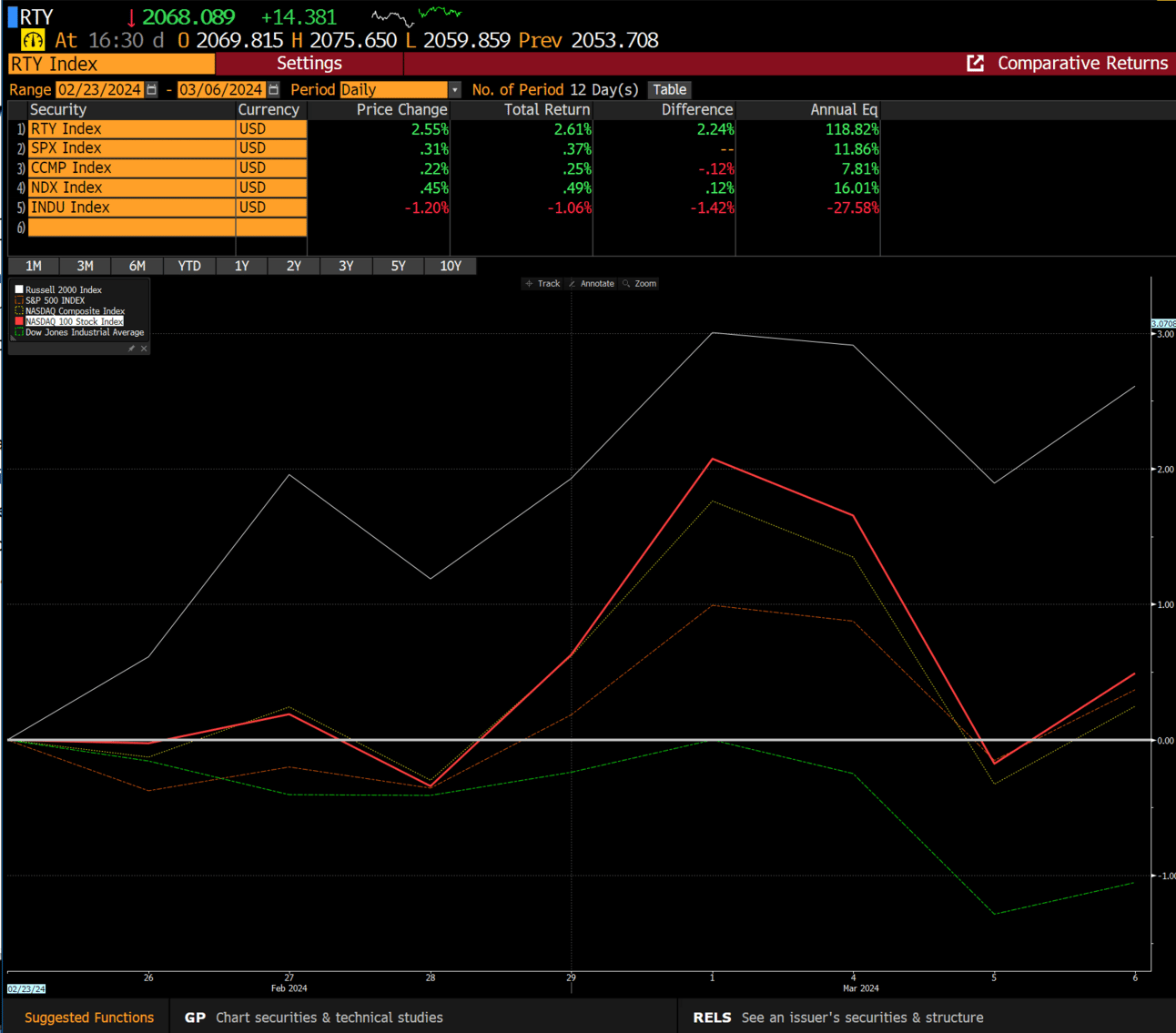

Here is the performance since our bullish call on the Russell 2 weeks ago. Over 200 bps of outperformance is nothing to sneeze at.

There are so maybe pockets of strength in the stock market that nobody wants to talk about because they aren’t tech.

While tech is what grabs the most attention and is the most fun to discuss for their eye-popping volatility, we are quietly seeing a good number of large companies trudging relentlessly higher. Here are a few:

HD is at a 2 year high.

COST doesn’t want to seem to ever go down.

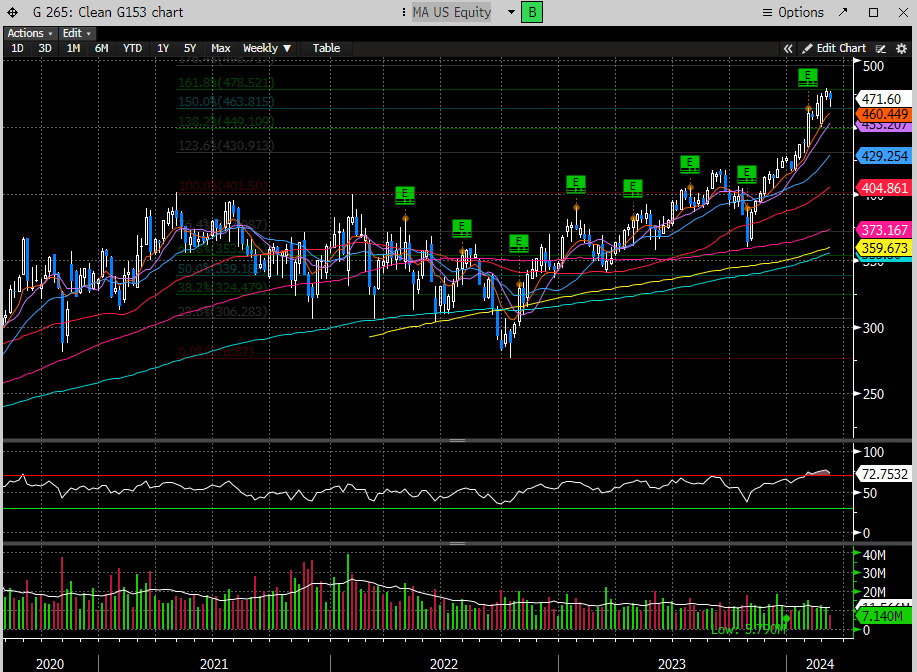

MA has been on an absolute tear.

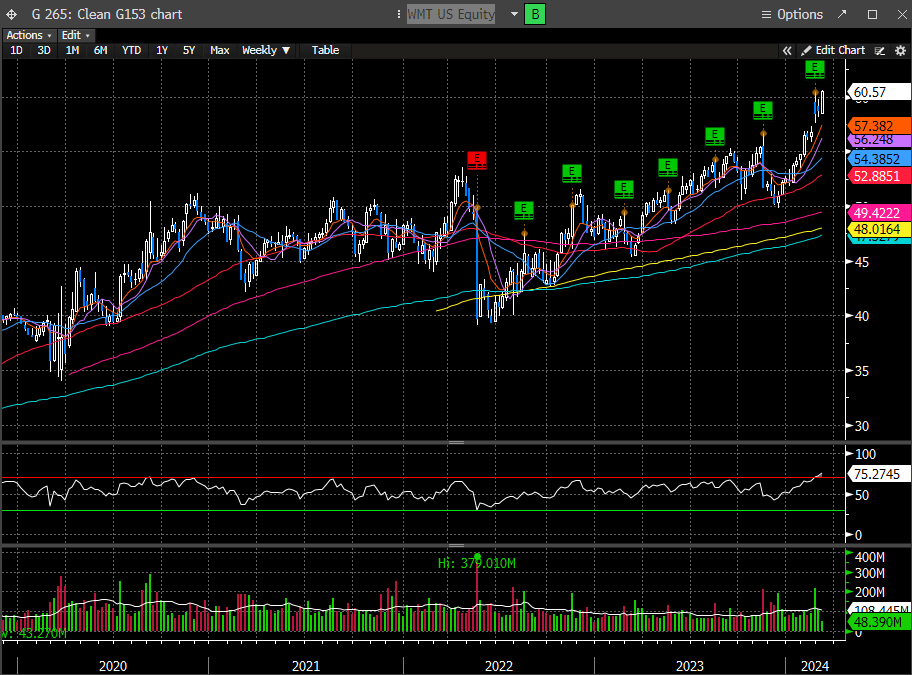

WMT is making new ATH’s.

CMG must be selling a ton of burritos.

JPM is at an ATH.

AXP looks like a tech stock.

CAT is almost 50% above its ‘21 high.

These are some of the biggest companies in the world that aren’t in the Mag 7. If these stocks are representative of major consumer and commercial segments of the economy, what’s that tell you about said economy.

The point is there are lots of companies that are doing extremely well that aren’t talking up their AI initiatives. While the Mag7 does carry the most weight in the indexes, peel the onion a little and you will see some of the most important companies from an economic activity standpoint completely humming.

So, what’s this mean for the stock market?

Subscribe below to find out.