We apologize for not getting this out sooner, we have had a few technical issues this evening.

The stock market picked up where it left off last week and remains aggressively for sale. We have been warning our readers for weeks to play defense and to be careful deploying capital. Not only was the market set up for downside but the geopolitical events, kickstarted a new wave of volatility to an already fragile situation.

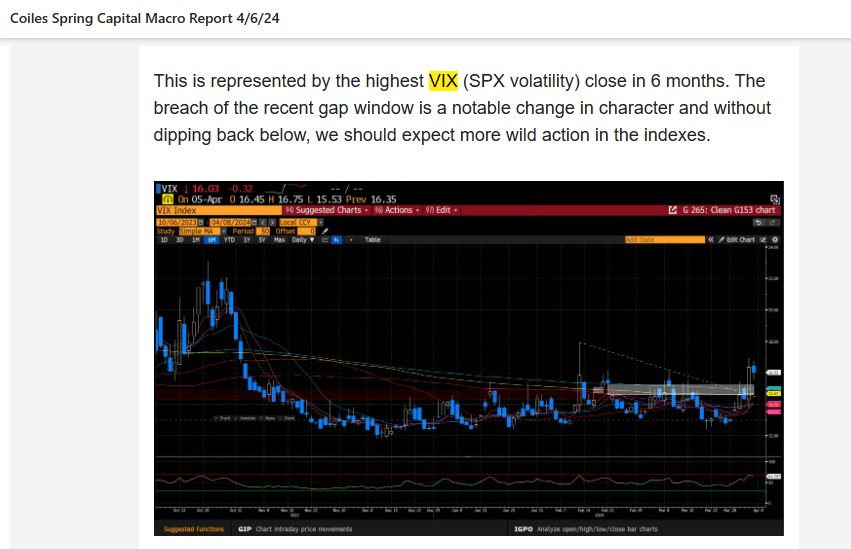

We wrote this in our 4/6 report discussing the notable “change in character” for the VIX.

The VIX has since catapulted another +20% to its highest level in 6 months.

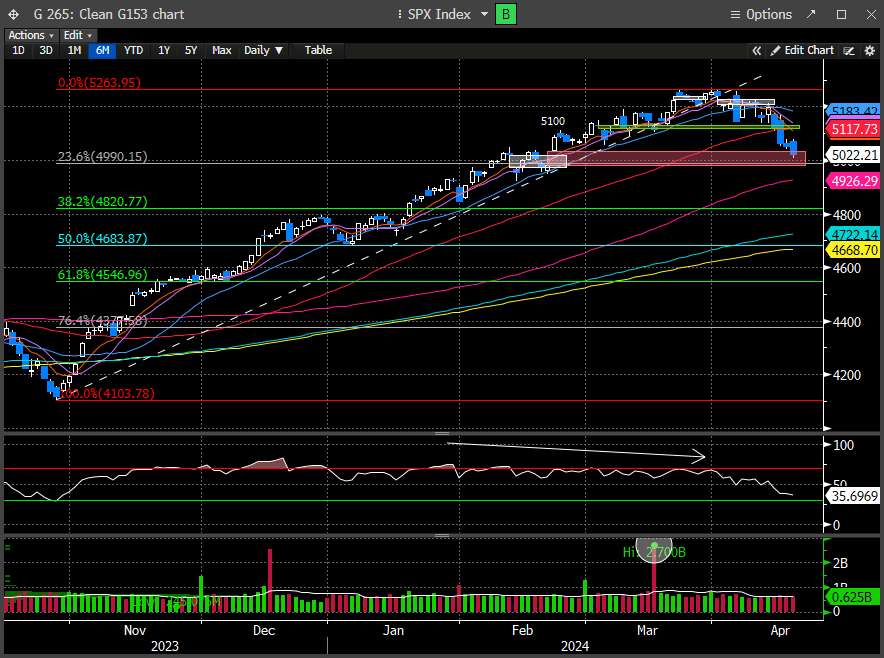

When we wrote that report, the SPX was still above 5200 and now is trying to hold on to 5K, just 2 weeks later. The red gap window from Feb 21 is now being visited and an area we expected to test if the 50 day MA was lost. This all happened in the last 3 days. Remember, risk happens slow and then all at once.

We are now almost -5% from the recent ATH, almost in line with the garden variety -6% correction.

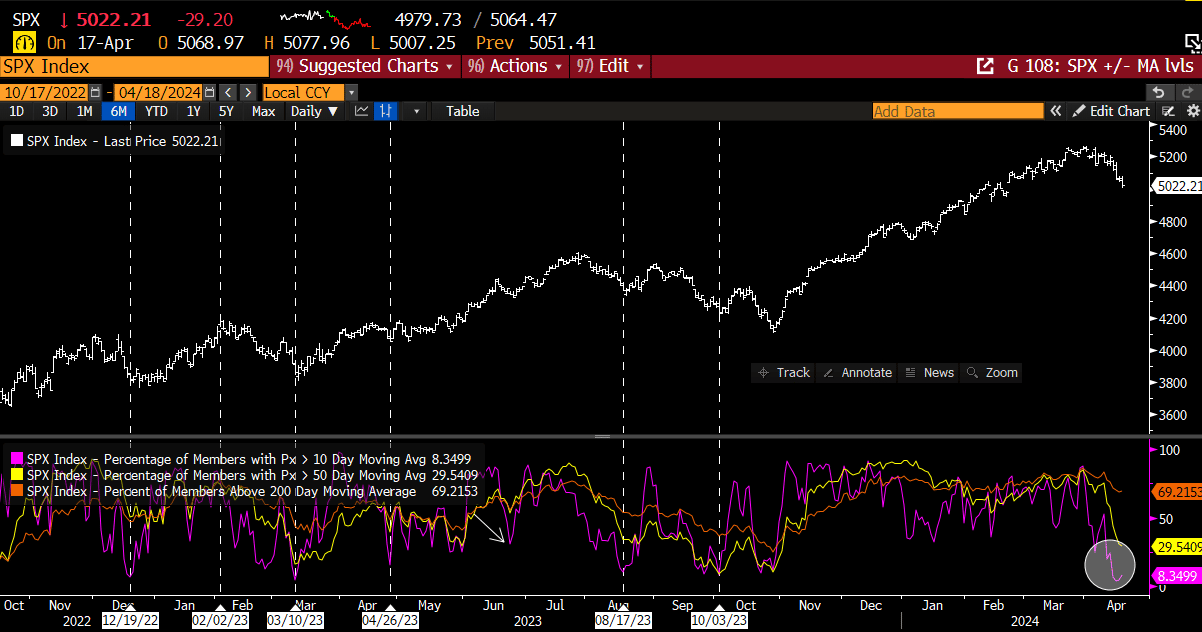

But we must admit, we look at hundreds of stocks nightly for our institutional clients, and it looks much worse than the indices are suggesting. We can thank the Mag 7 and their hefty weightings for this masking of reality.

Below is a chart of the SPX and its constituents in relation to their moving averages. Stocks below the 10-day MA, were less than 4% at one point today before rebounding. To put that in perspective, this mirrors the levels of last March and the Sept/Oct ‘22 lows. At that time the SPX was in the 3500-3700 range which were the SPX lows for the cycle.

Does this mean the market has to rebound from here? Of course not, but to think the market hasn’t been getting sold aggressively in such a short time span is unfounded. As an old Wall Street friend of ours, Carter Worth, used to say, “it’s so bad it’s good.” We particularly like this colloquialism because DeMark analytics and a cornerstone of our analysis, attempts to identify trend exhaustion vs trying to buy momentum. Identifying momentum is easy, calling for trend change when everyone is betting for the opposite takes courage and skill.

The current macro picture remains undeniably murky. Not only do we have geo-political uncertainty in one of the most volatile parts of the world, but we also have notable Fed frustration with the stubbornness of inflationary forces, sending bond yields back to levels when Powell pivoted in Nov ‘23, which sent the SPX on a +28% bender.

We have been very lightly positioned during this correction, and we thank our rigorous analysis for steering that ship to safety. That doesn’t mean we don’t get stung by reversals in the stock market. We do, we always have LT money in stocks and attempt to trade swings, but our drawdowns are far less severe these days vs historical. We like to think we are wiser and more sophisticated, but the reality is, we just let our analysis guide us, and so far, it has kept us on the right side of this correction.

So that begs the question: “is it so bad it’s good?”

As a premium subscriber, you now have one day to act on our promotional idea tier. This offer is only good until the end of day tomorrow. There is no commitment, but the discount will not be repeated. We only want subscribers who are committed to the process. That means, they understand that we are not going to trade just for the sake of trading. If the conditions are not right, then we will largely sit out of the fight. We know that when the tide turns, and it will, that the feast will be bountiful. And for that inevitability, we need a clear head, a calm mind, and a war chest of cash. Do we think that comes this week? We do not. It may not even come this month. Being patient is part of being a good trader/investor. Forcing trades is how you burn holes in your bank account.

We took a few lumps this week, but our cumulative performance is still over +700%. We welcome this correction, as the opportunities that will come out of it will enable us to compound our gains faster because we will have ample capital to deploy quickly.

We hope you join us.