Last week, we saw considerable carnage in certain areas of the stock market. We are certain late bears were pressing their luck with short positions into Friday’s close. Unfortunately for them, the market did what we expected it to do and rebounded. History was clearly against them as six down days in a row for the SPX hadn’t happened in 4 years.

Here is a quick snapshot from last weekend’s report:

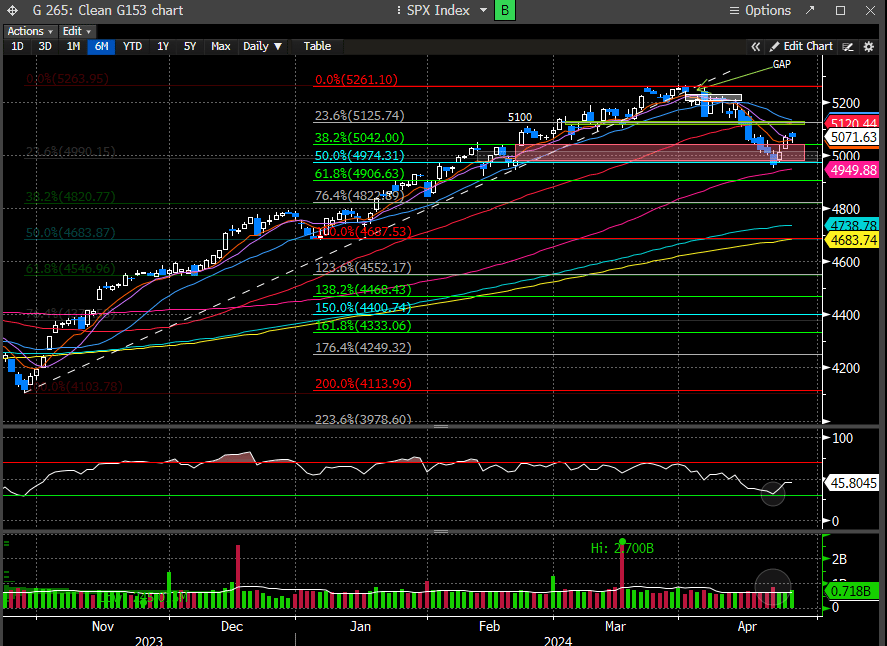

We had been targeting a zone for a bounce in the 4980 - 5040 zone, and the SPX bottomed at 4967.

While the SPX overshot the bottom end of our range, the DeMark Trend Factor levels we shared a couple of weeks ago with our readers were much more precise. The Trend Factor level was 4972.

The Nasdaq Trend Factor level was also quite close in calling the support level (15178 vs. 15222).

We explicitly mentioned that a bounce was imminent. Here is the excerpt:

But that doesn’t mean we were positioning long for a counter-trend bounce. We prefer higher probability bets, and to take that long position would have required other conditions to be satisfied.

The current rebound has only taken the SPX back up to the 38.2% Fib retracement level from the peak. This is a perfectly normal retracement and doesn’t imply the bear trend is over.

The Nasdaq retraced closed to the 50% level but settled around the 38.2% Fib.

After the bell we received enough poor tech earnings that the bear likely resumes tomorrow. META led the charge and is down almost 20% on a small beat but ramped up their spending on AI. This is a stark reminder of the days of the metaverse, where Zuckerberg told investors to be patient with spending, which seemingly continues to be a large cash drain. Reality Labs, the division inside META that is spearheading that effort, lost $16B in 2023. The new forecast of $35B -$40B for AI spending was above the prior guidance of $30-$37B. And despite what seemingly appeared to be a sales miss against very high expectations, they still grew sales +27% when compared to the same Q last year. For a company this size, that’s pretty remarkable. Regardless, Wall Street has little patience for their endless cadence to spend, and until the AI bets deliver profits, META will be put back in the penalty box.

We will offer levels to consider for META in the premium section.

The issue with the META report is the perception that AI will be a continued cash drain for most companies with very little profit to show for it. GOOGL reports tomorrow and will undoubtedly get painted in this light, as they are also engaging in the AI race vs META and will have to spend considerably to match their efforts. This sort of contagion can certainly spill into the rest of the market as the AI spending debate will be inflamed. Last year the initiative to spend on AI was viewed positively, but what if it now becomes a dirty word?

IBM and NOW also reported after the bell and were equally disappointing.

We now have to ask, was last week’s massive stock market reversal discounting the reality of a less-than-stellar earnings season for growth stocks?

It’s certainly possible.