We had a conversation the other day with someone claiming that the stock market was ignoring the macro. Quite frankly, we are not sure what he was referring to because the stock market has been getting whipped around by the macro for the last 2 years. This was even more pronounced this past week, when Powell seemingly went surprisingly dovish at the FOMC meeting, confirming the rotation we were seeing in other sectors and in SMID caps. On Friday, we saw a cooler than expected PCE inflation report, giving us increased confidence that the rotational trade would gain momentum this week and for most of Apr. That was clearly incorrect because Monday the US Manufacturing PMI rose the highest in 2 years, causing treasury yields to break out, and in turn causing stock market dislocation.

Talk about a macro whipsaw all in the span of 1 week. This was not the outcome we were hypothesizing.

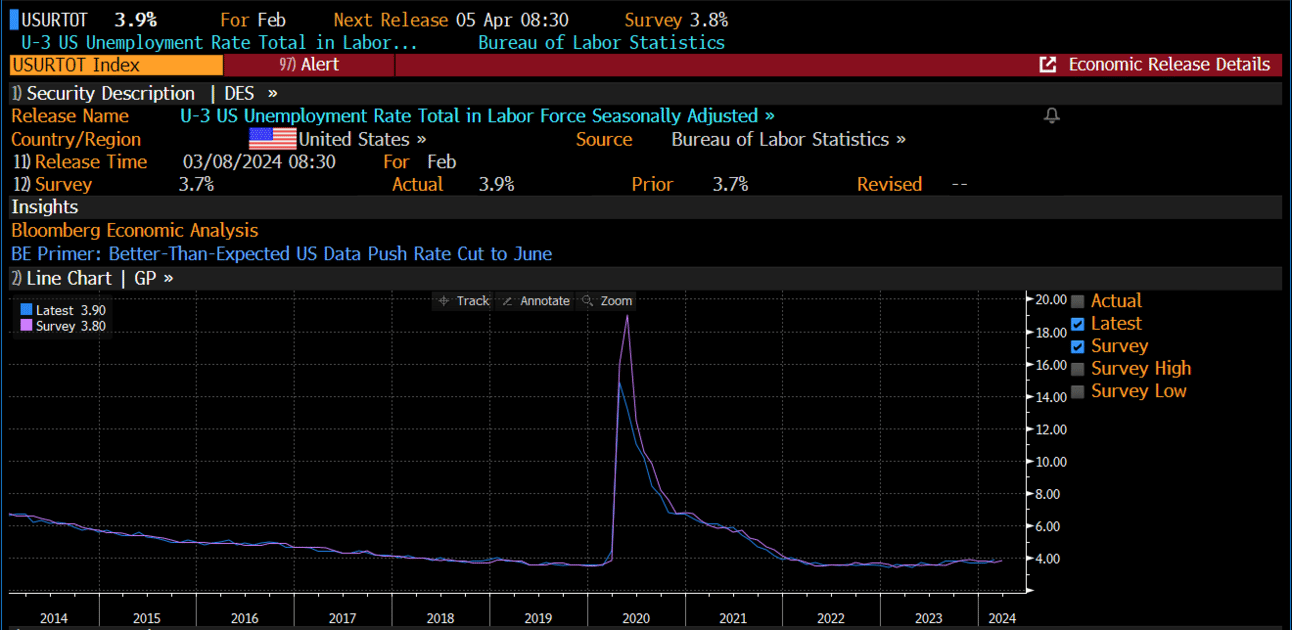

The rate cut trajectory dipped below 50% on Monday post the report only to shoot back up to 57% after todays ISM services growth cooled.

This stands in stark contrast to the ISM data earlier in the week showing a manufacturing cost-input gauge that climbed to the highest level since July ‘22, suggesting the pace of goods disinflation is leveling off. Today’s services price data may assuage the growing concern that the Fed’s progress on inflation is at risk of stalling. Talk about a macro maelstrom. This does not make for an easy trading environment as each report shifts the narrative, with macro funds funneling cash in and out of interest rate sectors.

One of the most interest rate sensitive sectors is real estate.

The IYR (Real Estate ETF) collapsed this week.

HD, which is tied to housing, also saw its stock fall out of favor.

Thes are big moves in big instruments and are usually the result of an unwind. The trade to get long interest rate sensitive stocks post a dovish Powell was abruptly reversed.

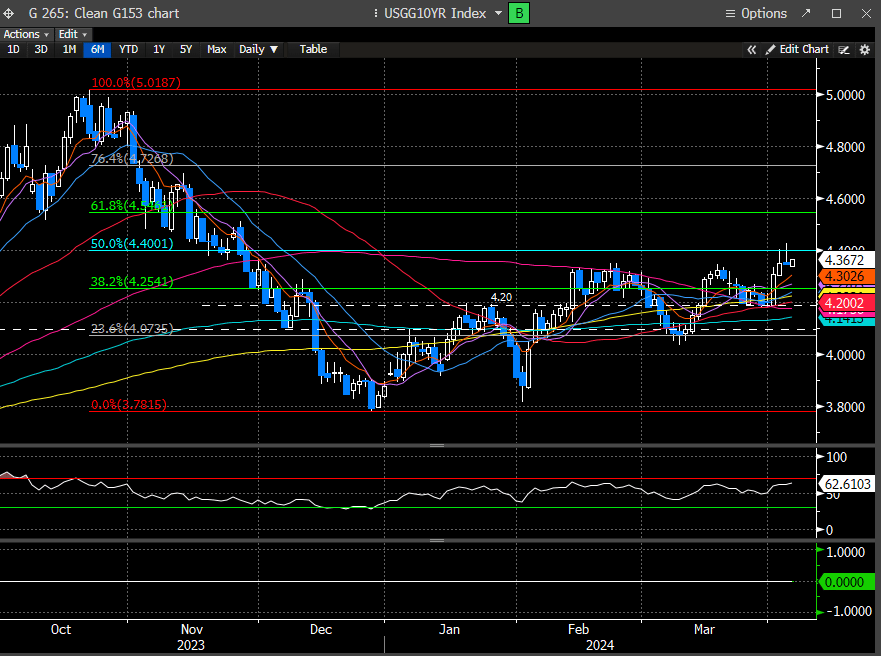

Over the weekend, we mentioned that treasury rates were sitting at levels where they could break up or down, and we thought given the cooler reported PCE and the fact that the bond market was closed on Friday, that bonds would rally this week.

Post the unusually strong ISM report on Monday, the 2 year catapulted higher.

The 10-year treasury traded the highest since last Nov, right around the time the stock market began its 5 months rally. At that time, yields were in very well-defined downtrend. Fast forward to today, and this looks more like an inverse head and shoulders reversal pattern. Quite the different picture.

Despite all of these contrasting macro reports, Powell gave a speech today and didn’t alter his messaging. He still advocated a data dependent approach and that it was too soon to say whether the recent inflation bump was sustainable. This implies status quo, and to expect rate cuts this year, despite the clear angsty signals the bond market is sending.

This can mean only one thing, to expect more volatility in the stock market, especially around days when there is a meaningful macro report. This Friday we will get payrolls, and given the underlying strength in the economy, we doubt it will be weak.

To exacerbate market confusion, next week we will get another CPI report.

We guess it’s time to strap on a seatbelt, and wear a helmet, because the next couple of weeks could be a little turbulent.