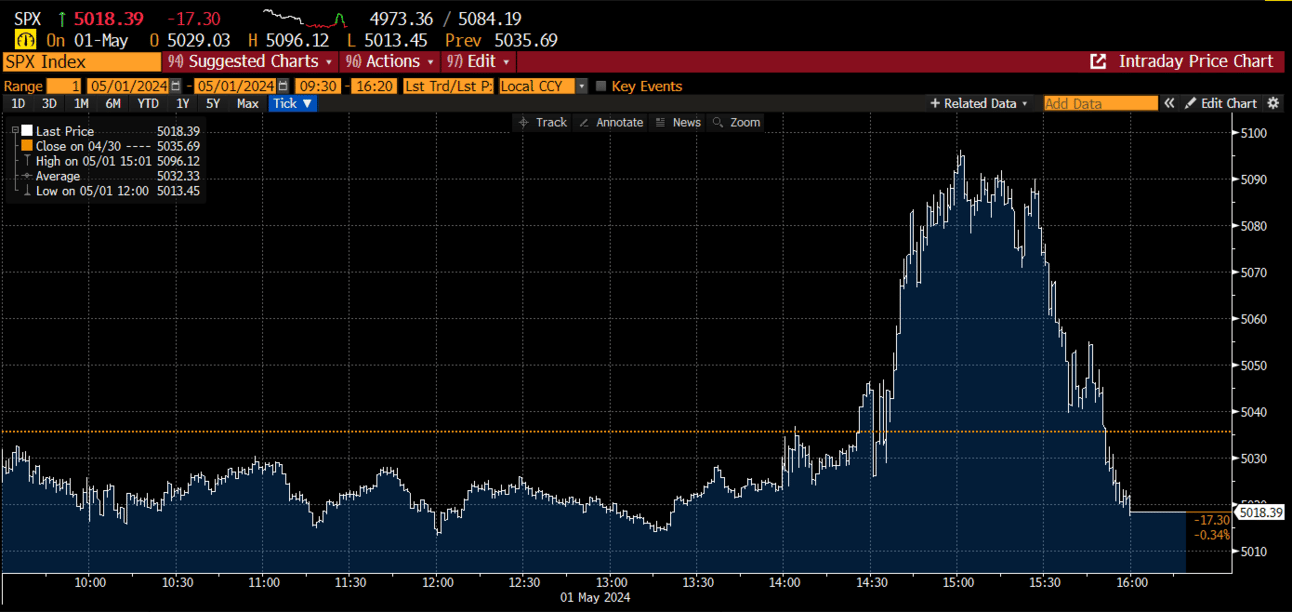

Coming into this week, we knew it would be difficult to navigate the stock market, and so far, that has proven to be an understatement. The massive gyrations between good and bad earnings reports mixed in with a myriad of macro releases, culminating in an FOMC meeting that was cheered in the stock market for an hour, only to quickly reverse in 30 minutes, is mind-numbing. Fed days are notoriously volatile, but this seemed a bit extreme. What seemingly was a hawkish message, and well expected, turned violently bullish following remarks of no rate hike and faster relief from QT.

Intraday the SPX rallied 1.6% only to give it all back.

Why did the market reverse? There are several theories, one being the volatility unwind post the event, and another being the reality of no rate cuts in the near future. The latter doesn’t seem to make sense because the pace of rate hikes being discounted in the Fed Fund Futures actually increased. That should, in essence, be bullish for markets.

There is now 140% chance of 2 cuts by Dec and 94% chance of one in Nov.

Putting volatility aside, the FOMC’s messaging was somewhat status quo. Powell moved closer to a neutral stance vs. a hawkish one, as some feared.

Something we noticed that isn’t being widely discussed is the collapse of oil. Oil is very sensitive to any economic slowdown. Maybe the market is disappointed that rate cuts are too far out given the underlying slowing in certain areas of the economy. It’s hard to say with any certainty if that is the cause but certainly seems to be a factor.

This mirrors the disappointing GDP forecast we saw last week. Then you sprinkle some pretty dire reports from large consumer companies and it’s not hard to paint a picture of an economy that’s rapidly cooling. Remember, the Fed is always the last to know and when they start cutting rates, it’s usually too late as the damage has already been done.

This morning, we also saw US factory activity slow with the ISM dipping below 50, which indicates contraction.

Adding to the angst, was that prices paid index in the ISM report, posted its highest reading since Jun ‘22. This only exacerbates the inflation situation.

Wrap it all together, and we have a volatile cocktail of confusion. Confused markets are difficult markets, and difficult markets are hard to make money in.

But are there any silver linings?