“Nothing but net.”

(Basketball phrase that implies a perfectly executed shot where the ball travels a smooth trajectory from the shooter's hand into the basket without any interference.)

That is how we feel after our very bullish report on the US stock market eight days ago, where we very explicitly explained the rarity of our 3-factor analysis, giving the green light to get long the stock market.

We review stock market price construction for various instruments, the most important macro inputs, and hundreds of internal indicators to look for confirmation. When all three align, we get fairly aggressive with our cash deployment, and thus far, that has paid off in spades.

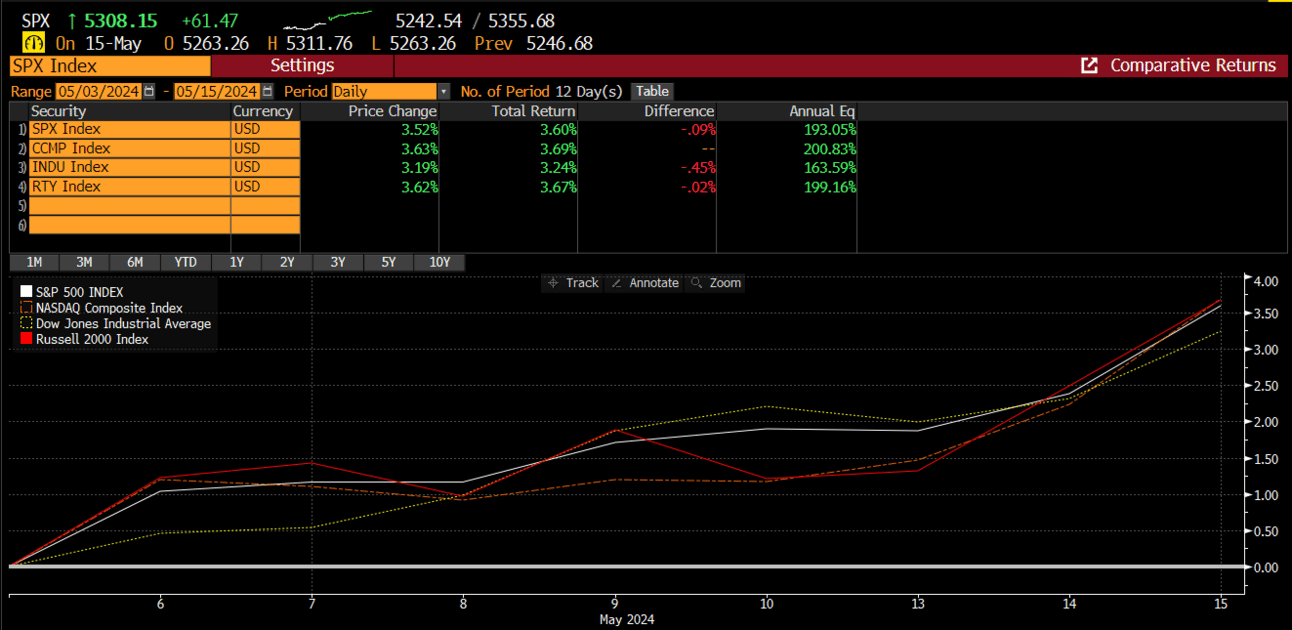

Since our 5/5 report, the major indices have all been up over 3%.

In our last mid-week report on 5/8, we offered up 3 large-cap stocks to consider: NVDA, AVGO, and AAPL.

The outperformance, when compared to their benchmarks, is notable.

While the setup coming into this week (PPI/CPI) made it difficult to be overly aggressive with new positioning, we had built up enough of a cushion from joining the rally early last week; we felt the risk/reward was justified.

Yesterday’s positive reaction to a seemingly hotter PPI increased our confidence in staying with our bullish short-term view and existing capital allocation into a possible binary CPI report.

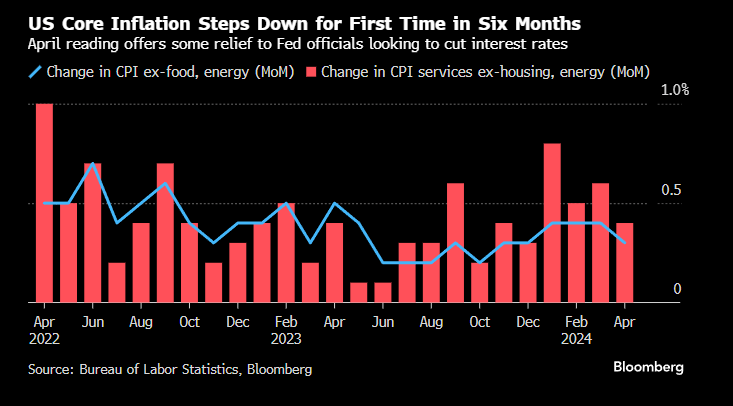

The reported CPI cooled for the first time in six months, with the core climbing .3% from March, snapping a 3-month streak of above-forecast readings. The year-over-year measure cooled to the slowest pace in 3 years.

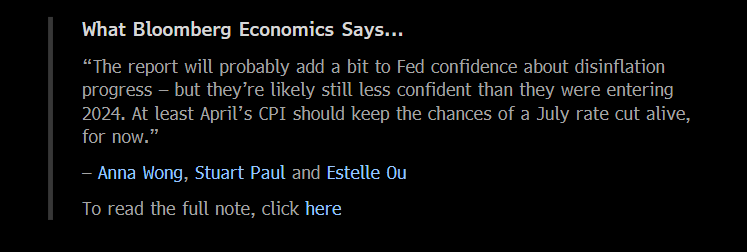

Here is a comment from the Bloomberg Economics team:

The slowing inflation reading pushed forward the odds of the first-rate cut occurring in September. Fed Fund Futures are now discounting a 63% chance of a cut in September vs. the probability to start the month at around 35%.

Changes of this magnitude in bond market futures are typically cheered by the stock market, which resulted in a new all-time-high (ATH) for the SPX.

And also, the Nasdaq.

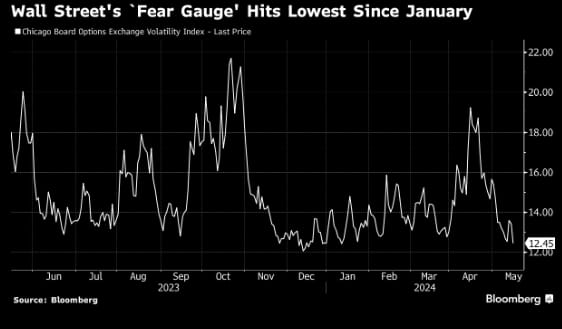

The good news on the inflation front will likely shift the narrative to revisit the soft-landing scenario and “when” the Fed will cut rather than “if” they will cut. Whether it plays out that way is anyone’s guess, but we should see a reprieve in the recent built-up anxiety until the next set of important macro releases. This increased calm is being expressed by the sinking VIX, which has been hitting the lowest levels since January. This will most likely force active managers to ramp up their exposure, sending stocks higher in the near term.

As mentioned above, we will discuss a few more ideas for premium members to consider at the base of this report. Don’t miss out - sign up below: