It turns out all-time highs are bullish. It’s just a fact. Why people must find a reason to hate bullish activity in the stock market is insanely puzzling. The main reason for all the dissension in the community of analysts, strategists, and media pundits who try to predict for a living and those who do it for a hobby is that they want to be proved right. It's a basic human condition to strive for correctness. These people will dig in so deeply that they cannot see what is actually happening around them. Ignoring all the signals for probabilistic outcomes along the way and why most of them are usually wrong.

It's important to acknowledge the dedication of these strategists and their teams, who tirelessly conduct rigorous analyses to derive their conclusions. Their work is often of top-notch quality, and at the time, their thesis for stock market direction seemed plausible.

Yet, the stock market remains an unpredictable arena, as history has repeatedly demonstrated. Even the most seasoned analysts, known for their vocal and visible stances, can find themselves on the wrong side of the market. This week, a prominent bear made a surprising shift in his outlook, a move that has not gone unnoticed.

We posted this on Twitter in February of last year, discussing his very spotty track record.

We think Mike does very good work and have always admired his analysis. Our issue is that we don’t get paid for our opinions. We only get paid to be right. We discovered a long time ago that there was a better way to analyze market trends, and that is why we have worked for years to develop a system that can identify trend change. This doesn’t mean we will get every wiggle right in the market, but it does mean that we and our clients don’t get caught on the wrong side of the market when the winds are changing. It is why we largely avoided the April stock market drawdown (-6-9%) and got aggressively long for the last stock market’s last ramp to ATH’s. We have been at this for years, and we rarely, if ever, miss a big swing in the market. Some may say we think too short-term, and maybe that is partially true, but dominant market trends last for months and years, not weeks, and we have been largely bullish since the Oct ‘22 lows.

Our strategy is simple: we follow price. But don't be fooled by its simplicity. Price in the index is just one variable. We track multiple instruments that move together and define the stock market’s symphony. This comprehensive approach allows us to stay attuned to the market's rhythm and make informed decisions about stock market direction.

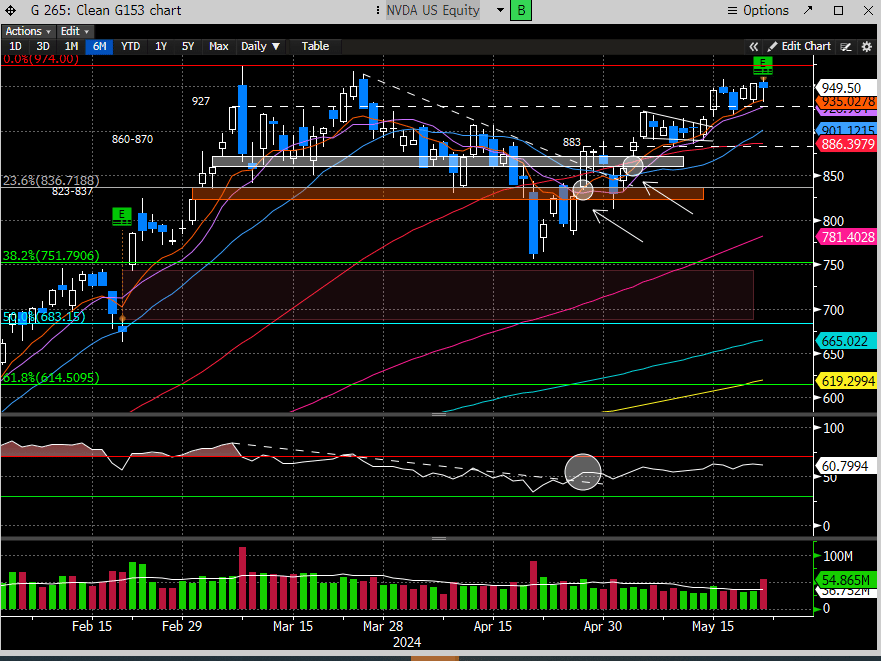

We wrote a report two weeks ago discussing why the stock market was set up to run higher. We even highlighted three stocks likely to define that setting (NVDA, AVGO, AAPL). All three of these stocks have large weightings in the indexes, and two of them are in the Magnificent7 Index. If these stocks were on the cusp of moving higher, how can one be bearish on the stock market? These are serious questions for any strategist. The market is made up of stocks, and if the biggest, most influential stocks are poised to move higher, then shouldn’t the stock market follow their path? The short answer is yes.

NVDA reported a stellar quarter after the close, and it was trading above $1000 in the after-hours.

Here is the performance of all three of these stocks measured to the close of today. These will all likely be higher tomorrow, so we are underselling their outperformance.

When we highlighted NVDA in our 5/8 report, it had already moved decently off the lows. Our point is only to stress that when stocks like NVDA are leading the market off the lows, breaking through key resistance areas, and gapping through major moving averages, there must be a reason. And now we know the reason. Ignore obvious signals like this at your own peril.

We will not discuss the importance of NVDA’s report on the overall market. We’ll let the chorus of fundamental analysts opine on that topic. But the reality is that the stock market had already been anticipating a positive reception.

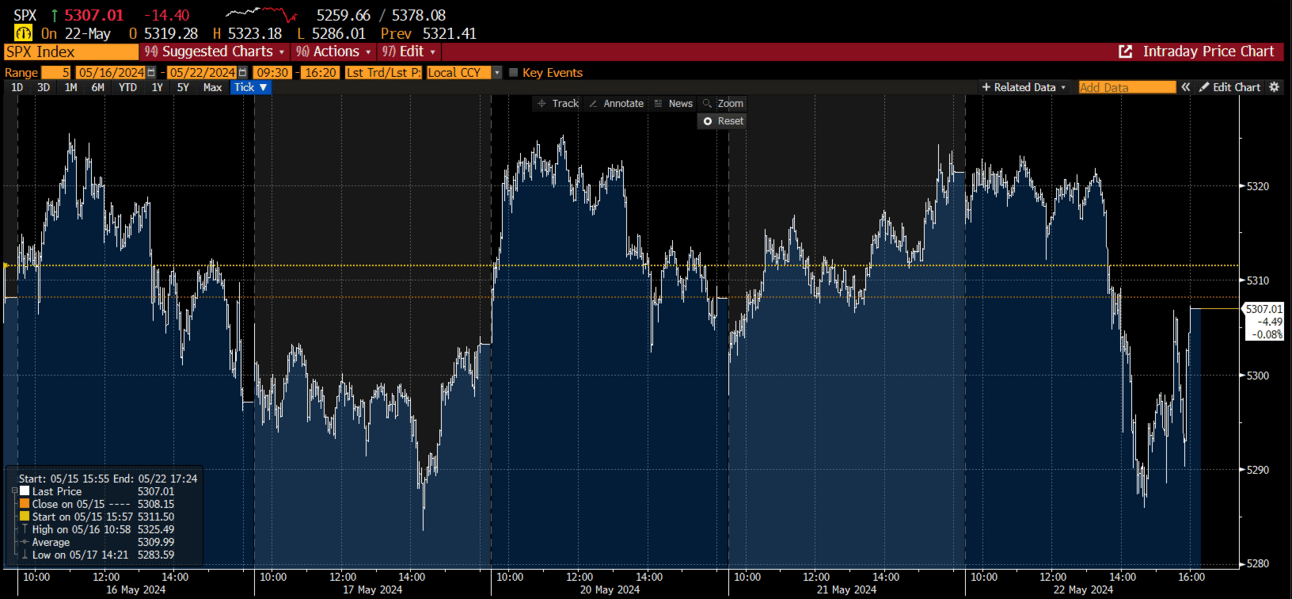

The SPX made a new ATH last week, and every day since that new high, we have traded in a fairly tight range. Consolidations above a key breakout are generally positive. When those consolidations have fairly tight ranges, that’s typically a precursor to continuation.

Here is the range for the SPX over the last 5 days (40-point range or <.8%).

The stock market should close at another ATH tomorrow, barring any major reversal.

Let’s revisit the upside levels where sellers could emerge.