This week so far has been mainly about earnings season, as the major macro-economic releases don’t get reported until next week; CPI being the most anticipated. That leaves the tail end of earnings season to drive most of the market’s gyrations. This week has been littered with catastrophic misses and large individual stock drawdowns, yet the stock market is taking them all in stride.

We are almost through with SPX earnings (439 reported), and the results have come in better than expected (as of 5/3 per Bloomberg’s table).

*79% have issued positive surprises vs. 17% reporting negative surprises.

*EPS is clocking in at around 7% growth, compared to expectations of 3.8%.

But as we alluded to above, the results seem much more bifurcated below the surface, where the market is punishing those that report lackluster results, especially in the growth segment of the Nasdaq. This implies we are in a stock pickers market.

UBER was one of the worst-performing stocks in the SPX today. They missed gross bookings, and the stock gapped down. UBER has looked fairly sick for a while, and why we have been telling clients to sell the stock. Technically speaking, when UBER was rejected at the 50 day MA, losing the upper bound of the earnings white gap window on 4/15, that would have been the signal to sell.

GPN is another great example of an SPX stock that has looked challenged for some time. GPN had given many reasons to exit before its recent earnings debacle, which sent the stock down an additional 11%. GPN has now lost 25% of its value since Feb.

Conversely, there are plenty of stocks that look great, and we’ll offer a few ideas to consider at the base of this report. As we mentioned above, this is a bifurcated market and we should only think about buying strong stocks with notable relative strength or those that have repriced higher.

In our weekend report, we discussed how we thought the stock market would break higher, and so far, that’s what’s occurred. While our thinking was that there would be more of a tug-of-war at the resistance zones, we were mistaken, and the stock market wasted no time in breaking through those areas. Bears will tell you that the volume has been light and that it’s a sucker’s rally. While we agree that the volume being light does cast some doubt on the move thus far, we follow price first. And price is breaking out. If sellers had any power, there would have been more selling at obvious key junctures. Alas, the bears did not show up when it mattered, and that speaks volumes.

Strength begets strength, and CTA’s (Commodity Trading Advisors) also follow price momentum, and when key levels are broken, notably the 50-day MA, their buying machines get activated. Couple this buying with a freshly opened stock buyback window, and it’s not hard to see why the stock market is levitating.

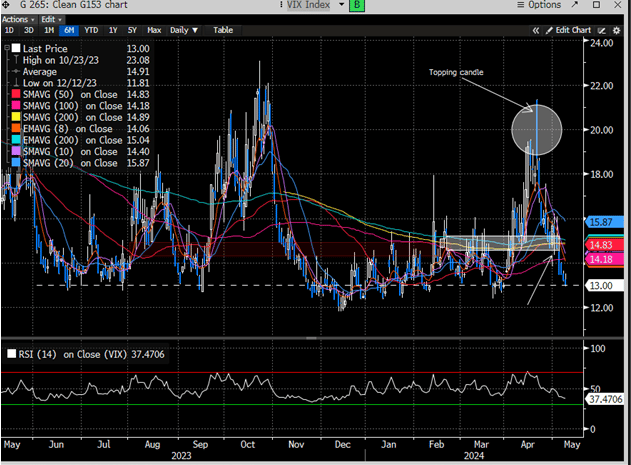

Then, there is the notion of the sinking VIX. When volatility sinks to palatable levels, we also see a new wave of buying from active managers and algorithmic funds. We pointed out over the weekend that the VIX breaking our white gap window volatility zone was a bullish indicator for upward index trajectory. The VIX is now the lowest since March and is testing a key pivot.

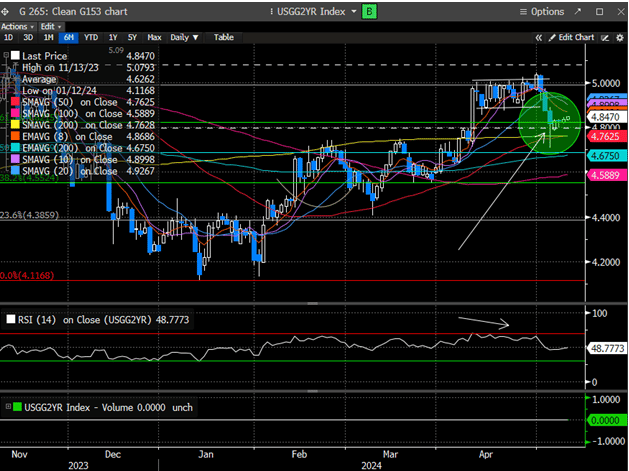

We talked about the 2-year treasury negating the bull flag structure and falling into key support. Lower rates are supportive of risk assets.

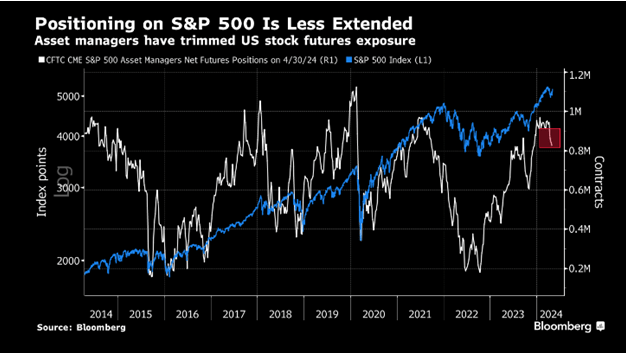

We highlighted that sentiment remains fairly subdued, despite not being that removed from the all-time highs (ATH’s) in the major indexes. And now we are seeing positioning in futures exposure, fall off.

Does this mean the stock market is signaling an all-clear and that we should put all of our chips into the pile?

Subscribe below to read our conclusions.…. We also have 3 ideas to consider at the base of the report.