There were several unanswered questions we had coming into this week that we discussed in our weekend report, forcing us to approach this week cautiously.

1) Would NVDA see a sell-the-news post-split reaction and derail the market or would money flow into lagging names and sectors?

2) Would inflation re-acceleration rear its ugly head on the CPI report?

3) Would the FOMC deliver a hawkish surprise?

Unfortunately, we did not have a strong opinion on any of the above to formulate a directional bias. We wrote last week that we thought NVDA rotation would occur, and while there was some evidence of that, it was not pervasive, and any associated weakness was limited to one day. Our opinion was for a softer CPI, but that was always a hunch and not something we would increase positioning into. The CPI report and the FOMC were binary events and being aggressive in front of such a loaded outcome seemed too big of a gamble. This doesn’t mean we were sitting in cash, but our long bets were calculated and had enough cushion to warrant staying with them. We de-risked some of that long exposure into today as precautionary.

Today’s CPI report started off with quite the bang, posting milder-than-expected readings. These figures could point to a disinflationary trend, paving the way for faster rate cuts.

The detailed readings show some real deterioration in some stubbornly high inputs, specifically gasoline (-3.6%), and car insurance saw its first decline since ‘21.

The initial stock market reaction was positive, with broad-based gains across most sectors. Then, the FOMC released the updated dot plot, lowering the expected rate cut forecast to one cut from three on the last report. This was undoubtedly a hawkish surprise that took some of the air out of the market’s ascent.

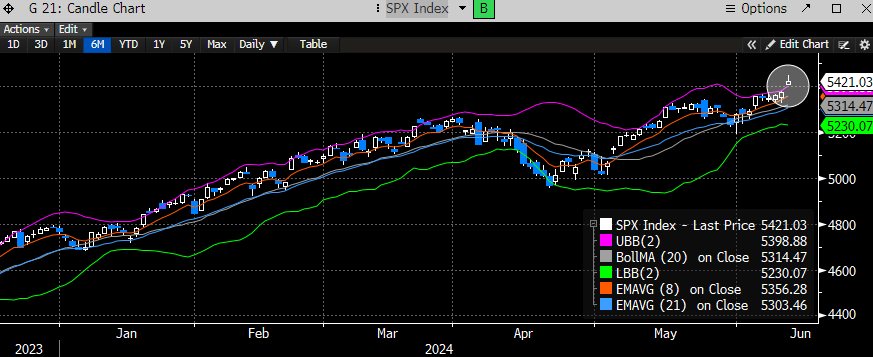

Interestingly, the SPX nearly tagged the 161.8% extension target we discussed in our last report, before turning lower post the FOMC. This resulted in a shooting star reversal candle. All candle formations must be confirmed, but it looks ominous.

This candle is also occurring above the upper Bollinger Band.

The Nasdaq has a similar-looking candle formation above the upper Bolling Band.

The 2-year treasury yield (a proxy for interest rates) broke below last week’s lows only to recover meaningfully after the FOMC release.

This type of volatility is what we should expect into a macro-heavy day. Especially where positioning was likely set up for a hotter CPI and a status quo Powell. The market never makes it easy.