We hope you had a very nice day off from the stock market. The new holiday is tough to get used to as this never existed when we worked for Wall Street Investment banks. Regardless, we’ll never complain about a day off, although we rarely, if ever, completely pull away from the stock market and our analysis. It’s a job that never sleeps.

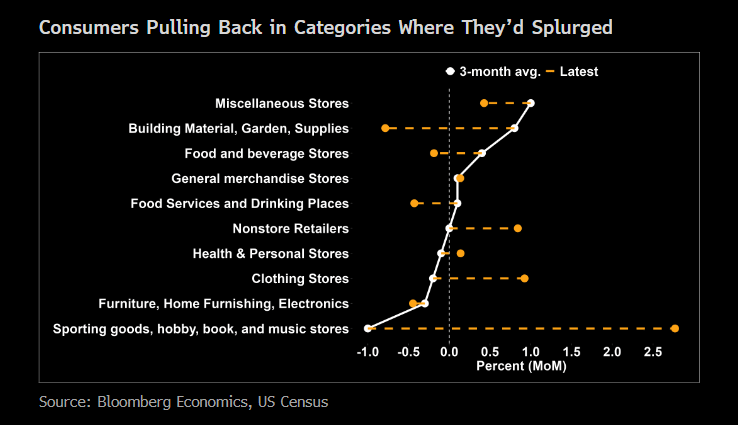

There's not much to share after just 2 days of data. On Tuesday, we received a rather disheartening piece of macro data in retail sales, indicating a potential slowdown in consumer activity.

This was now the second straight month that US consumers exercised caution.

This is a positive leading indicator for inflationary forces, but we must also be careful about what we wish for. Consumers make up 70% of the US economy and a marked slowdown could severely impact economic growth.

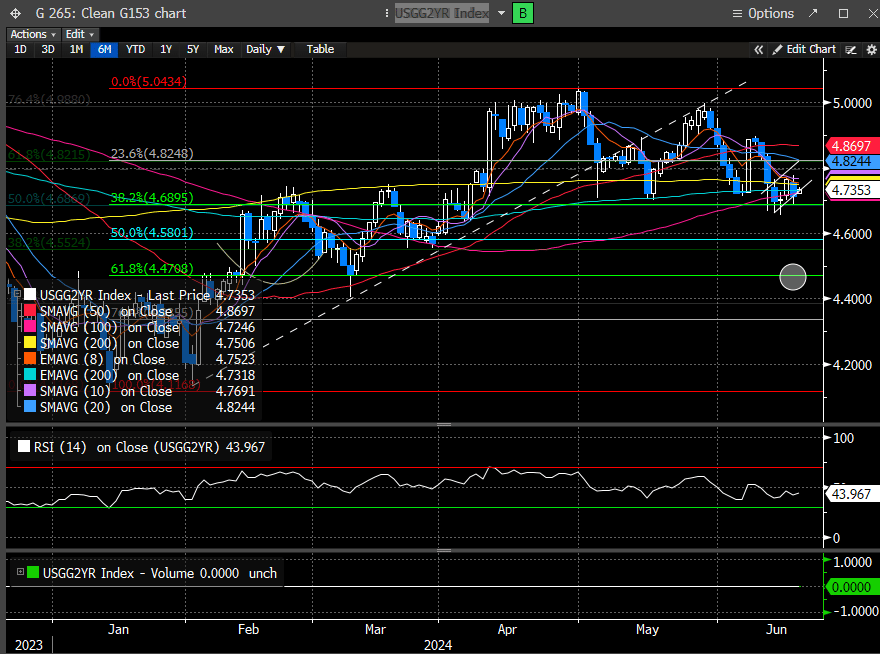

As a result of the report, the rate complex saw further deterioration and tested last week’s lows. The 2-year is forming a bear flag; a break could take this down to test the 61.8% Fib retracement level (4.47).

We will be discounting our Idea Tier for the July 4th Holiday. This tier continues to perform extremely well and has a cumulative return (adding all the gains and losses) of 871% since March 31, 23. Our win rate is still well above the average at 61%.

Given the level of breadth deterioration in the market, finding stocks that work in our model is becoming harder and harder. We aim to produce outsized returns by holding stocks longer and letting them work. While the indexes have continued to push to new heights, the number of stocks that are actually contributing to those gains is dwindling.

This implies the probability of being right has significantly been reduced. Despite that, we continue to perform admirably, and should we get any breadth reversion into the summer months, we expect our success rate to climb considerably and the performance to accelerate higher.

Please be on the lookout for the offer, as we will only offer this discount to our current newsletter subscribers.