Sometimes calm markets are good markets. Volatile swings can be mentally exhausting and also chop up traders as seemingly innocuous reversals lead to bigger directional moves. The predictability of volatile markets is more opaque and challenging to react and capitalize on. The last few days since the weekend has seen a welcomed calm. Most indexes have churned but nothing too alarming in either direction. Some of the rotations we saw at the end of last week have slowed down and the large caps are taking the baton again.

It’s the end of the quarter in two days and re-positioning and index rebalancing is driving most of the flows. The end of quarter machinations offer clues for what sector may take the lead into the 3rd Quarter.

While we had thought that large cap tech would be a source of funds to fuel any rotation, that’s not what has occurred over the last few days.

Let’s review:

AMZN has officially broken out and closed at a new all-time-high (ATH).

GOOGL did as well.

AAPL is building a bull flag pattern after making an ATH two weeks ago. Bull flags are continuation patterns.

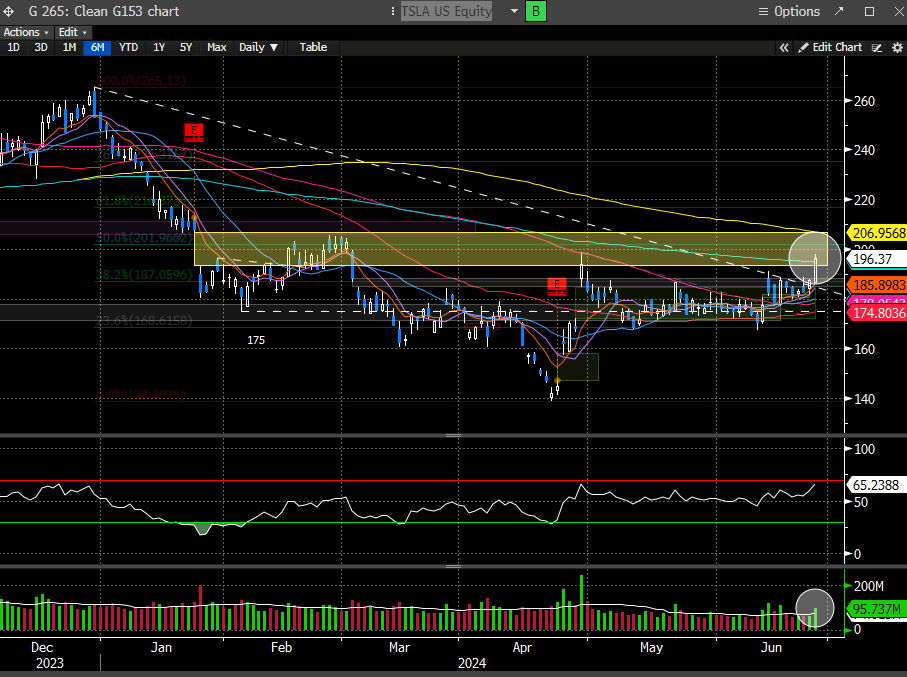

TSLA has been one the largest drags for Mag 7 index performance and is finally breaking out of a two-month consolidation.

MSFT made a new ATH today.

NFLX made a new ATH last week and is now building another bull flag.

META is knocking at the door for a possible cup and handle break which should catapult this over its ATH. Cup and handle patterns are also continuation patterns.

If you are bearishly positioned for the stock market to retrace meaningfully, wouldn’t it be wise to consider how the largest stocks in the world are acting? We think it would be foolish not to.

Most people believed that if NVDA rolled over it would take down the stock market. It seems the only thing that’s really happened is NVDA money is rotating into the other large caps.

Micron (MU) reported after the close. This has also been one of the AI leaders, and while their earnings were robust, the stock is trading at the higher end of its historical valuation range. As a result, the stock is getting hit in the aftermarket. We would think this sparks more semi rotation into other stocks, and sectors. Rotating out of the hottest sector at the end of the quarter to reposition into lagging sectors or other areas makes sense.

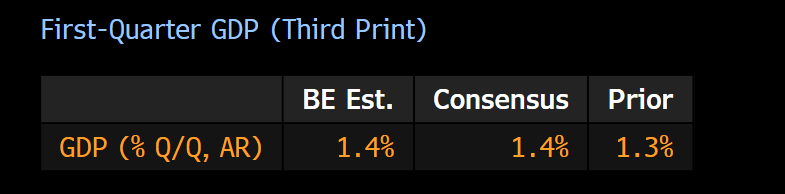

Tomorrow, we will get 1Q GDP and Friday the PCE will be reported (the Fed’s preferred inflation metric). GDP is backward looking so we wouldn’t read too much into the number.

Barring anything way off consensus, it should be a non-event. The PCE has much more sway as it pertains to the stock market. Bloomberg economists believe the PCE will register the smallest pace all year, with declining gasoline prices and flat food and beverage inflation. Unfortunately, they think it will likely re-accelerate into the 2H of the year.

If PCE comes in slower than expectations, is it possible that the markets are setting up for a big July? Yes, as the seasonal tailwinds for the 1H of July are some of the best of the year. Couple that with positive pre-election seasonality, and July has the potential to be gangbusters.

We are long most of the large cap stocks listed above in our Idea Tier. You have to be part of the journey to enjoy the upside. Please consider subscribing at our new website: