We came into this week concerned the stock market would see more weakness and Monday didn’t disappoint. The Nasdaq touched our first downside target of 13325 (low on Monday was 13334).

Here is that excerpt:

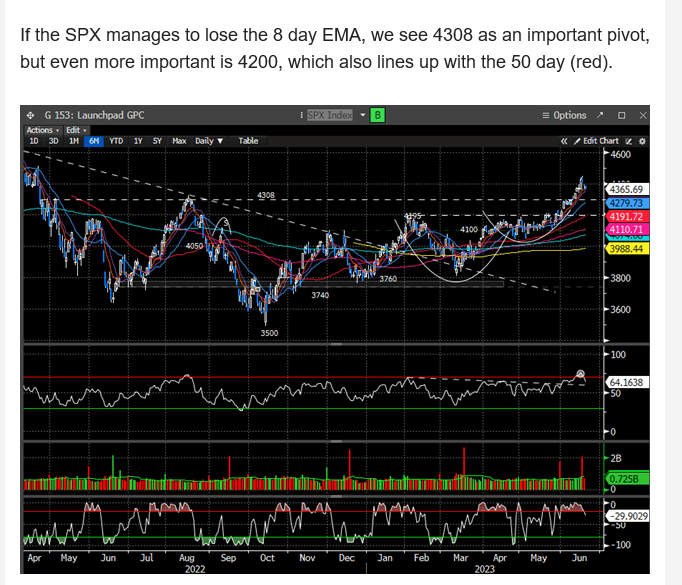

We highlighted last week in our mid-week report that the 4308 pivot was another area of confluence that could be defended. The low on Monday was 4328.

The goal here isn’t to pat ourselves on the back but to simply point out that when the market is very easily defended at obvious junctures, that’s a healthy market and one where buyers are in control. We admittedly thought we would see more weakness this week but were mindful of the end of Q flows as well as the seasonality factor.

We mentioned in our 6/19 weekend Macro report that the seasonality window, according to Wayne Whaley, began on Jun 27th. And right on schedule, the market has ripped back from a small <3% Jun swoon to frustrate the persistent bears some more.

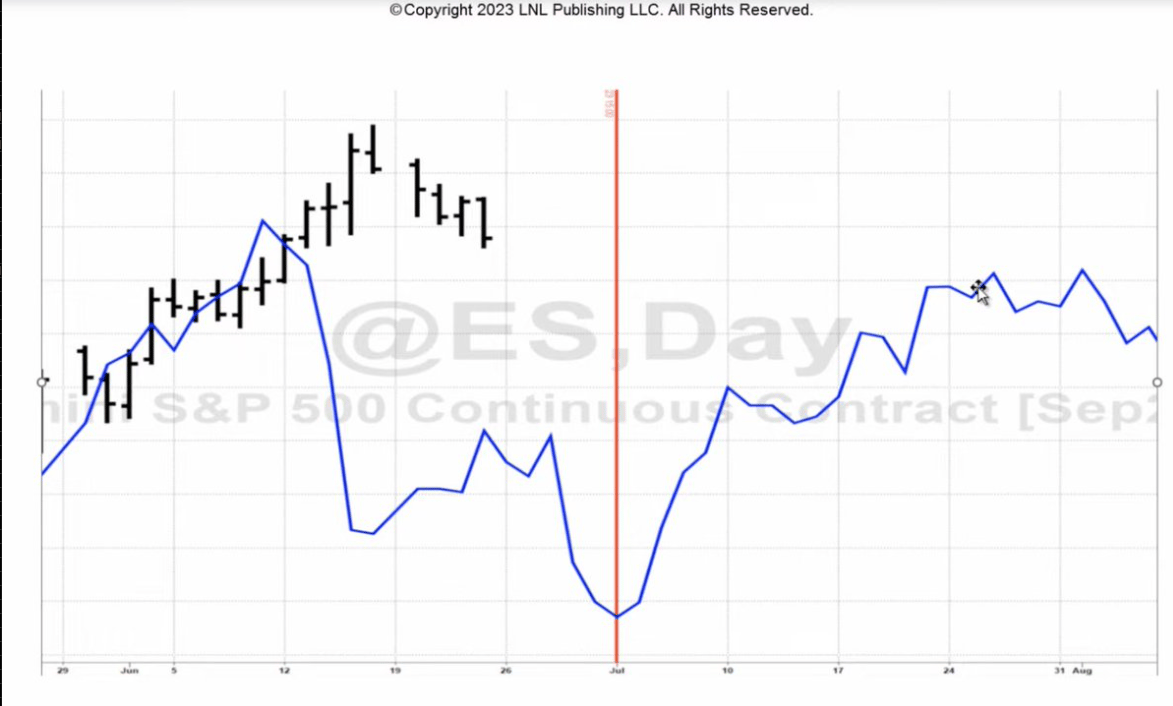

Additionally, Larry Williams, one of the great cycle analysts, is also calling for a July rally.

And apparently, the rest of the globe is entering a fairly bulled up July period.

We don’t make decisions based on cycles, but we respect them, and pay attention as they are clearly a powerful force in the market. Ignore them at your own peril.

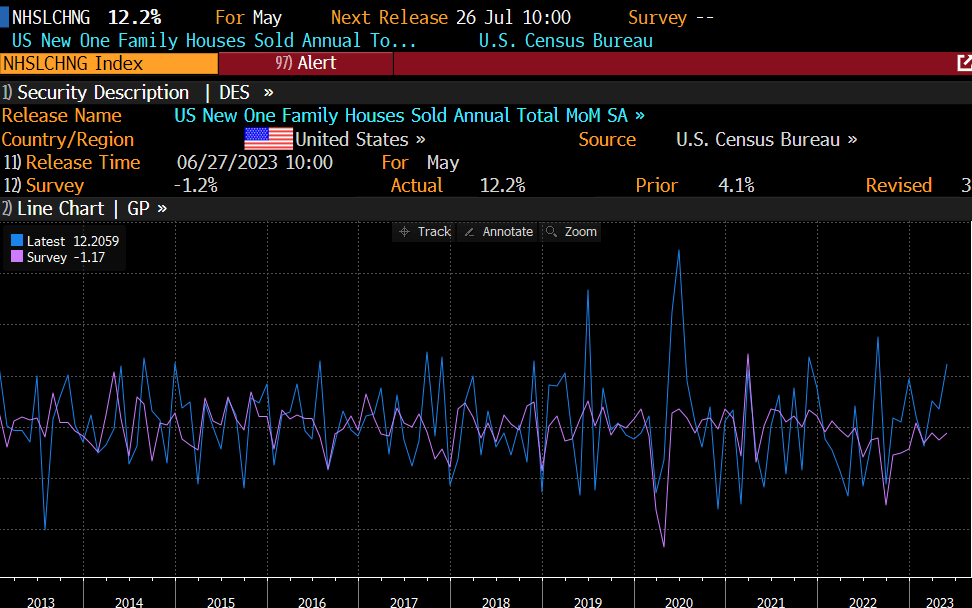

We have also found the recent macro statistics that were reported this week to be more supportive of an expansionary period, rather than recessionary. Maybe this is why the market is celebrating. Recall our conversations and missives about the market discounting a recovery sooner. Maybe it’s already here?

Home sales are reaccelerating? Thats certainly puzzling in the face of decade high interest rates.

Non-Defense Capital Goods orders beat expectations last month and hit a record high in March. That doesn’t sound recessionary.

Consumer confidence is rising. Not something you typically see as we head into a difficult economic period.

Maybe the stock market had it right all along. The stock market is a discounting mechanism and why we view the market construction as the key determinant of how we invest/trade. Our opinions are meaningless, and if the market is telling us our fundamental opinions are wrong, who are we to argue?

Friday, we will get the PCE, which is the Fed’s preferred inflation metric. As long as it doesn’t reaccelerate meaningfully, we doubt it would be construed negatively. What if it dips? Maybe the market is telling you that it will, which puts cold water on the Fed continuing to raise rates, despite the rhetoric from the FOMC this week. Here is a snapshot of Powell’s comments today:

Sounds quite hawkish. But until the market gives us enough clues that a larger selling regime is at hand, we will stay constructive. We were correct in calling for a correction a week and a half ago. Did the correction end yesterday or will there be more weakness. We will offer our opinions below.