All the media wants to do is talk about NVDA. We get it, it’s been a monster stock, and if you are a fund and need to outperform your benchmark, you likely have to be overweight. There has been so much bantered about whether NVDA’s ascent makes sense. If you have been reading our reports for a while, you know we are huge fans of what Jensen Huang has built. We have said for years that he runs the world's most innovative and groundbreaking semiconductor company. He dominates and trailblazes major technology trends. We have been bullish countless times in this newsletter, discussing it as an investment or trade. We were one of the lone bulls when the stock was trading at $120 in 2022.

NVDA has singlehandedly defined this recent bull phase and awakened the animal spirits in the semiconductor sector. Semis are now the largest weighting in the SPX, at 11%.

NVDA crossed $3 Trillion in market cap today, leapfrogging AAPL.

NVDA’s ascent this year has been historic, and its importance to the market’s trajectory is undeniably frightening. If NVDA were to reverse in any meaningful way, we think the stock market would see a fairly healthy correction.

Friday, the stock is set to split. Typically, for momentum stocks, there tends to be enthusiasm into a split event. Fundamentally, this makes little sense as nothing is changing regarding the company's underlying performance; it only makes investing for smaller investors more palatable. The idea behind the rise is that more retail demand will flow into the stock, pushing it even higher. Theoretically, that’s true but NVDA has already been exploding into the event, which likely means institutions will be looking to sell into that demand. This can create a sell-the-news reaction.

How much of a sell the news is tough to say at this point. We will discuss this later in our premium section.

Over the weekend, we discussed all the reversal candles that occurred in the stock market last Friday. We repeatedly illustrated that those reversals were taking place at very calculated junctures. While most wanted to explain away the reasoning as part of a massive MSCI rebalance, we took a different tact.

Here is an excerpt from our conclusion page over the weekend:

“While the bears seemingly had the upper hand, the dip buyers showed up in full force at key junctures, returning the indexes to respectable levels. This reversal was confirmed by meaningful volume, a collapsing VIX, and retracting rates. This is undeniably bullish…”

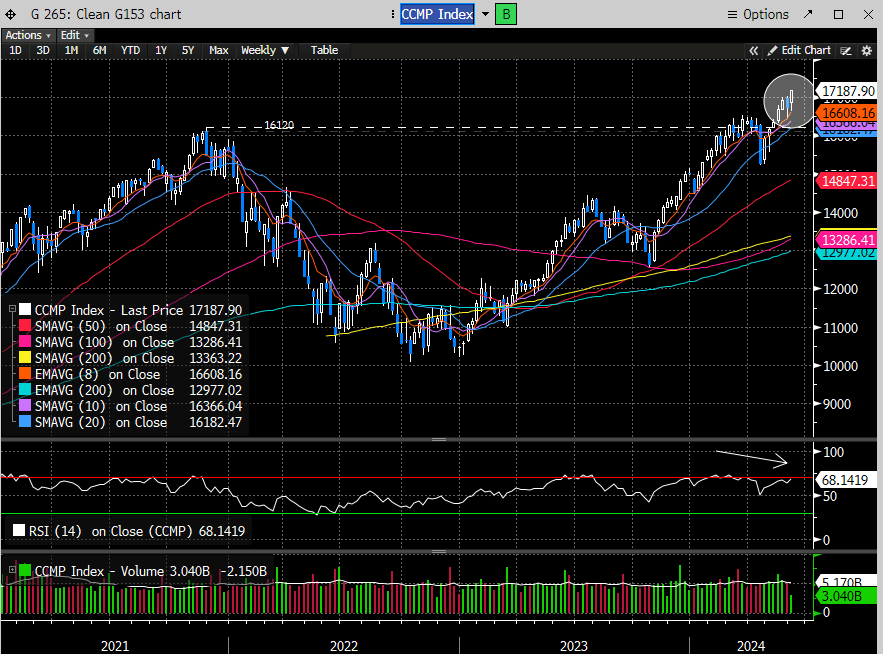

Today, the SPX and the Nasdaq posted fresh ATHs.

We’ve said it numerous times, and we’ll repeat it: ATHs are bullish. Why do so many try to explain away a strong trend? Why does this not compute in their brains is beyond our comprehension. The stock market has been in a bull market since Oct ‘22; that’s a fact. ATH’s happen in bull markets; that’s a fact.

Guess what’s easier to make in bull markets? Money.

If you are struggling to make sense of the market. We are here to help.

Join us below.