The FOMC posed a considerable risk to upset markets today, but as expected, Powell is not interested in disrupting the markets, and stuck to the script. He raised interest rates by 25 bps and remains data dependent for further rate hikes. In-line expectations is enough to keep things status quo, for now.

The Fed Funds Futures were forecasting an almost 100% probability of a 25 bps hike at today’s meeting, and the forecast for the next meeting barely budged. The probability of another hike at the Sept meeting is only 41%. Interestingly enough, cuts have actually been pushed up to March, with a 58% probability of a rate cut. This is a bit perplexing on the surface and either means that the bond market is forecasting faster disinflation over the next 8 months or that the economy is going to slow so rapidly the Fed will be forced to cut rates quicker. My assumption is the former for now, but that could change.

Powell doubling down on being data dependent until the Sept meeting implies the next 2 months are going to be quite volatile around inflation and employment data releases. This sets up for a potentially turbulent time during a difficult seasonality window. This is one of many reasons why we have dialed back being aggressive with our single stock ideas. The risk/reward to being aggressively long seems a bit out of place. The easy money has been made in the market this year, and if you missed the rally, we suspect trying to make up for being absent will only compound frustration. This Friday we will get the first dose of inflationary data with the PCE report. We do not have any real opinion on this report, but we suspect we should see more moderation, as does consensus.

The next couple of reports is where we have some real concern for core inflation readings re-accelerating. There is notable evidence of commodities starting to lift. Here is a basket of commodity futures. This has now eclipsed Jun peaks.

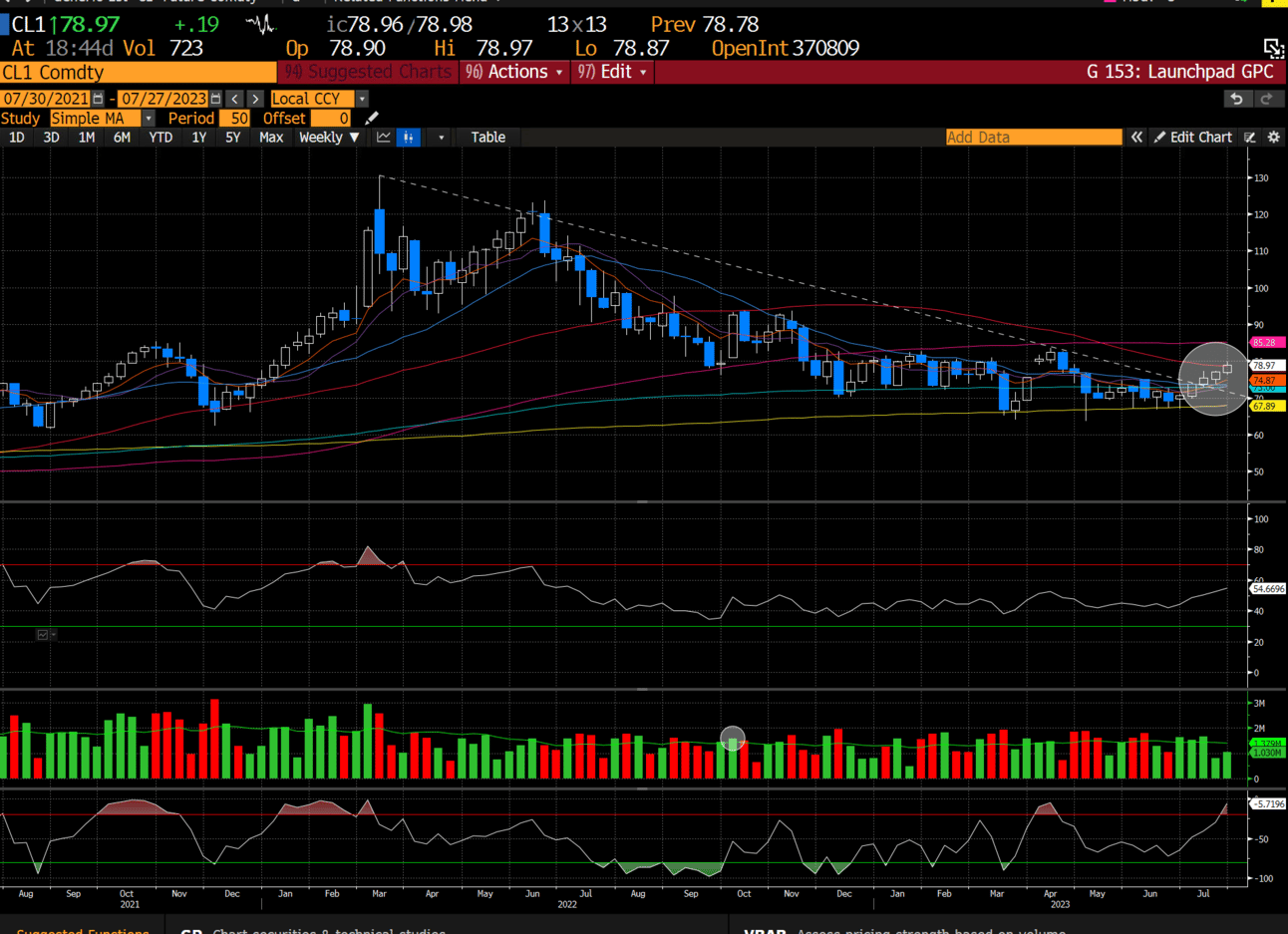

We also know that energy prices have reverted higher since troughing in May and now the highest since Apr. This certainly poses a risk to inflationary data. Staying above this gap window is a good gauge for bull/bear debates. Currently, bulls have taken back the ball.

And we showed this Oil chart last week. The weekly picture is clearly bullish.

The good news is we were positioned for the rotation into energy stocks that everyone is now waking up to. Our $EOG position is up almost 12% and $FANG up 10%, just in the last 2 weeks. We did cut our $EOG position in half as it’s getting OB and will look to exit the balance into strength before they report next week.

We also were fortunate enough to position into the China thematic. While we still have a considerable position in the sector, we did trim back some of our $NIO for +45%, which we detailed on our Twitter handle.

To read the balance of our analysis and how to position for the next market moves, we would consider becoming a premium member.