July is closing out with a bang—not only because the stock market closed higher, but also because our directional calls have been incredibly precise. Predicting market swings is challenging, but achieving such accuracy is immensely satisfying.

We are proud that our work helps clients make better decisions with their capital. A quick review of our calls this month.

We avoided a costly drawdown in large-cap tech by advocating selling into mid-July strength.

We correctly pivoted into SMID laggards following the CPI report.

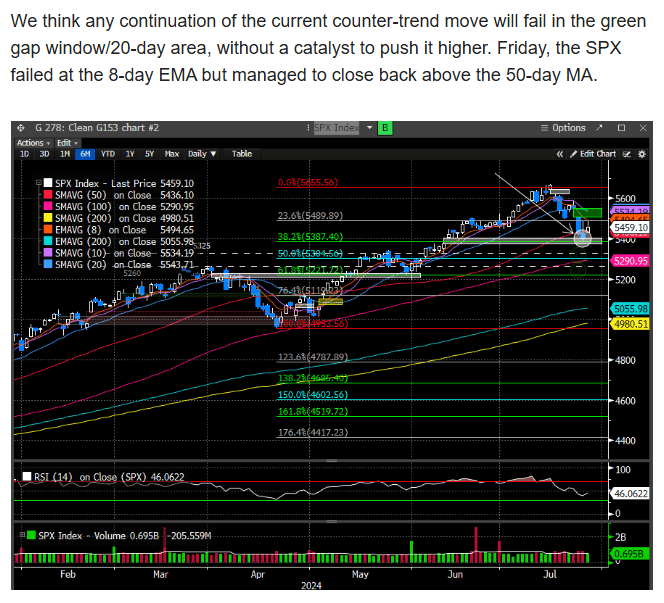

In our 7/24 report, we noted that the indexes were approaching downside levels where a counter-trend bounce was likely.

In this past weekend's report, we anticipated that the counter-trend bounce would continue but likely fail at our defined upside target.

Here is an excerpt from our 7/28 report:

“We think any continuation of the current counter-trend move will fail in the green gap window/20-day area, without a catalyst to push it higher.”

We approached this week with enthusiasm for more upside, but we were cautious to increase exposure until the right opportunities presented themselves or we got some clarity with the FOMC and Mega-cap earnings.

MSFT reported last night and talked up cap-ex spend. This was enough to alleviate the growing concerns that AI spending would moderate. NVDA traded into key support after the MSFT release at nearly $100 and closed up 17% from that low point after MSFT gave guidance. That’s quite the reversal; reversals at key junctures are always important. Why? Because real buyers show up when it matters.

So yes, NVDA likely bottomed yesterday, at least until they report at the end of the month.

We believe the same is true for the semiconductor space. The SMH saw an equally powerful reversal at a key support level. After MSFT reported the Q, SMH traded down to the top of the white gap window and rebounded 9%. The ETF is up more in the AH after QCOM and META’s robust earnings reports.

Should we interpret their resurgence to mean that Semis are reestablishing themselves as the leading sector again? No, but it does mean the 19% drawdown for the ETF, has likely found a floor for the near term.

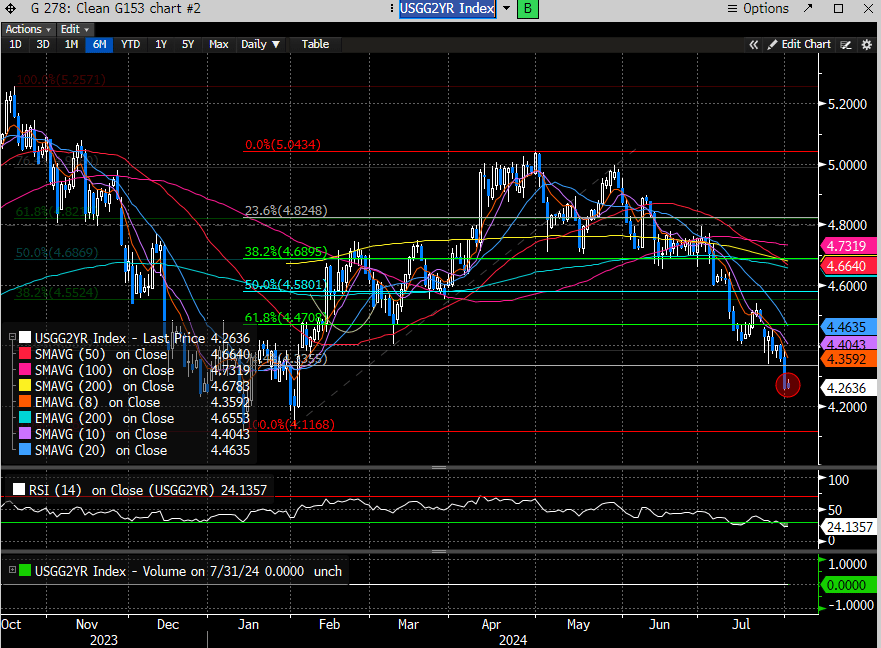

The other piece of potentially market-moving news was the FOMC decision and the language concerning the rate cut trajectory. While Powell didn’t explicitly say that a September rate hike was a certainty, he did say that if the data remained supportive, then a cut in September would occur.

The bond market took the news well and has now priced in almost 70 bps of rate reductions this year, with 100% probability for a September cut intact.

The 2-year treasury (a proxy for short-term rates) collapsed to new lows.

Now that July is over, and we enter the notorious difficult month of August. How should we think about positioning?