On the backs of Fitch downgrading the US debt, the stock market took quite the hit by normal standards. This was completely unexpected, and the timing was a bit perplexing. The Nasdaq took the brunt of the impact and settled in at a -2% loss. This was the worst loss in 5 months but should be somewhat expected as the Nasdaq is also up the most year to date by a wide margin. To keep things in perspective, the Nasdaq was up +35% year to date before today, so giving some back is completely normal.

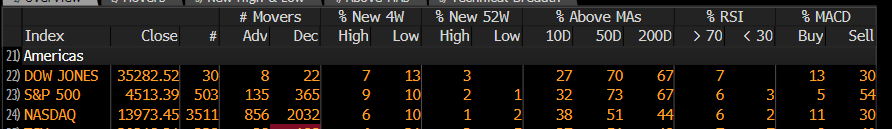

Interestingly, the breadth wasn’t that bad. 3 to 1 decliners is sort a run of the mill down day. Washout days are in the 8-9 to 1 range. Washouts are usually capitulatory, so this was anything but that.

Volume ran heavier than average and should be expected, but nothing alarming.

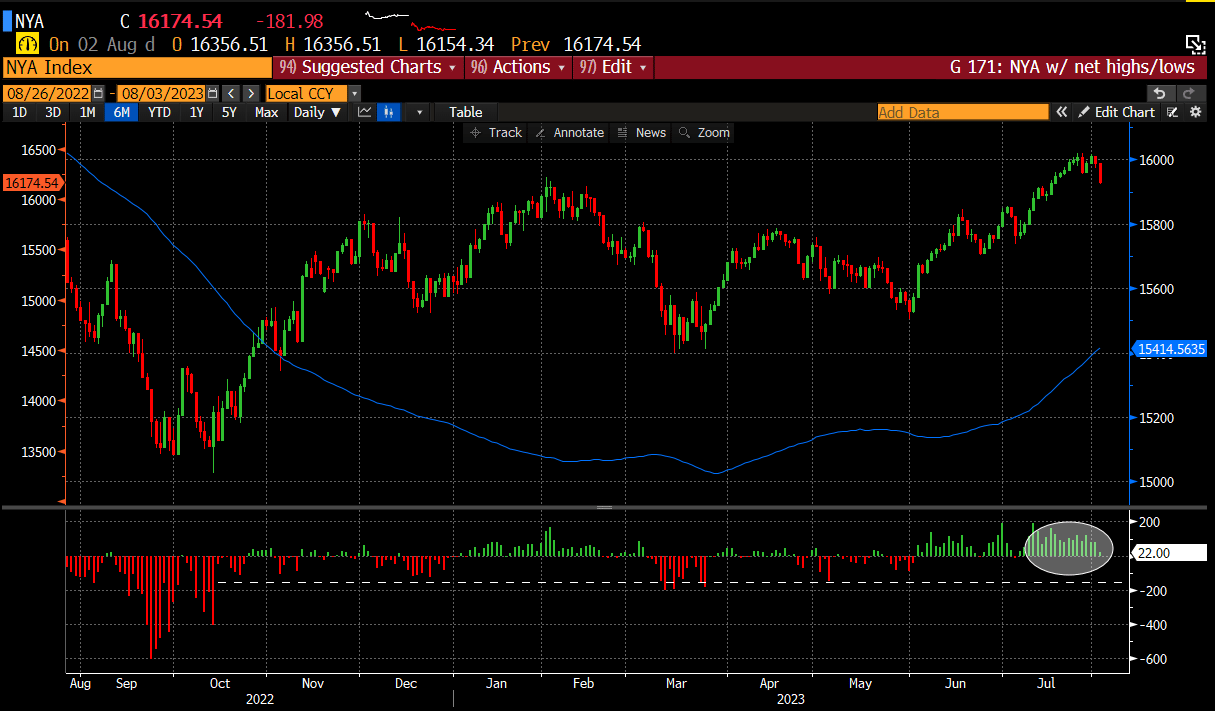

While the NYSE posted Net New Highs.

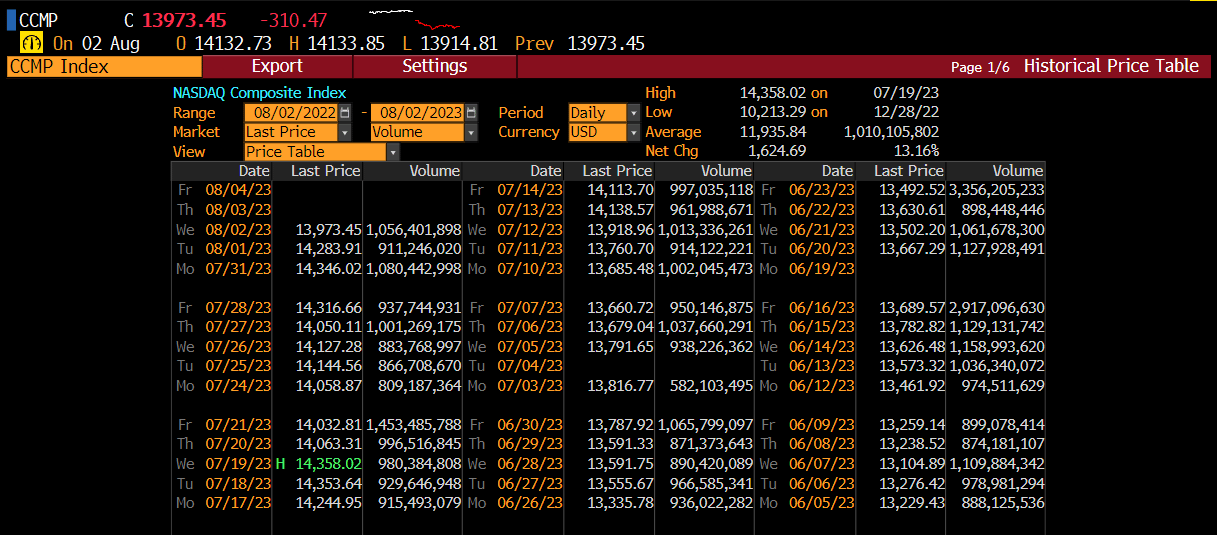

But the Nasdaq dipped back into the red.

Regardless, this market was due for some sort of correction. We were in print last week suggesting selling longs, tightening stops and to prepare for volatility. We didn’t know when it would happen or why, but today may have been the exogenous event that removes the well needed euphoria from the market.

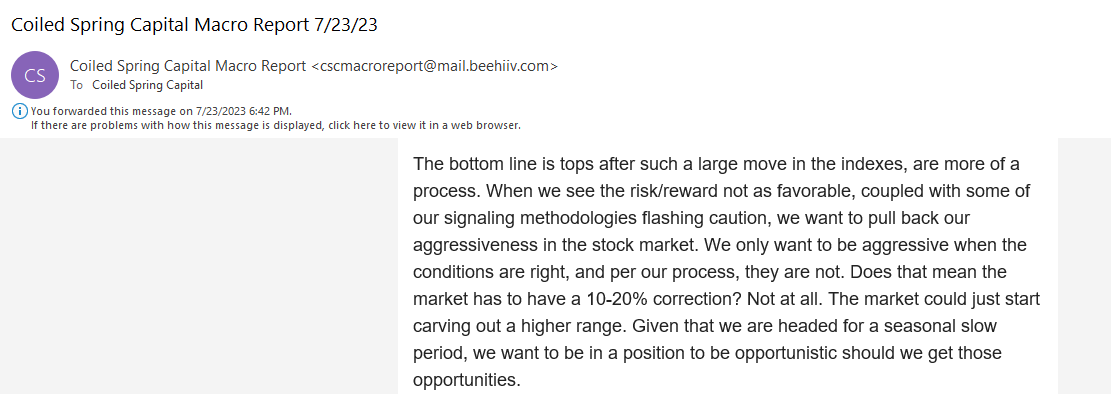

Here is a snapshot of our report from 7/23:

“The bottom line is tops after such a large move in the indexes, are more of a process. When we see the risk/reward not as favorable, coupled with some of our signaling methodologies flashing caution, we want to pull back our aggressiveness in the stock market. We only want to be aggressive when the conditions are right, and per our process, they are not….”

And reiterated our point in our mid-week report on 7/26:

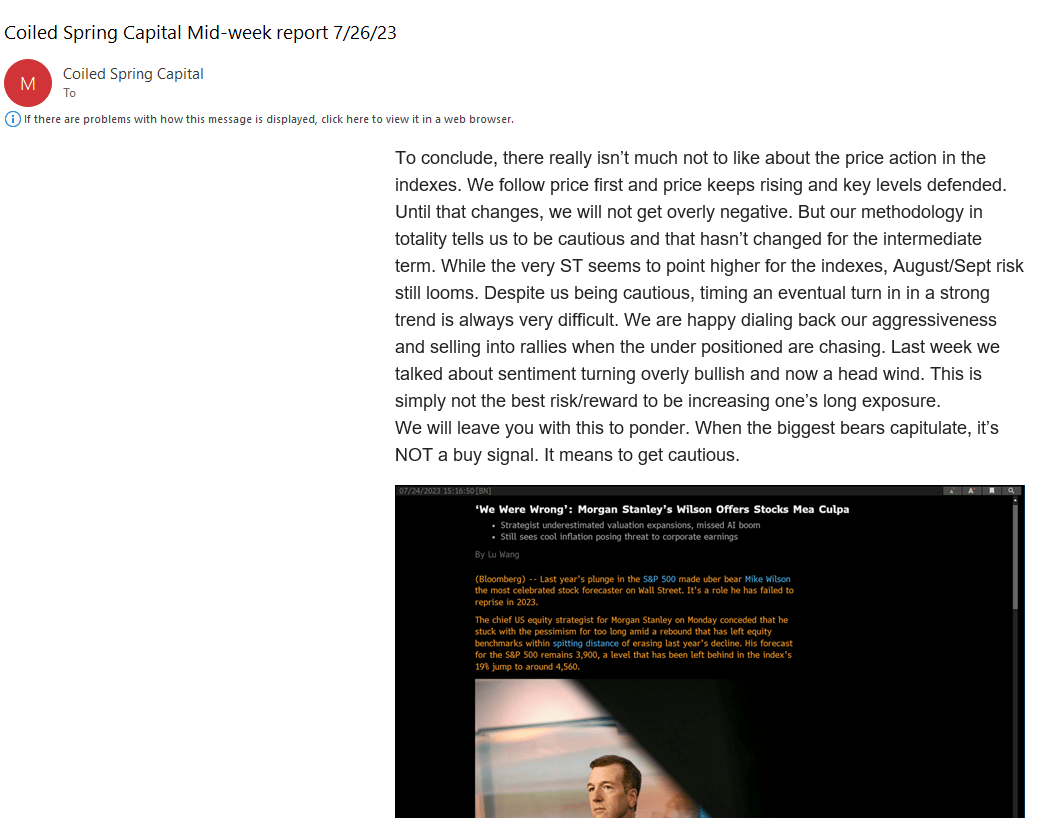

“our methodology in totality tells us to be cautious and that hasn’t changed for the intermediate term. While the very ST seems to point higher for the indexes, August/Sept risk still looms. Despite us being cautious, timing an eventual turn in in a strong trend is always very difficult. We are happy dialing back our aggressiveness and selling into rallies when the under positioned are chasing. Last week we talked about sentiment turning overly bullish and now a head wind. This is simply not the best risk/reward to be increasing one’s long exposure.”

And from our weekend report (7/30):

“There isn’t much to deter us from our current cautious stance on the stock market. If anything, the internal picture is worsening and a big warning sign for us since it is coming with DeMark signal alignment, coupled with entering the weak seasonality window. The indexes remain OB per RSI, and rates remain elevated. This implies little NT upside to the indexes in our opinion. We suspect that the next few months will remain choppy with opportunities to trade both long and short.”

Again, we are not trying to pat ourselves on the back for expressing caution at the right time, as we still have enough longs to feel the pain today. But stock market investing and trading is a balancing act on when to get aggressively long, as we have been the last few months, and when to dial things back and raise cash. We were right to be exiting a lot of our longs the last 2-3 weeks. Risk happens fast and then all at once. This means 1-2 down days can erase a month’s worth of gains. While the indexes were only down -1-2%, quite a number of growth stocks were down high single to low double digits. Late buyers into the recent market strength just got steamrolled.

We hope our readers heeded our advice and sold into the recent market strength. If you are struggling to understand how to time market swings, we can help.

Is the market ready to finally correct or will the dip buyers’ step in as they have all year? We will assess below.