The stock market rarely offers a smooth ride. What initially appeared to be a momentum-shifting Jackson Hole meeting last Friday has since evolved into a slow grind lower, right from the resistance zones we flagged as potentially troublesome for the major U.S. indexes. The bearish engulfing bars that formed the day before the Fed event were a clear warning sign of further selling pressure, underscoring the importance of respecting market structure changes when they occur.

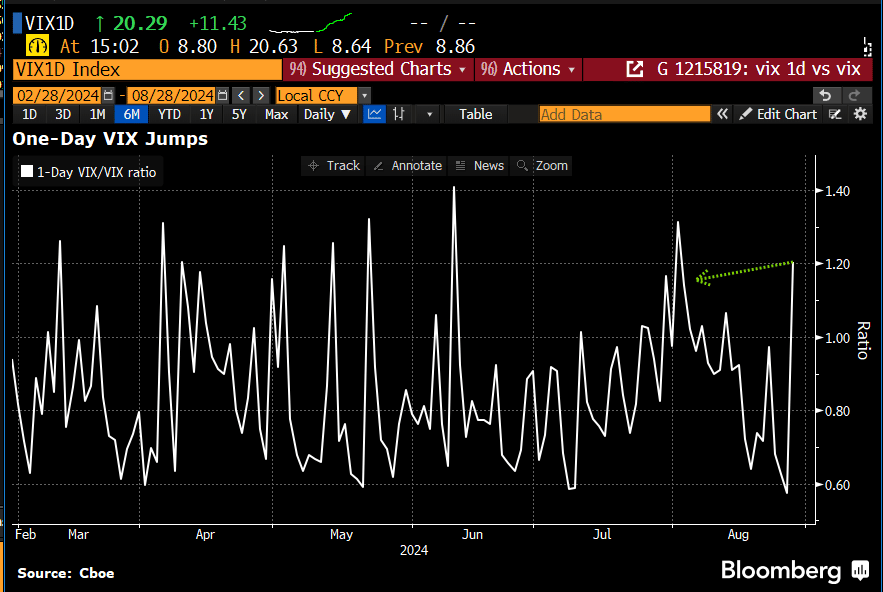

The index's one-day VIX spiked into the NVDA print and was at its highest level since the August 2nd meltdown.

According to Bloomberg, a long-dated option base (LEAPS) at 5550 needs to hold to prevent a surge in selling. This is also an important level as it represents the previous tops before the early August drawdown began.

In our weekend report, we underscored the risks the stock market faced ahead of NVDA’s earnings announcement. As the poster child of this bull market, any disappointment from NVDA would likely ripple through a fragile market, especially during one of the most illiquid weeks of the year. The stock market is ultimately a diverse mix of stocks and sectors, but the prevailing narrative is clear: AI-driven growth and productivity are seen as key drivers of this bull market. We generally agree with this perspective, and thus, a disappointing report from NVDA will undoubtedly leave a mark.

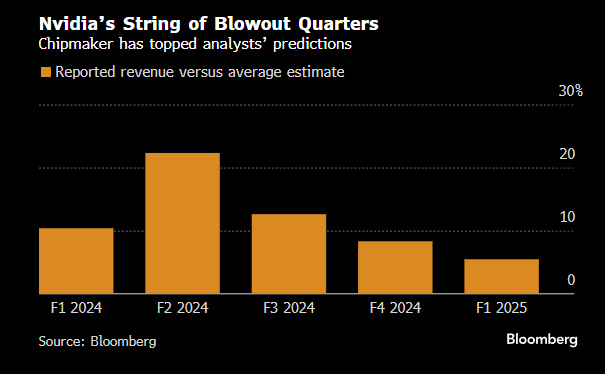

This Bloomberg chart highlights the extraordinary influence NVDA has exerted on the broader market.

The Magnificent 7 index has been under pressure since its mid-July peak, and NVDA’s report could push these stocks deeper into purgatory. In contrast, our rotational theme is well-positioned to outperform in a negative NVDA scenario.

In our weekend report, we pointed out NVDA's strong technical setup and its impressive track record of earnings beats as reasons for optimism. However, earnings ultimately dictate the stock’s direction, regardless of the technical backdrop.

NVDA delivered slightly better-than-expected results and announced a massive $50B buyback. But is that enough? With sky-high expectations and endless hype surrounding NVDA, the buy-side demands were even higher than what was reported.

NVDA is also showing a steady deceleration in their beat magnitude.

More importantly—and likely to provide some market reassurance—NVDA announced that their new Blackwell chip will ship in Q4. However, the stock is down after hours, and understandably so, as the magnitude of their beat was underwhelming.

The bigger question for our readers is: Does this derail the market? Not necessarily, though some near-term softness should be expected. NVDA didn’t really miss; they simply didn’t deliver the blockbuster results investors were hoping for. The AI narrative remains intact.

While we anticipate some continued market weakness, we still see opportunities to be opportunistic.