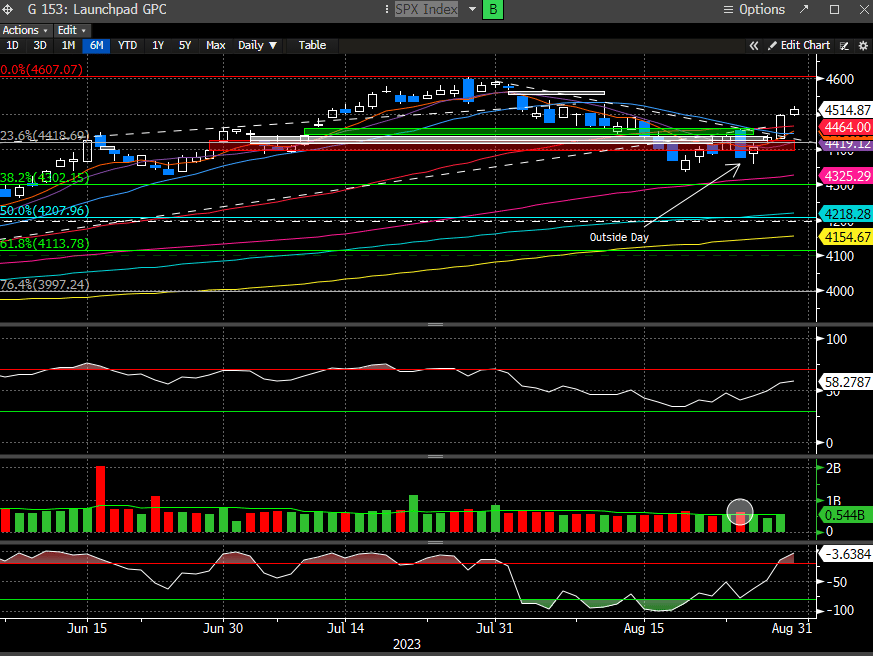

The stock market is seeing quite the reversal of fortune this week. Last week’s post NVDA drubbing had all the makings of a market in distribution. Sellers waited for the right moment, when the indexes were at a difficult level, to push the sell button with vigor. That day is referred to as an outside day, and something all astute traders pay attention to.

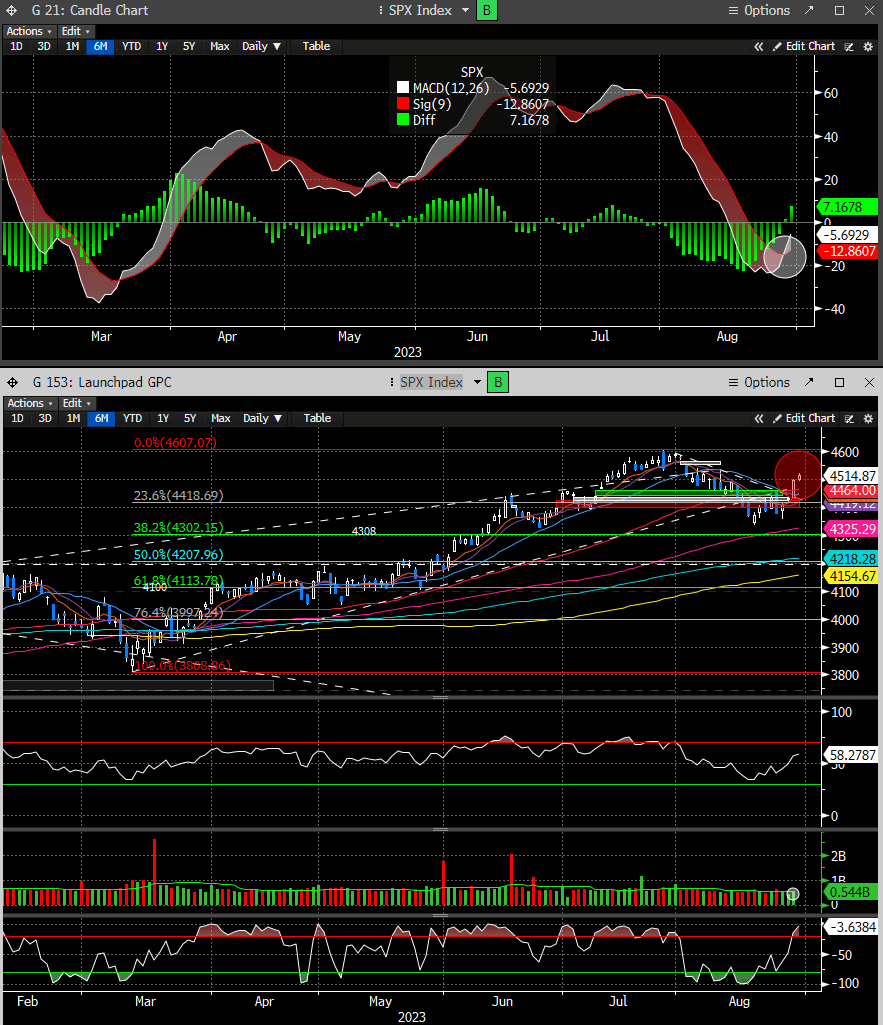

Fast forward 4 days and the stock market has eclipsed all of our resistance zones, the DTL from the high, reclaimed the important 50 day MA and now the MACD is bullishly inflecting. Did we think this sort of rebound would occur? Not at all. In fact, we have been fairly cautious with our positioning and only decided to re-enter small longs on Friday’s candle. To put it bluntly, we were severely under positioned for this move.

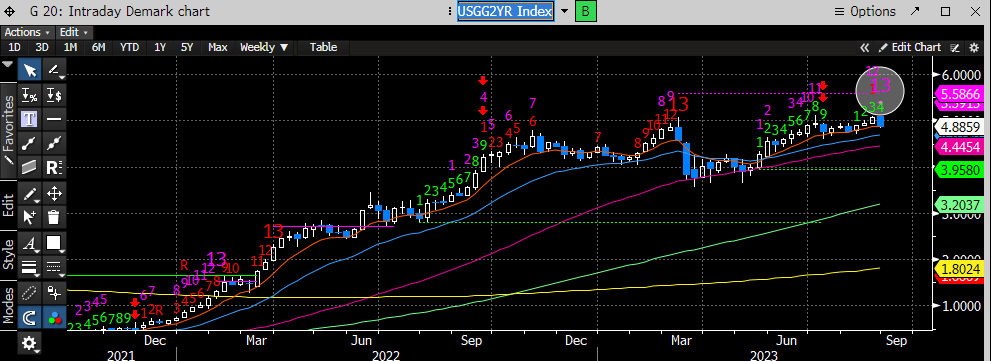

The culprit for the index strength this week has been the deteriorating macro-economic data and the belief that the FOMC is done with their rate hike campaign. The 2 year, which is the most sensitive to short-term rates attempted to break out and failed. With failed moves comes fast moves and the 2 year now looking like a triple top.

With its MACD crossing bearishly.

Meanwhile Fed Fund Futures are pulling in their forecast for another hike as well as when the Fed will begin cutting. There is now less than a 50% chance of another hike in November, vs 62% last Friday. There is now an almost 80% chance of a cut in May ‘24, vs 19% previously. We have been writing for weeks that the most important chart in the stock market was the 2 year, and a breakout would certainly cause quite a bit of volatility.

How about the fact that the recent COT report revealed that the 2-year treasury is the most shorted in history by a very wide margin. When everyone is loaded on one side of the boat….

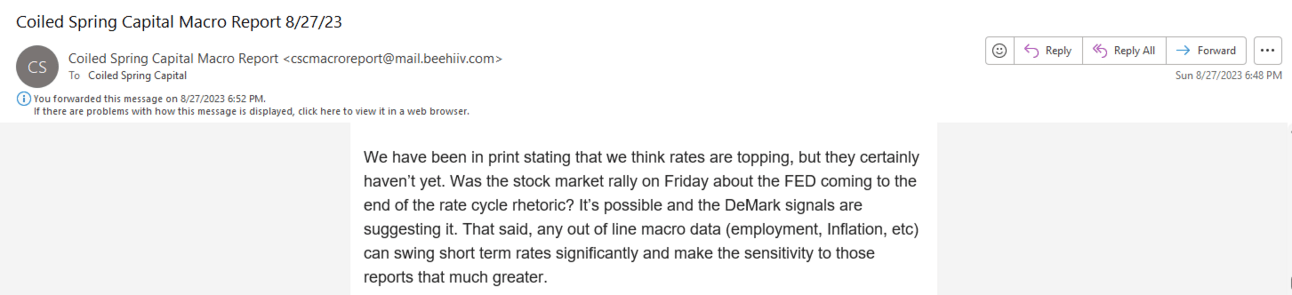

Last weekend we reiterated that we thought rates were going to top soon. Here is that excerpt:

“We have been in print stating that we think rates are topping, but they certainly haven’t yet. Was the stock market rally on Friday about the FED coming to the end of the rate cycle rhetoric? It’s possible and the DeMark signals are suggesting it.”

The combo 13 sell on the weekly that we posited would occur this week is now present.

Although the signal alignment with the daily has alluded us.

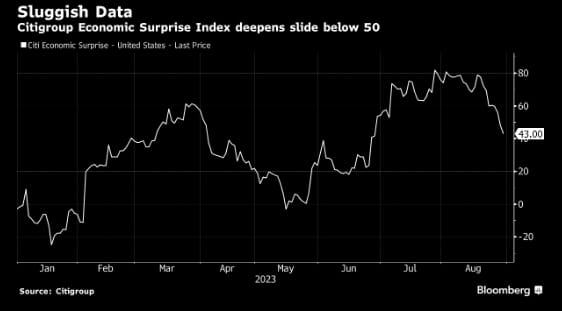

This is happening courtesy of the weaker macro data that has been released the last few days. The Citi economic surprise index continues to slide.

Last Friday we saw consumer sentiment dip.

Job openings saw quite the dip as employers are pulling back their enthusiasm.

Today, GDP came in lighter than expected and the 2Q was revised lower as there was more moderate business investment than initially reported.

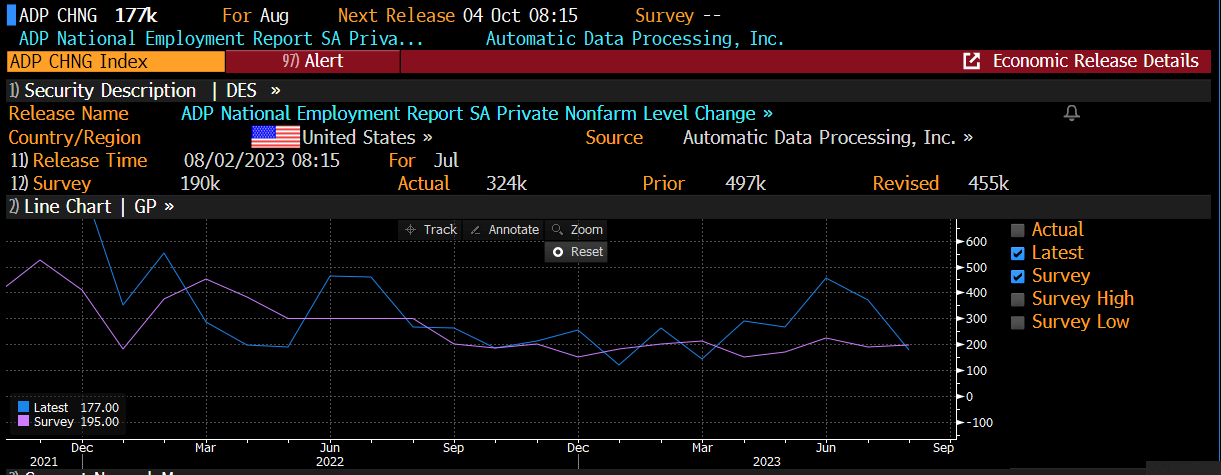

The ADP employment data was weaker than expected, setting the stage for a potentially weaker Friday payroll number.

It seems we have fallen back into a “bad news is good for the market” regime, as this takes the pressure off the Fed to keep choking it’s liquidity. We still have 2 potentially market moving pieces of news to get through over the next 2 days, which are occurring when most participants are off their trading desks. This creates a vacuum of liquidity, setting up for some violent swings as the algos battle for supremacy.