Our weekend report focused primarily on buying the panic dip on Monday. The dip turned out to be much more significant than we had anticipated, with the Japanese market plummeting 12.5%—a scenario we hadn't foreseen. The ranges we provided for our dip buys were too conservative, as the SPX opened 100 points below our projected range. Nonetheless, our core message remained clear: to buy at that extreme moment. This strategy proved highly profitable as the indexes closed significantly higher than their opening levels. The momentum continued into Tuesday and Wednesday before reversing.

Many of the reasons we argued for that bounce came to fruition.

1) We believed volatility was set up to compress after the massive spike.

Volatility is down almost 60% since Monday’s high.

3) Bonds prices would revert as they were reaching unnatural and extreme levels.

The 2-year treasury yield bounced almost 10% since Monday’s low.

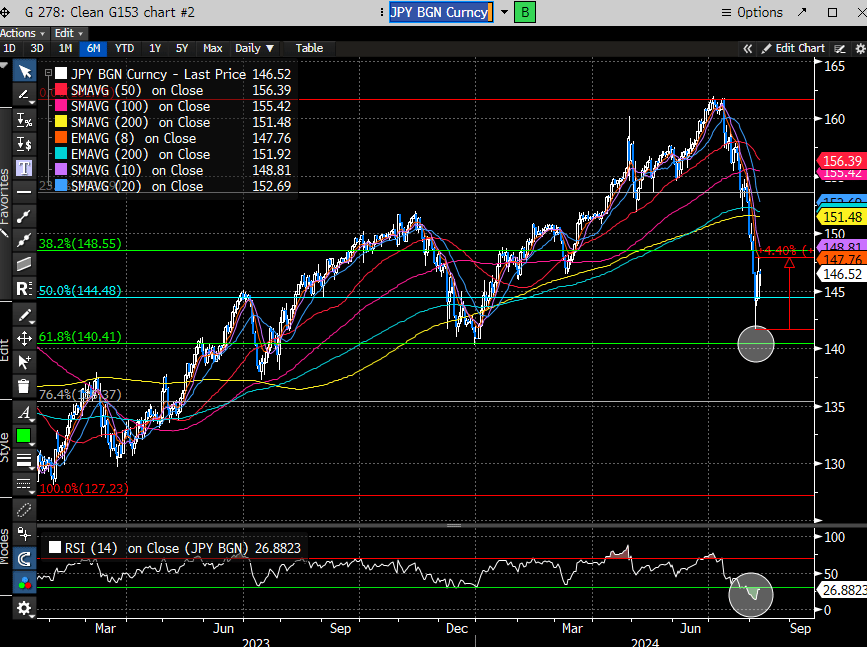

3) The Yen would find support at around 140.

The Yen bounced at 141 for over 4%.

Contrary to what many may believe, this was a highly calculated bet. We encourage you to review our report for more detailed content supporting our call.

However, we understand that was yesterday's news. The bigger question now is: are the lows in?

Before attempting to answer that, let's consider how we got here and whether there has been any relief on that front. The market was hit by a perfect storm last week, a macro-Molotov cocktail. It started with two bearish macro releases that reignited the "hard landing" narrative, followed by the unwinding of the Yen carry trade, mirrored by the collapse of the Japanese stock market.

Regarding the macro front, our analysis indicates that the stock market is placing too much emphasis on these two data points. While it’s true that the Fed likely kept rates too high for too long, causing damage to growth as evidenced by the slowing ISM report, the market's reaction may be overblown.

The lower-than-expected unemployment rate triggered the Sahm rule, which suggests we are headed for a recession.

But even Sahm is out publicly saying that distortions from Covid and the huge influx of migrants could be skewing the readings.

It’s also worth noting that the employment report had some nuances, which may cause a significant snapback on the following report when workers return to their jobs.

This chart from Carson Research shows a historic spike in people who couldn’t work because of last month’s weather, mainly because of the issues in Texas. This is more than 10x the average.

Is this more of a growth slowdown vs. an actual recession brewing? We won’t know the answer for many months but remain in the “growth scare” camp.

SPX earnings continue to grow, and despite what’s felt like a choppy earnings season, it is delivering robust results. The forward outlook continues to push higher, which is not something you typically see when staring down the barrel of a recession.

With regard to Japan, the BOJ has already come out suggesting they will put additional rate hikes on hold until the market stabilizes. JPM also says that 75% of the global carry trade has been unwound.

We thought it was interesting that the dip buyers on Monday were professional investors where retail was selling. That’s usually what you see at tradeable and sustainable bottoms.

But alas, this doesn’t mean the waters are safe.