It’s been a pretty rough week for newly minted bulls. Remember this chart of the AAII sentiment survey. 1000 SPX points later and everyone is a bull. This is NOT when you should be aggressive with your capital.

Since Mid-July, we have been recommending selling longs, tightening stops on single stock exposure without duration, consider tactical short index plays and buying energy stocks. If you faded your growth longs and bought energy when we suggested, you are trouncing the rest of the stock market.

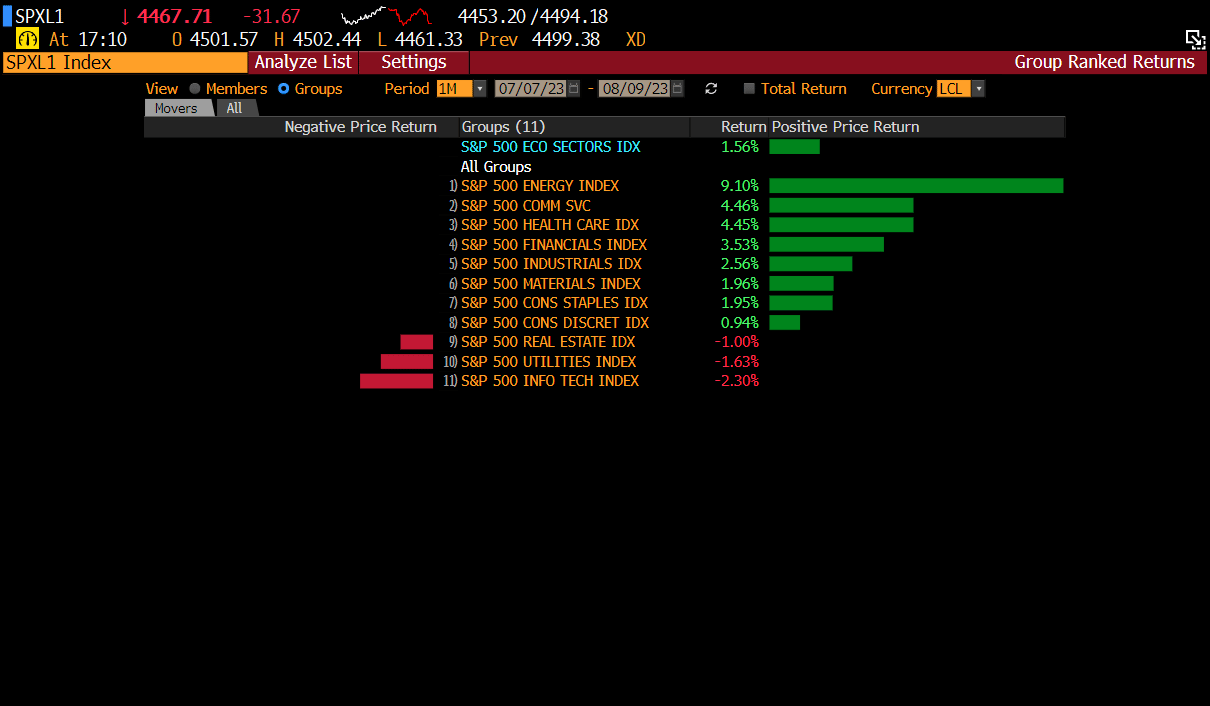

Energy is leading the market over the last month by 2x. Here are the excerpts from our July 9th report.

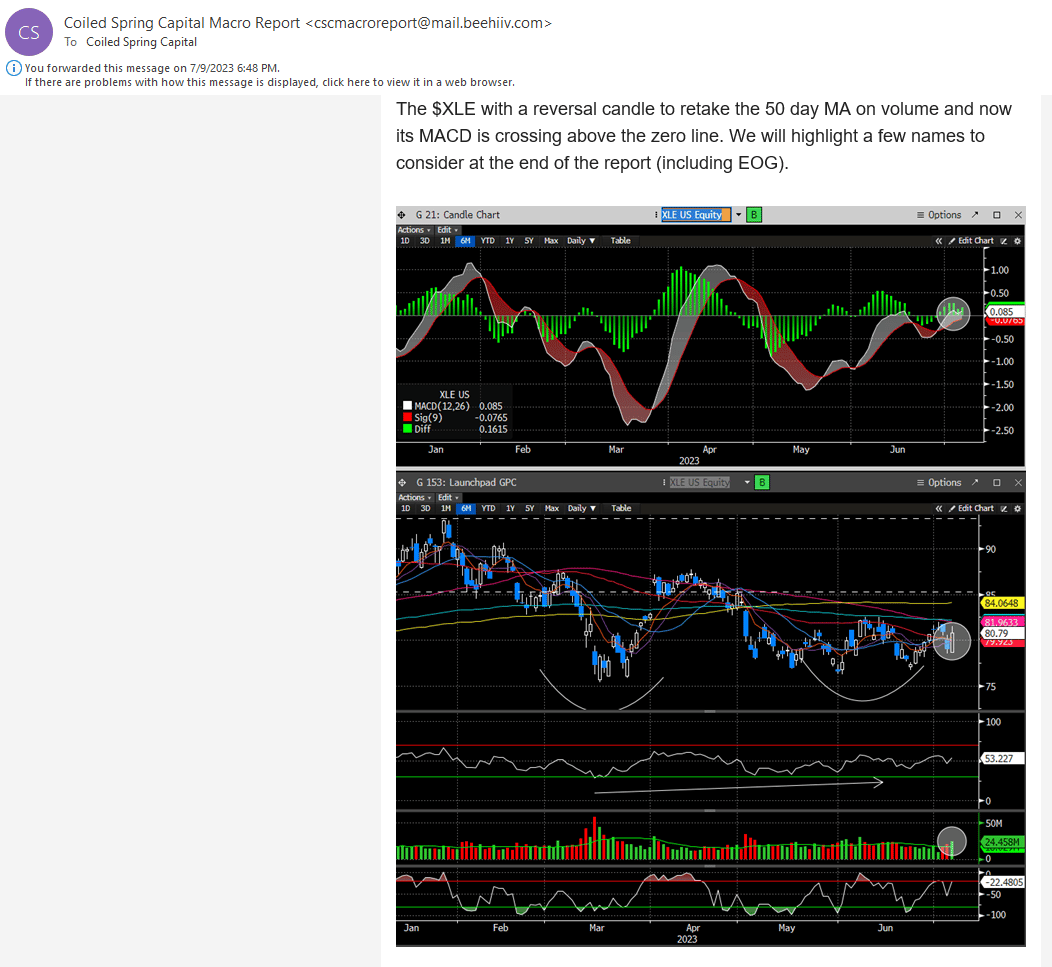

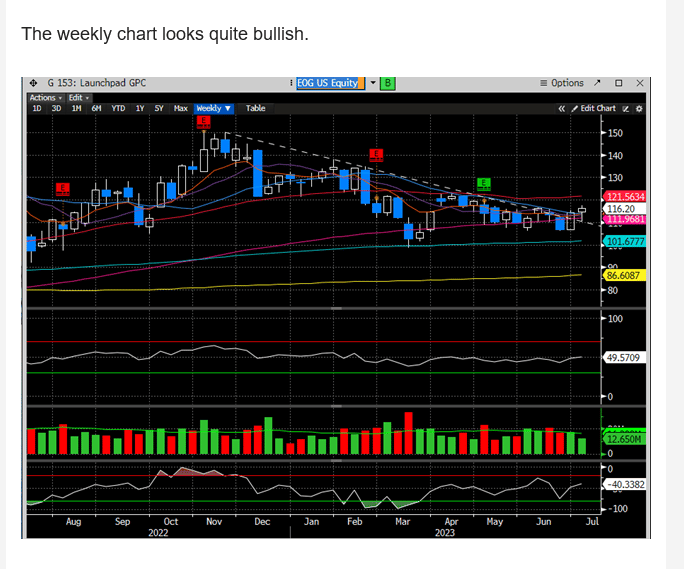

“In reference to our sector call out on Energy above, we wanted to highlight a few idea suggestions to track and manage. We think these could outperform, even if the market enters a difficult period, much like last year.”

Not only is Energy beating the market by an insanely wide margin (+9% vs 1.5% for the SPX since the July 9th published note), but the individual stocks we highlighted are also beating the energy GICS level index.

*FANG and EOG both up +13%

*HAL+14% and SLB +11%

We are hard pressed to find any newsletter that gets you out of the hottest trade (growth and tech) and into the next hottest trade (Energy) with such precision. We offer this for only $24.95/month).

The newly minted bulls have gotten scorched. Consider the NAAIM Index which measures invested capital by institutions. In late Sept and into Oct ‘22, when we started to get bullish, this stood at 12.6% invested. Last week it stood at 101.82%. Those institutions that were recently forced into the market, ignoring all the positive structural changes in the market for the majority of the year, just got clobbered. You honestly can’t make this up. This now stands at 78% after the last 2-week stock market drawdown.

Tomorrow we will get CPI and as we have written previously, the next few CPI reports are going to be increasingly important. The Fed is looking for a directional bias for further interest moves and the CPI is the component they seem most concerned about. This means tomorrow could be binary if it swings too far in either direction vs expectations.

CPI is forecast to come in at +3.3% and core at +4.7%.

A too hot or too cold CPI does have the power to move Fed Fund Futures around, and undoubtedly the stock market. Currently there is only a 34% chance of another hike by November and cuts are creeping back to Jan, albeit only a 12% probability.

While we have no official view of the CPI, we do think there is the potential for re-acceleration at some point over the next few months. Whether that comes tomorrow is not for us to predict, we’ll leave that to the economists.

The stock market has corrected some of the euphoria that hit the market in July. Does this mean that the stock market is destined to test the Oct lows or is a buying opportunity on the horizon?