The stock market's recent wild swings bring to mind a famous line from Ferris Bueller's Day Off:

"Life moves pretty fast. If you don't stop and look around once in a while, you could miss it."

And so does the market—sometimes too fast. Over the weekend, our call was to anticipate a bounce to resistance that would ultimately fail. True to form, the market bounced on Monday and Tuesday, testing our resistance level perfectly. On Wednesday, the CPI print triggered aggressive selling, driving the SPX down to retest last week’s lows before reversing course and rallying sharply into the close. Our tactical expectation was for a market rebound in the latter half of the week—we were just a day early.

By 10:40 am, the SPX countered the bears and surged higher, producing an intraday swing of nearly 3%. While we expected volatility to persist until the election, we didn't foresee this level of whipsaw action.

On Wednesday morning, we were confident that the lower pivot range we discussed in our weekend report would be tested, creating a favorable risk/reward entry point. The market, however, had other plans and quickly invalidated that expectation.

Bull markets have a way of making it difficult to join the rally, and today's action was a textbook example of that. The rally from last week’s lows formed a hammer reversal candle—something we often emphasize in our reports for its significance. In simple terms, buyers took advantage of this morning’s weakness to trap late sellers.

So, what triggered this sudden shift in the market? It's hard to pinpoint precisely. The CPI came in hotter than expected, showing a 0.3% increase—the largest in four months. This tempered any lingering hopes for a super-sized rate cut at next week’s FOMC meeting. The stock market is notoriously unpredictable; it thrives on a balance where the economy isn't cooling too quickly, which could force the Fed into more aggressive rate cuts. Stable inflation, in turn, helps companies protect their margins and maintain earnings.

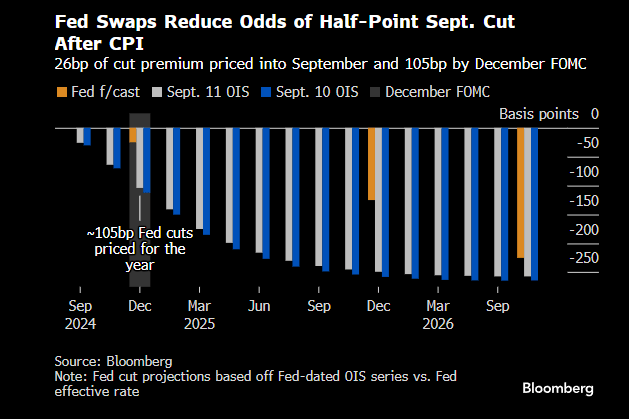

The FOMC probabilities have shifted further since last week, when we noted that the bond market seemed less concerned about the payroll report than the equity market. So far, the bond market’s perspective appears to have been the correct one. Lower rate cut probabilities align closely with the soft-landing narrative. The greater the likelihood of a substantial rate cut, the more risk there is of significant dislocation in equity markets as recession fears come to the forefront.

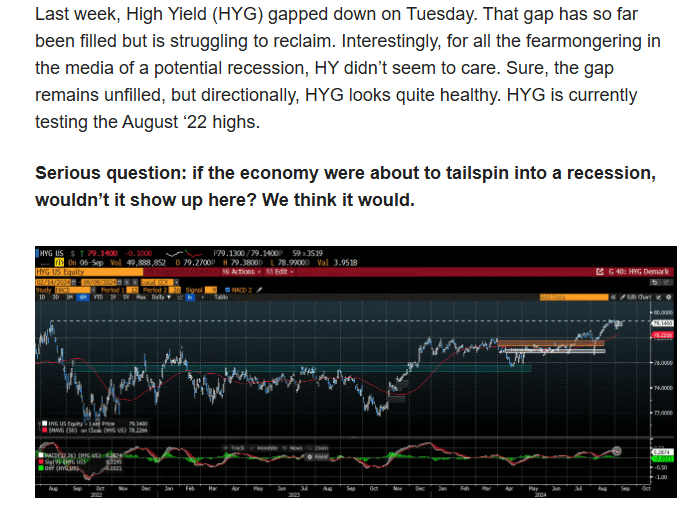

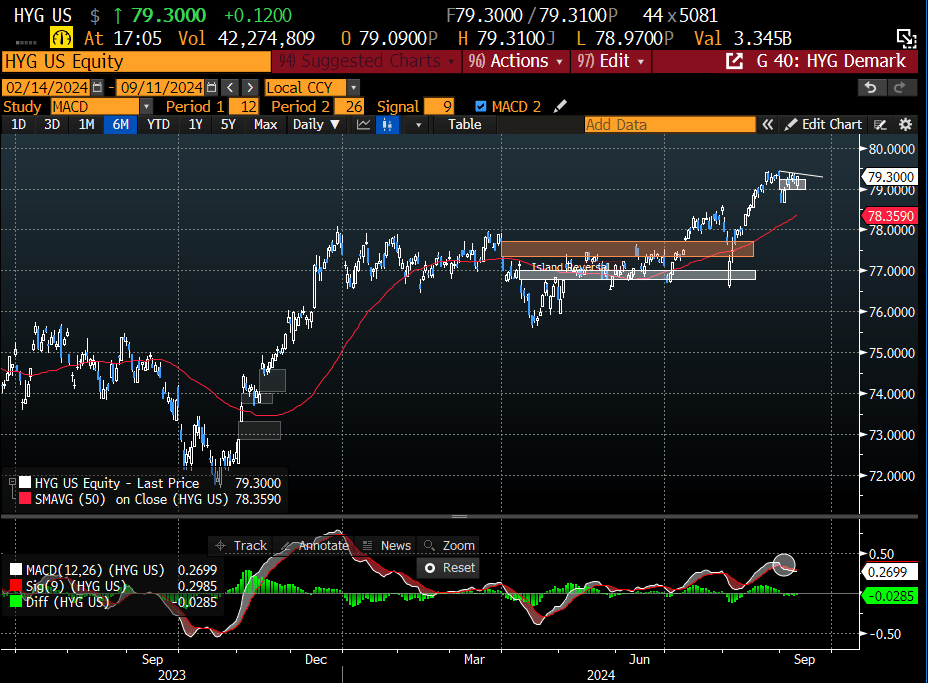

In our report last weekend, we pointed out that the equity market seemed to be overestimating the likelihood of an economic slowdown. Our reasoning was partly based on the observation that high-yield investors weren't significantly rattled by the 4% drop in the SPX last week.

Here is that excerpt:

High Yield (HYG) has since reclaimed the gap window, forming a bull flag at the 2-year high pivot. This seems bullish.

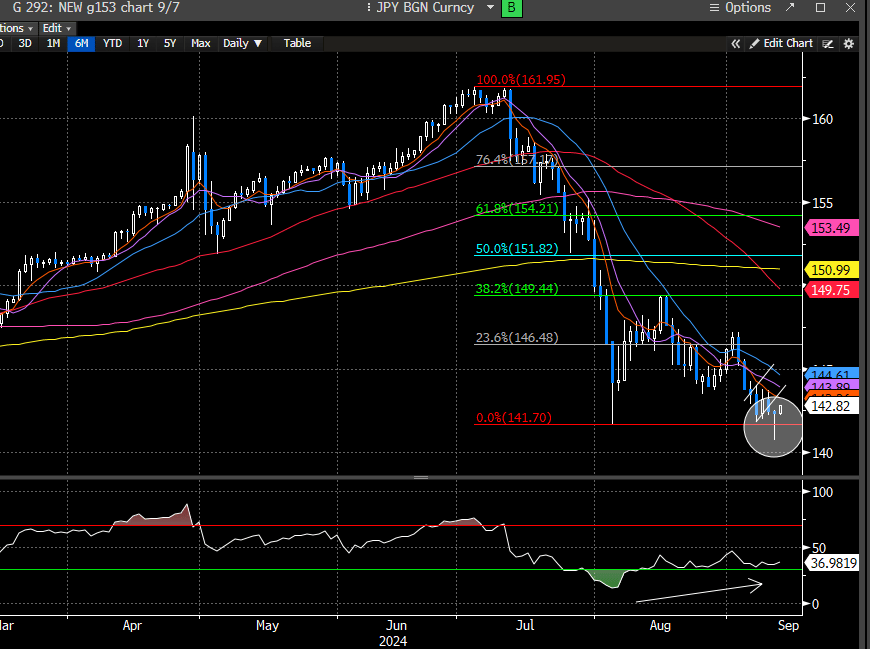

We focused extensively on other macro factors—like oil, treasuries, and the yen—indicating that a reversal in these instruments was likely, which could help ease some of the pressure on the equity markets.

Oil, for example, has been in free fall since the end of August, but today it finally found some stability. Whether it's due to the weather or simply needing a reason to rally, we believe the latter is more likely.

The 2-year treasury bounced where we suggested it would after the CPI report.

The JPY formed a hammer reversal candle, suggesting that the wave of buying is easing. This stabilization in the yen was clearly reflected in the more liquid areas of the stock market, particularly in the Mag 7 index.

The Mag 7 Index was up over 2.5% today. This chart should worry you if you are bearish on the stock market.

As should this (NVDA):

This too (AMZN):

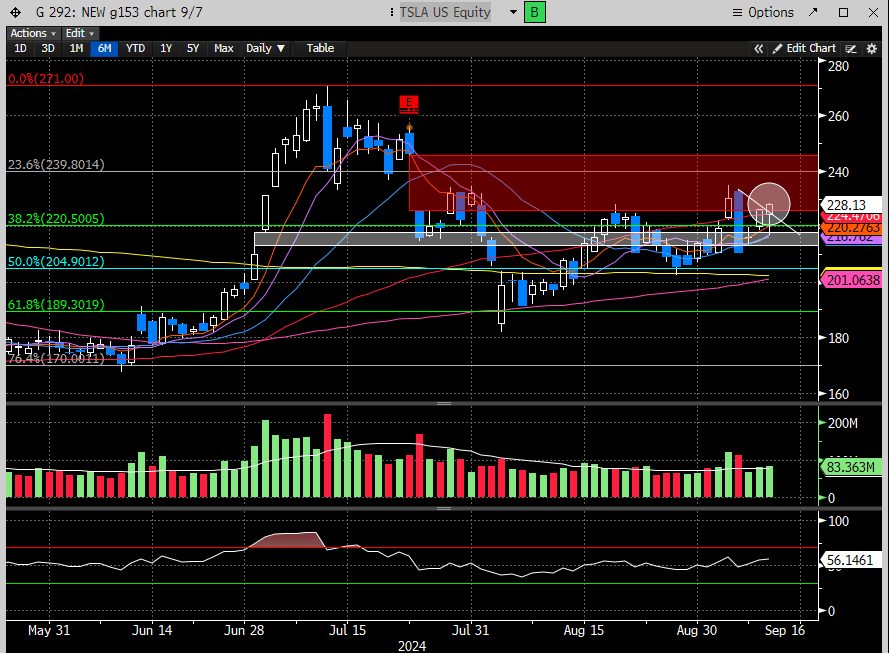

TSLA is starting to look perky.

MSFT is as well:

AAPL has been well supported recently and now seems poised to resume its rally.

When the largest stocks driving the indexes begin breaking through resistance points with renewed strength, it's challenging to maintain a bearish stance, even with poor seasonality in play.

Ultimately, our goal is to equip our readers with the tools and insights needed for better investment and trading decisions. We won't always pinpoint every market move exactly, and while we had hoped for lower prices to become more aggressive, the market had other plans. Our priority is to keep our readers aligned with market trends. Although we didn't reach our ideal buy-the-dip zone, we were ready to act on today's market reversal, consistent with our weekend strategy.