Have you ever opened a door too fast, only to have it slam right back in your face? That’s exactly what today’s FOMC meeting felt like for the stock market. The day started strong with a surge in gains after the Fed surprised everyone by cutting rates by 50 bps, only for it all to unravel by the close.

Fed days are notoriously tough to navigate because of the massive hedging and derivative exposure surrounding these events. This creates volatile swings in both directions that are less about fundamentals and more about the unwinding of positions. It's hard to glean the true direction of the market from this kind of activity, as the real moves often come a day or two later.

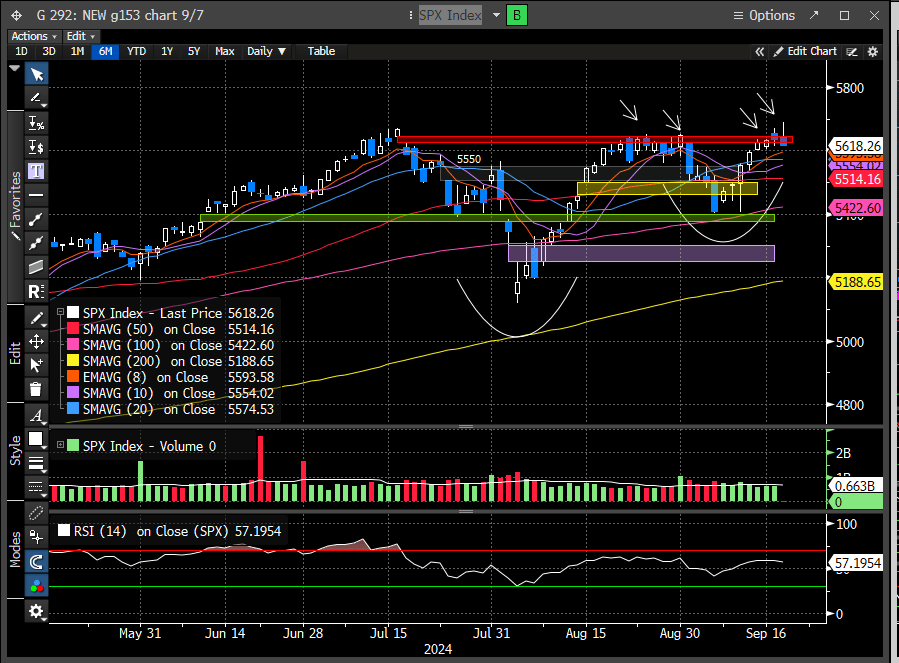

At first glance, the SPX’s setup looks a bit concerning. We hit a new all-time high (ATH), only to reverse sharply, dropping below key resistance and closing at the lows. This could be viewed as a false breakout—and false breakouts often lead to more significant downside moves. Today’s "shooting star" reversal candle will certainly have the bears feeling vindicated as they celebrate post-close.

It's important to remember that the SPX had been up for seven consecutive days, so a “sell the news” reaction shouldn’t come as a huge surprise. The bigger question is whether we’ll see any follow-through. One day doesn’t make a trend, and while today’s rejection is concerning for the bulls, the more critical factor will be the weekly close. We should wait before jumping to any conclusions.

Powell’s press conference was notably dovish, signaling the Fed’s readiness to intervene if necessary to support growth. There was no real indication of concern over the economy, aside from stubborn inflation in the housing sector. Considering that the Fed Fund Futures had doubled the probability of a super-sized rate cut in just over a week with little macro data to justify such a move, it’s possible the Fed intentionally leaked its intentions to prepare the market. That would explain the recent rally leading into today and the sharp reversal afterward.

The key takeaway? The "Fed put" is back. Investors are now betting on an additional 75 bps of cuts by the end of the year.

Unless we see clear evidence that their hesitation to cut rates sooner has derailed economic growth, we should assume the outlook remains optimistic. This shifts the focus back to the macro data, particularly the jobs market.

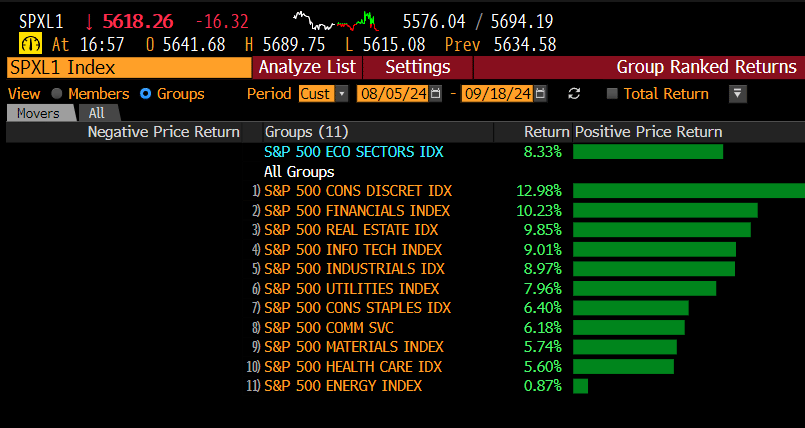

Bears may latch onto the idea that significant rate cuts in a slowing economy often precede a market decline, and today’s brief move above all-time highs could mark the top. Perhaps. However, we believe the cuts reduce the likelihood of a hard landing, which should benefit cyclical sectors and small caps. The market has already been pricing in this scenario, and we expect that trend to continue.

Since the August 5th low, cyclicals have been mainly leading the SPX.

This doesn’t mean that growth stocks won’t participate—we believe they will. However, as we’ve been highlighting since July, the previous large-cap leaders are likely to underperform under the new Fed rate regime. Given their heavy weighting in the major indexes, this could create a scenario where many individual stocks perform well, but the indexes themselves struggle to gain significant ground. In essence, we’re entering a new era: a stock picker’s market.