We made an argument last weekend in our Macro report that the market set up for the week looked like more downside was coming, but largely we remain uninvolved as the trading environment has been a bit treacherous for both being long and short.

Here is the excerpt from our conclusion page:

Knowing when to allocate capital and when to avoid the pitfalls of a trendless market are sometimes half the battle. You simply don’t have to be involved, or aggressively involved every day. When markets trend, they typically do for months and there is ample time to make quite a bit of money. Since the end of July, we have tried to keep things on the lighter side unless we have duration with our allocations. That has been the right course of action as stocks have been getting bid up only to fail aggressively. Even the short side has been tricky. Trendless markets are how traders get chopped up and we prefer to avoid them. Our system is designed to identify the trend as early as possible and ride that wave for as long as our signals allow us to. This has worked well all year, and we see no reason to change. Since the end of July, the market has been a choppy mess.

Was today’s move the beginning of a larger down trend move or the end of one? Thats a good question but the answer is never one dimensional.

Powell gave the bears what they wanted to hear and broke the impasse of a 3-week consolidation. While the week is not over, the weekly chart looks like a wedge break to the downside after 2 inside weeks.

The SPX with a 2 inside week and down move:

And the same for the Nasdaq:

This is poor from a market structure standpoint and if we do not recover quickly into the end of the week, we suspect more downside is in front of us.

So why the impasse break today? The Fed left rates unchanged, which was largely expected, but the rhetoric coming out of the meeting was noticeably hawkish, discussing the likelihood of another hike by year end.

Here is the Fed’s new dot plot:

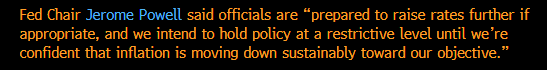

This caused treasury rates to reach the highest in over a decade.

The 2 year:

The 10 year:

And the 30 year:

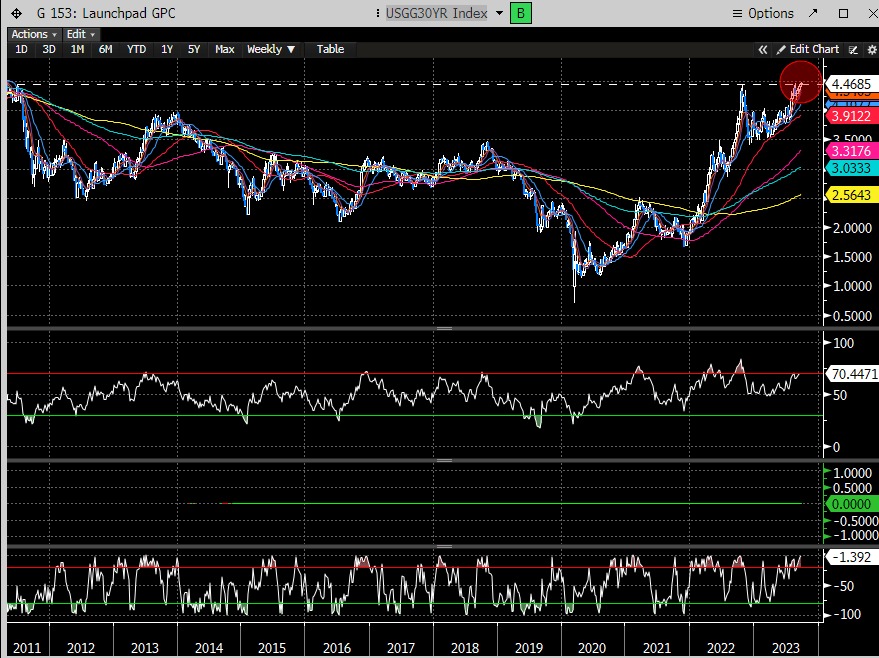

And remember our 2 other horsemen: The $USD and Oil.

The $USD (DXY) continues to press higher.

But oil is finally cracking. Remember our comment last week about shorting oil near $94? The high on Monday was $93.74.

Here is the excerpt:

Now oil is -$5 lower.

Regardless, 1 out of 3 rolling over is not enough to get bulls excited. It’s simply a very tough environment to be overly allocated to the stock market currently.

For more thoughts on the indexes and the current index set up, we would recommend signing up to read the premium content.