The proverbial “three horsemen,” as we’ve dubbed Oil, Treasury Rates and the $USD, continue to push to new heights. This surge in long term treasury rates is now the highest in 16 years. Oil broke $95 today and the $USD is blowing past major Fib and resistance levels. This sets up for a treacherous stock market environment if something doesn’t give soon. The soft-landing narrative is now in serious question.

The rise in the 10 year yield is up over a 100 bps since mid-May.

We’ve always maintained that quick moves in any major instruments can be dislocating to equities. The question is what is actually dislocating under the surface. The rapid rise of treasury rates/interest rates have to be causing havoc in some areas of the financial system. But where? This is the question any serious market participant has to be concerned with. We certainly are.

The $USD (DXY) just broke a major weekly pivot and now the highest since Dec ‘22.

And now plunging stockpiles has the oil market screaming higher. Oil just hit $95 for the first time in more than a year.

This came on the backs of an inventory report at Cushing, dropping below 22M barrels, the lowest since July ‘22 and close to operational minimums. This is coming on the backs of OPEC forecasting a deficit of as much as 3M barrels for Q4.

We cannot see the market sustaining any momentum should these stay as elevated as they are. Bulls need to see evidence of a turn, or this will start affecting out year earnings estimates in a big way. If you recall from an earlier report, the SPX earnings forecast for ‘23 is calling for 11% growth year on year. That sounds far-fetched, especially given the increasing higher cost of capital and oil prices that could break a $100 soon.

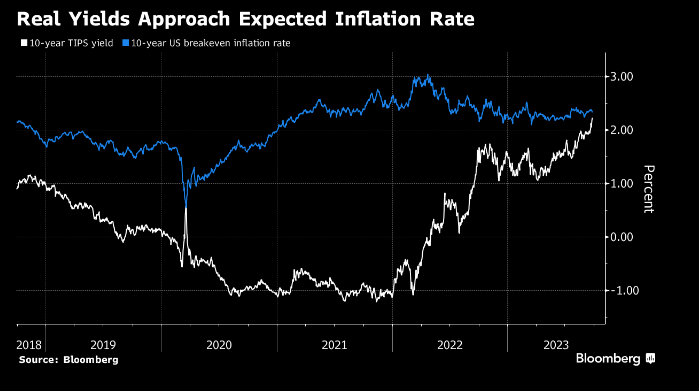

When the bond market’s real yield is above the expected inflation rate, that usually portends to higher cost of capital really starting to impact businesses as their revenues can’t keep pace. This can cause a very steep and brisk slowdown in the economy, as activity comes to a screeching halt.

Putting that aside, we are also fearful of what we don’t know. We alluded to this above, that massive dislocations usually occur when large instrument volatility is present. The stock market is starting to price in that trepidation, clearly with the SPX now off -8% since the July peak. We think this trepidation makes a lot of sense and it is becoming increasingly difficult to paint a bullish picture.

But markets don’t move in a straight line, regardless of what’s in the ecosphere, and our job is to identify turning points or opportunities to trade those inflections.

So how do we see the market set up from here?