We have no problem admitting when we’re wrong. Over the weekend, our analysis pointed to more upside in September, potentially reaching new all-time highs. Our strategy was to sell into the market's residual strength, anticipating a challenging back half of September and a contentious pre-election October. While our expectation for selling pressure in September was accurate, the timing was off.

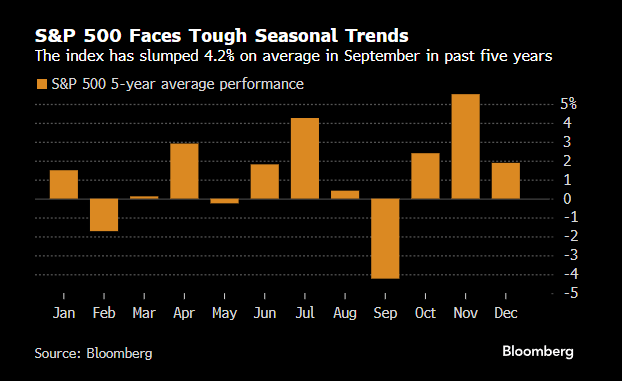

Right after Labor Day, the market took an aggressive downturn, with pervasive selling across the board. The Nasdaq and Russell 2000 both dropped over 3% in a single day, marking the worst drawdown since the August selloff. The key difference is that back in August, the indexes had already been in decline for two weeks, whereas Tuesday’s sell-off happened near all-time highs. Given the historically unfavorable nature of September, a quick rebound seems unlikely.

Technology stocks took the brunt of the beatdown, where previous market darling NVDA was pounded for almost 10% and the Semiconductor Index lost 8%. There were very few places to hide as most sectors were sold aggressively.

Heading into the weekend, there was little in the short term that concerned us. Most of our indicators were elevated but not yet extreme, and while DeMark signal counts were approaching sell triggers, they hadn’t quite reached them. The construction of the indexes and their underlying sectors all displayed bullish monthly closing characteristics. We take pride in uncovering subtle nuances before instruments reverse and are typically very adept at it. However, this recent market turn caught us—and many others—off guard.

Could the catalyst have been the slowing ISM report, similar to early August? It's possible, but the report was only slightly off from consensus, with the ISM Manufacturing PMI missing marginally. New orders did decline at an accelerated rate, and backlogs continued to drop, though modestly.

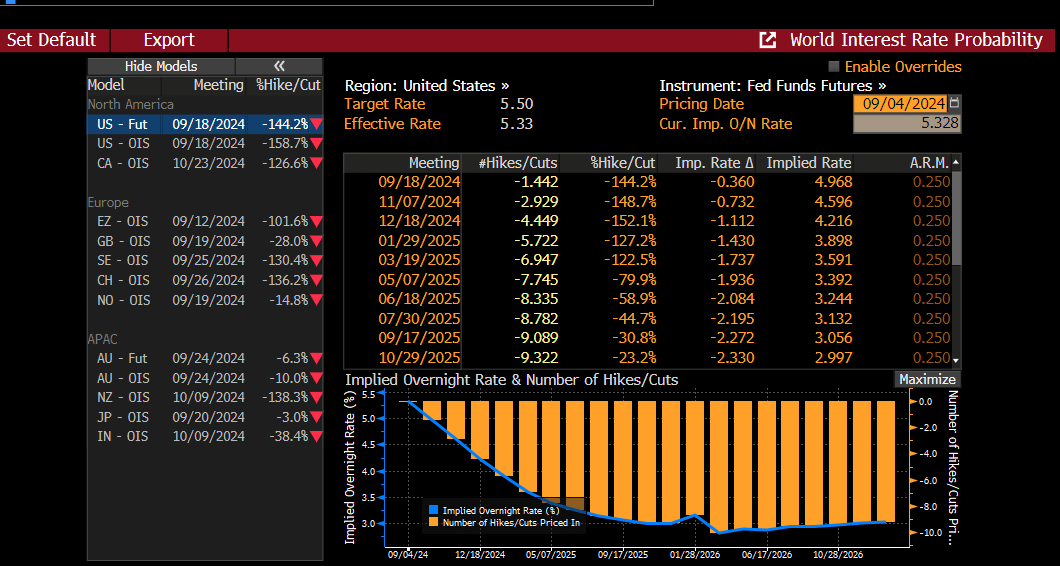

The bond market showed little reaction that day, with Fed Fund Futures maintaining a 40% probability of an additional rate cut in September—consistent with the odds at the end of August. This suggested that the bond market wasn’t anticipating a strong need for another cut.

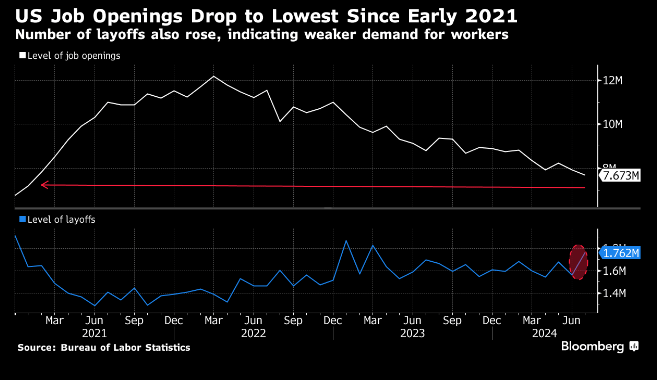

If the bond market views the ISM report as business as usual, what message is the equity market sending? Just one day later, the JOLTS data showed job openings falling to their lowest level since January 2021.

This increased the probability of a double cut in September to 44% from 37% the day before.

This sets the stage for a crucial payroll report on Friday, with the stock market clearly reflecting the anxiety leading up to it. Did the equity market catch on before the bond market? It certainly appears so. If the employment report falls short of expectations, we could see a significant retracement lower as fears of a hard landing take center stage. Conversely, a report that meets expectations might trigger a relief rally—creating a sharply binary outcome.

Bloomberg economists believe the report is unlikely to ease the growth concerns that fueled this week’s selloff. They expect a disappointing payroll figure, which would likely increase the bond market's expectation of a 50 bps rate cut in September.

Large shifts in the bond market’s expectations are usually dislocating for the stock market, and we think the potential for a more significant move lower is present.