Since we wrote a report 2 days ago discussing our tactical short in the indexes, we will keep this mid-week report brief and succinct.

Let’s quickly review this past week’s reports’ overriding conclusions.

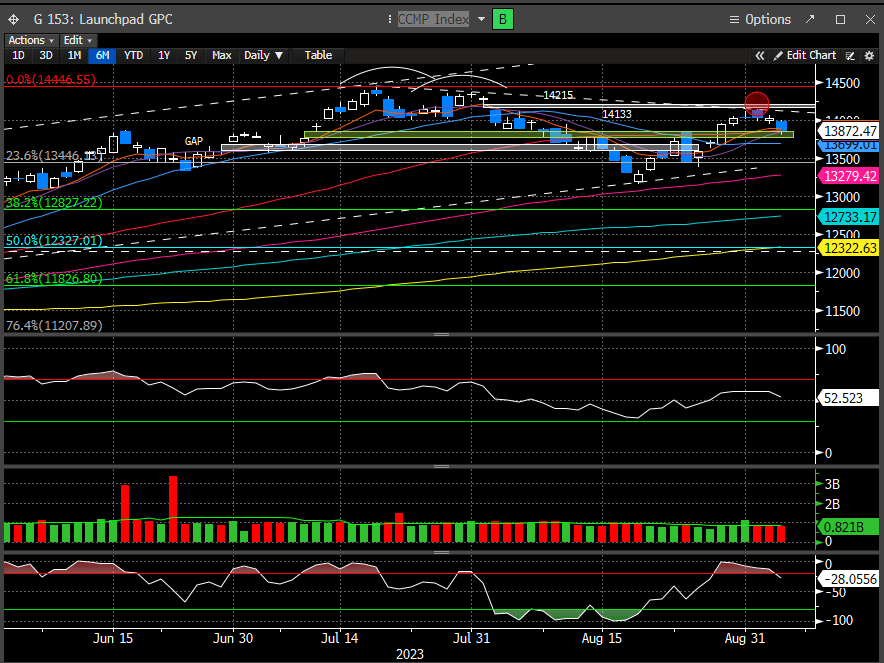

*We advocated a tactical short in the major indexes if our price levels were reached and if the DeMark signals printed. We got our level on the Nasdaq last Friday, while printing a 9 sell. So far, the Nasdaq is down over -2% since.

*We advocated a similar trade for the SPX but missed our level by 9 points and the DeMark signal never printed. Such is life.

Our report discussed multiple reasons to express caution in the very NT. Here is some excerpts from that report:

“…there are still quite a few hurdles to overcome in the near term. Namely the sell signals in in the indexes, the VIX buy signal, the fact that the SPX is in OB territory per the McL Osc, Oil continues to track higher, and a looming Sept CPI report followed by a Fed meeting.”

“Our goal this week is to possibly set up short tactically in the major indexes if we get our prices, but we will remain nimble and disciplined to our risk parameters.”

Last week we wrote a bit about being nimble in the expected choppy market and this is the definition of such. We had various other conclusions in that report as it pertains to the intermediate picture so let’s quickly update and see if anything has swayed our opinion.