We have been positioned tactically long from mid - late Dec into this week as our work suggested the internals were turning along with certain DeMark signals we track on various instruments. This was at odds with most of main street media, sell side analysts/strategists and the flip flopping Fintwit herd.

We continue to advocate that market predictions based on singular variables (i.e. price) are at best a coin toss. This is how most market participants trade, they follow price because they can't predict. Sure, they will draw squiggly lines on charts depicting their view, especially Elliot Wavers, but the reality is they are simply reacting to a price level, not predicting with any precision of an ensuing trend change. The market is so much more complicated than analyzing price singularly.

This is why we differ, and we are proud that we stand apart from the plethora of commoditized analysis. Not only are we differentiated but our directional index calls are consistently accurate, and quite precise in time and in price.

Get the direction of the market right and it's a lot easier to make money in individual stocks. Let's review some of our recent long idea public posts on Twitter and their recent performance:

$AMZN +$10 or +12%:

$SPX 152 points or +4%

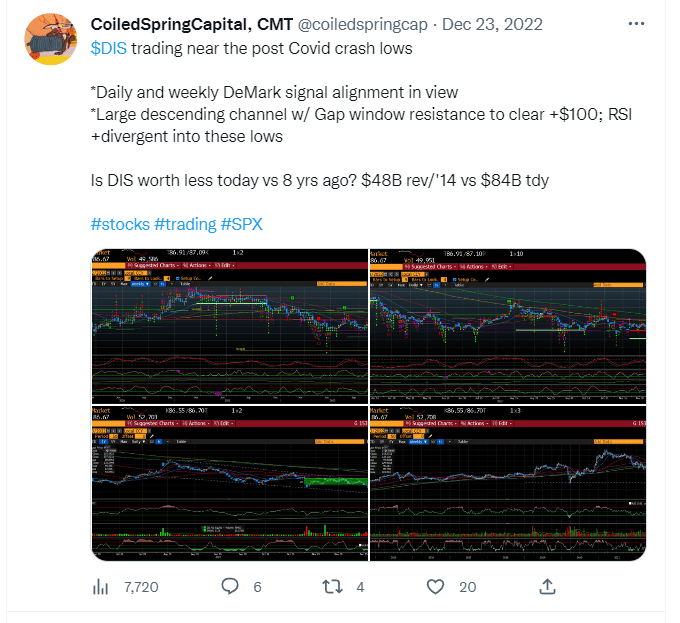

$DIS +$11 or +12%

$IWM +$9 or 5%

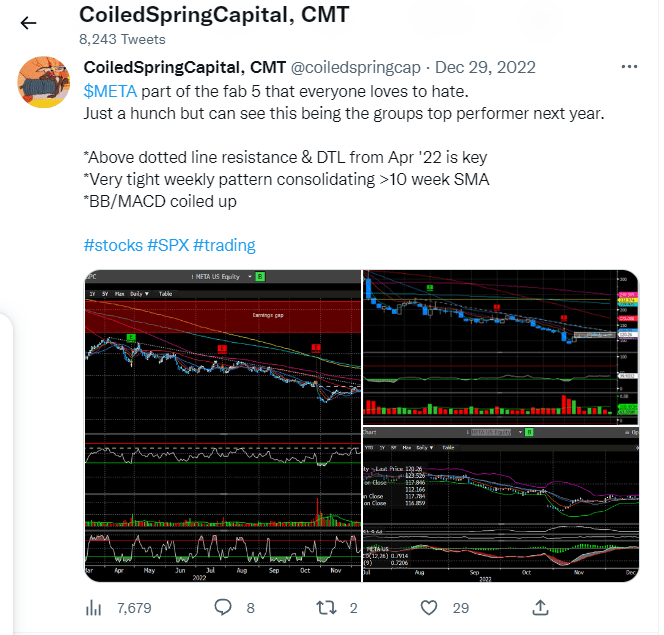

$META +$13 or 11%

$TSLA -$1 or <1%

$PYPL +4 or +5.5%

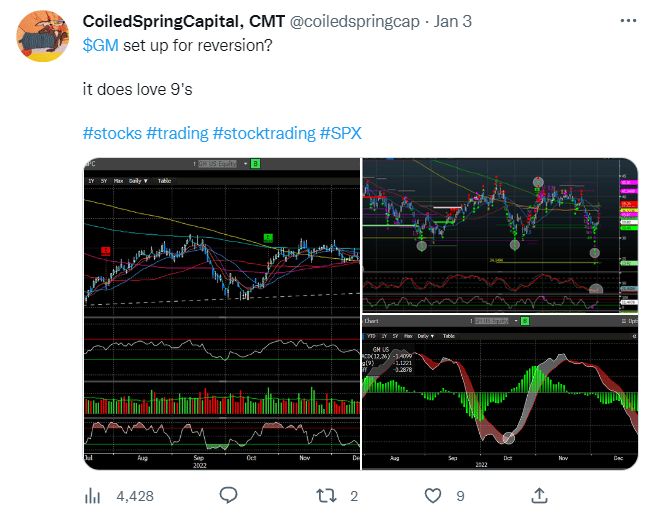

$GM +$4 or +12%

$DKS +$8 or +6.7%

$DOCU +$3 or +5%

We also closed out $BABA for +$25 or 29% since buying it in early Dec.

The point of this exercise is to demonstrate that you don't have to be genius to make money in stocks if you get the market trend right.

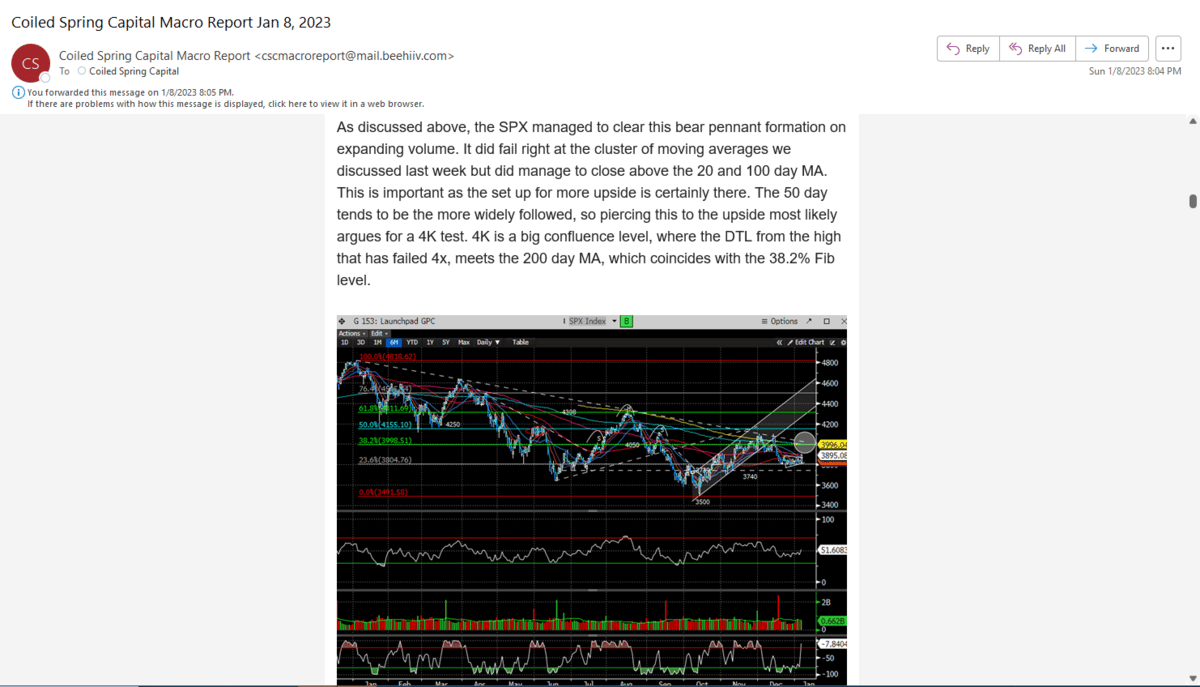

Our prediction this week was for the index to continue to trade up into our upper resistance levels pre - CPI, and to sell into that strength as the CPI report is too binary to consider being overexposed. Our SPX level was 3950 - 4K (closed today @ 3969).

Here is an excerpt on the SPX from our weekend report (time stamped):

We talked about resistance for the Nasdaq between 10800 -10900, and we closed @ 10931.

And the Russell resistance @ 1830. We closed today @ 1844.

The CPI gets reported in the morning and whether Hot, cold or in-line, we have a plan.

If you want to stop being on the wrong side of the market and increase your chances of success, we suggest subscribing for $24.99/month to gain access to our premium analysis.

Our analysis will now periodically include intermediate swing ideas for you to manage on your own (much like the ones we published publicly above).