The stock market has now experienced a sizeable counter trend rally that few expected. Why bears ignore major pivots like the post CPI bullish engulfing day is quite amusing. There are some very smart people that we respect, but they ignore the simple technical market structure changes and press shorts into key reversal days. That has now costed them and their clients 300 SPX points.

In our Oct 13th report, we wrote our profitable bullish Index trade was stopped out on the Oct 7th bearish island reversal and suggested our 3500 H&S target would likely be achieved if the CPI was too hot. We had been signaling that early positive divergences were occurring but hard to stay long into the CPI print. Pre CPI, we also wrote a report discussing the importance of 3496, and if the market were to plunge, it would be a likely spot that gets defended - the SPX bottomed @ 3491. This was all excerpted publicly if you would like to review our prior reports.

We started writing pre-CPI, that we expected a major pivot in the market to form sometime in Oct, and maybe the CPI event would be the catalyst. Here is that excerpt from our conclusion page on Oct 9:

In that report we also wrote that we expect a major top in yields to occur over the next month.

If you know anyone out there that is more accurate with calling these major pivots, we would like to meet them. While it remains to be seen if this the ultimate top in yields, the roll over is exactly what the market needed to find footing.

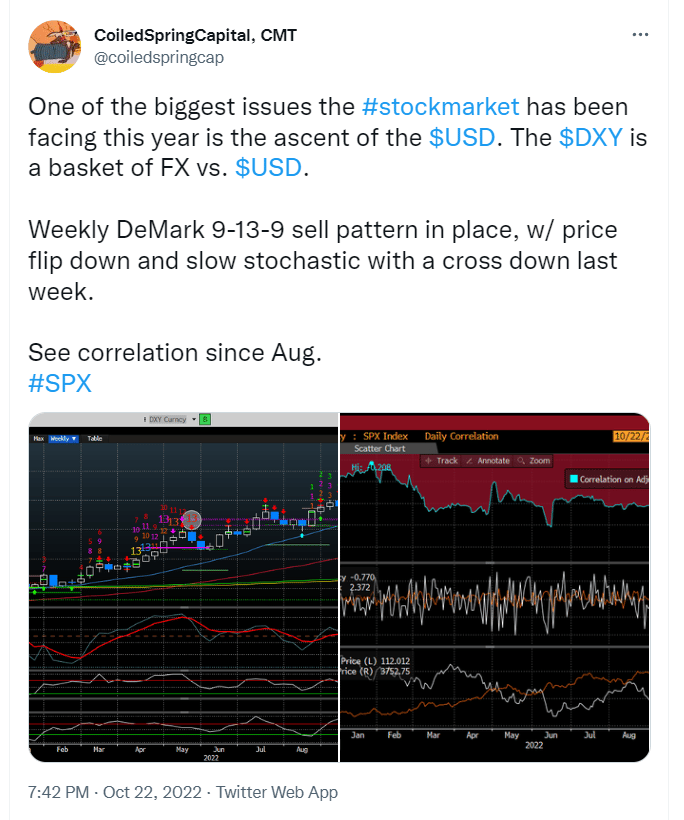

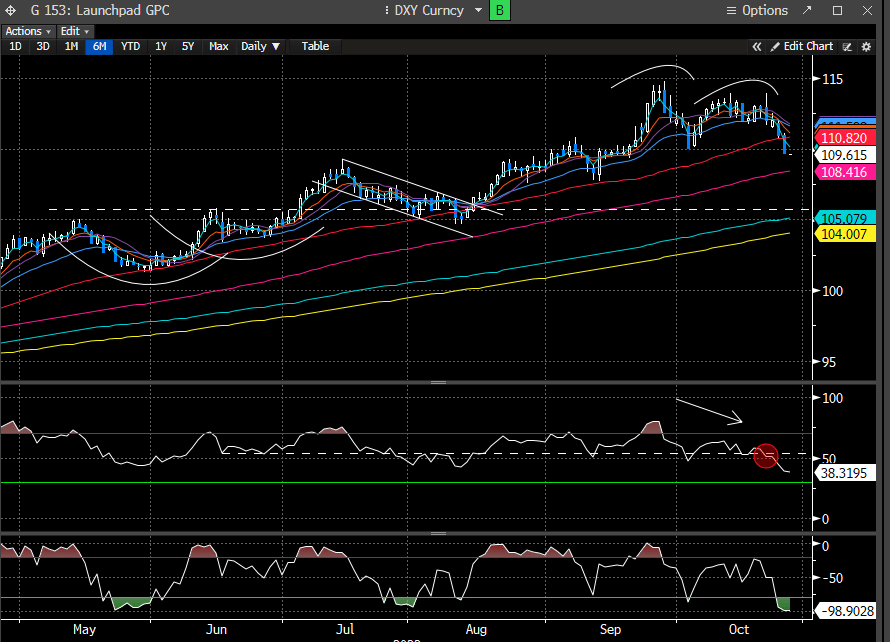

We've also been writing about the $USD possibly set up to roll over, which would add more fuel to any stock market rally. The $DXY is not looking so hot since our public tweet on Oct 22nd.

Fast forward to today....

Calling direction in the market is a difficult game but we think we do it as good as anyone. Most of what we have been writing about has played out with some very precise targets hitting today.

If you have interest in our views on market direction from here, we encourage becoming a premium member. We call the moves before the market sees it giving our readers incredible edge to position for pivots.