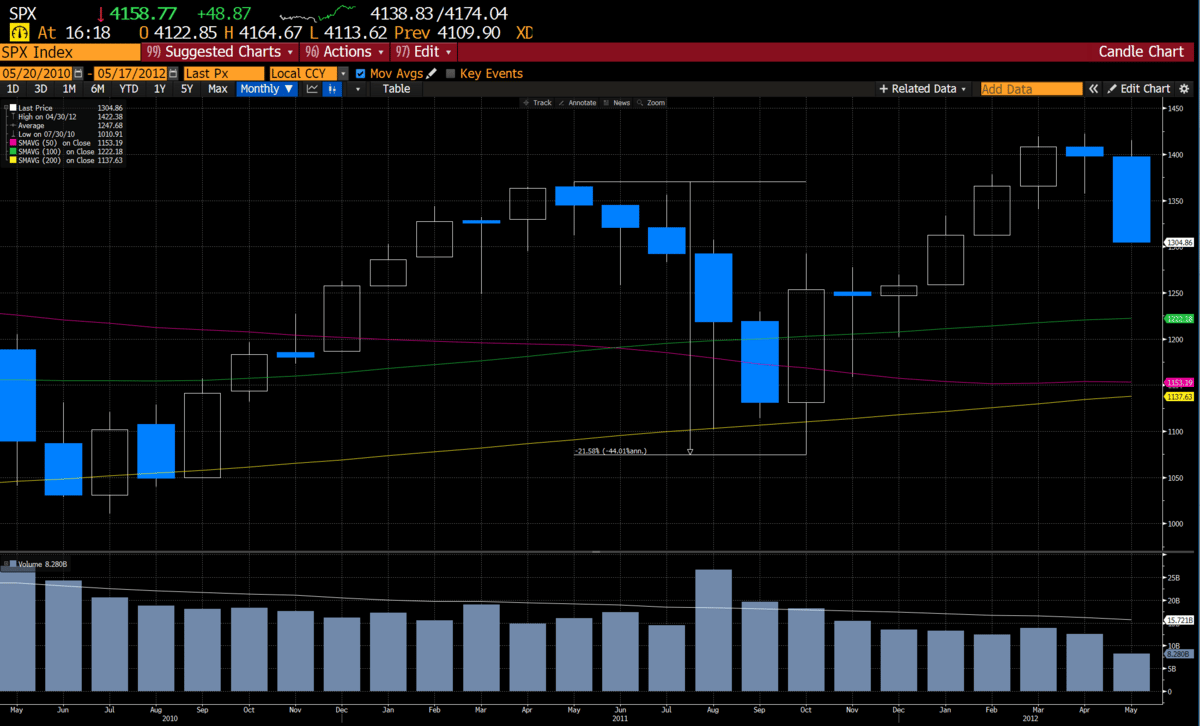

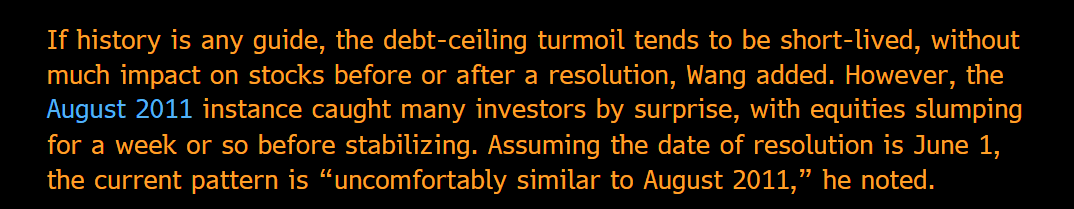

We remember 2011 when fears of the debt ceiling were ignored until it was too late. The VIX ran to almost 50 in a matter of months and the SPX lost 20%. This still spooks everyone including us, every time the specter of a US debt default enters the purview, but the reality is, it’s usually “much ado about nothing.”

This sort of environment around big cataclysmic events are always difficult to trade and predict, as daily data points whip around the market. While we know that most of the time the stock market looks the other way, there is always that chance it doesn’t go as planned, and a volatility event ensues. Nobody wants to be caught in that vortex, so they position defensively. When fears dissipate, that defensive positioning unwinds. Today seemed to be just that as the news flow around negotiating a settlement sparked a decent sized rally that broke the low volatility impasse. But are we out of the woods? The market seems to be leaning that way but there could always be late inning conservative antics that could send this market into a tailspin.

We’ve warned repeatedly about the sentiment being too bearish and todays reaction to seemingly innocuous news, is a reminder of just how lopsided the market has become. Internals have been a mess, yet the major indexes keep tracking ahead. We’ve warned our readers not to be overly bearish until certain levels are broken as the structure of the market is still constructive. We’ve also stuck with trading individual stocks vs. directional index plays.

That has worked out very well and today we sold the rest of our $GOOGL trade for +30%. We posted our exit on Twitter.

We continue to be underexposed to any one direction in the stock market but still managing to put up monster trades. If you are sick of being on the wrong side of the market, we suggest trying our premium subscription below for >$25/month & no contract.