We can’t tell you the amount of banter we’ve heard, read, and seen about how AI is a bubble. It’s not our place to make calls on a technology trend, but AI is now seemingly a mega trend emerging. NVDA just silenced all the skeptics about its recent run and it’s valuation. The stock is trading close to $400 in AH and is actually much cheaper than it was going into the report based on what we now know. We cannot recall seeing a beat of this magnitude. $7B was the estimate going into the print and NVDA guided $4B higher. Yes, that’s right, 4 w/ a “B.”

The semis have been leading the Nasdaq rally, and forecasted this as the landscape in AI has trickle down impacts to other semi companies. $AMD is probably the closest chip in the AI arms race to $NVDA, but companies that produce the wafers, like $TSM, or produce DRAM, like $MU, will also benefit tremendously. We will analyze these set ups in our paid portion of the report below.

We actually presented $AMD as an idea in our report from Jan 24th when the stock was trading at $74. Currently in AH it’s trading @ $117. Not a bad idea for 4 months.

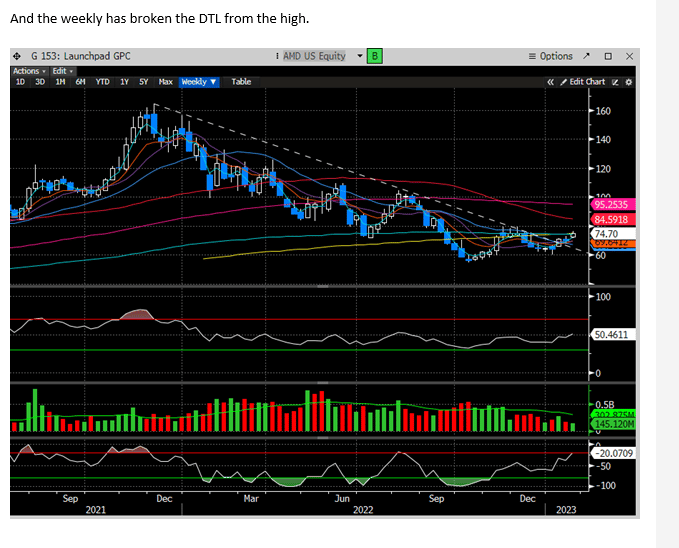

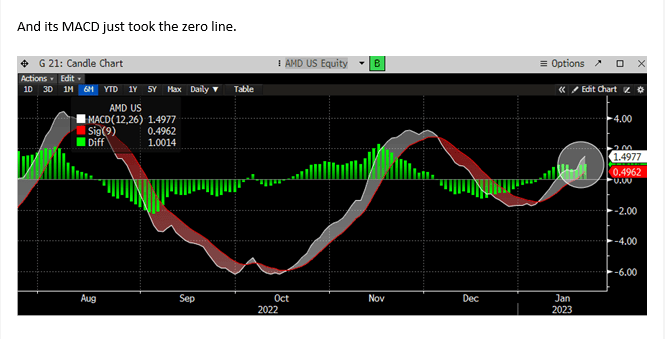

Here are the excerpts from that report:

Last week in our report we discussed if Semis break out of this consolidation, it’s very hard to be bearish on the stock market. This could happen tomorrow.

Are we still in the middle of the debt deal wrangling? Yes, and those headlines will make things whippy, as they have already. We do not think we will go into a government shutdown and this crisis will be averted, but putting faith in that argument, is asking us to trust politicians to do the right thing.

To read the rest of our analysis, please consider becoming a premium subscriber.