The tug of war continues between index price and weak internals. As we mentioned in our weekend report, we wanted no part of today’s FOMC decision. Powell has a vested interest in keeping a lid on the stock market and thats he did. While he hinted that the latest interest rate increase might be the last one before a pause, this was widely expected. Powell left the door open for officials to keep raising borrowing costs if inflation remains stubborn, and refuted any rhetoric about rate cuts this year.

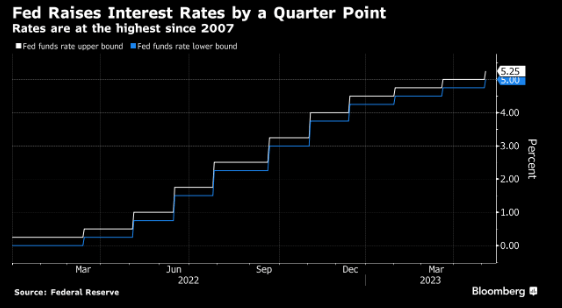

After today’s rate hike, interest rates are now the highest since ‘07.

There is some debate whether the Fed is breaking the system. I am not sure what there is to debate. We have had multiple banks go down (1 already this week). And PACW is on the verge in the overnight session. PACW is now trading at ~$2 in after hours or -60%.

This after already being down -46% from the ‘21 high.

In our recent report we talked about the “cockroach theory” post the SIVB collapse and to expect more failures, and here we are. Whether this is systemic or not, is not really the point. We already know the Fed is going to back stop financial bank turmoil. The bigger issue is what this does to lending. The Fed is trying to curtail lending through higher costs of capital (rate increases), but deposit flight at the banks is accelerating this trend. We can speak anecdotally about this as a good acquaintance of ours was having substantial trouble securing a mortgage to buy a commercial property that was being sold for pennies on the dollar, with a long-term tenant lease already in hand. His remarks to us were that they have never seen credit seize up as much as it has since the GFC. We have also been hearing that construction loans are being turned down, and being renegotiated, and even renewable energy projects are being cancelled. As the banking crisis deepens, we expect this to get louder. If lending dries up, employment trends will certainly follow.

We have written a few times about the implication of oil for global growth. And while we attempted to trade the commodity long this week on the DeMark signal, we were quickly stopped out (-2.5%).

Oil has been in free fall since losing the OPEC production cut gap and has seen the biggest weekly drop since the pandemic. What’s this say about the global economy if production cuts cannot help oil sustain a bid?

Nothing screams recession is coming more than oil falling apart.

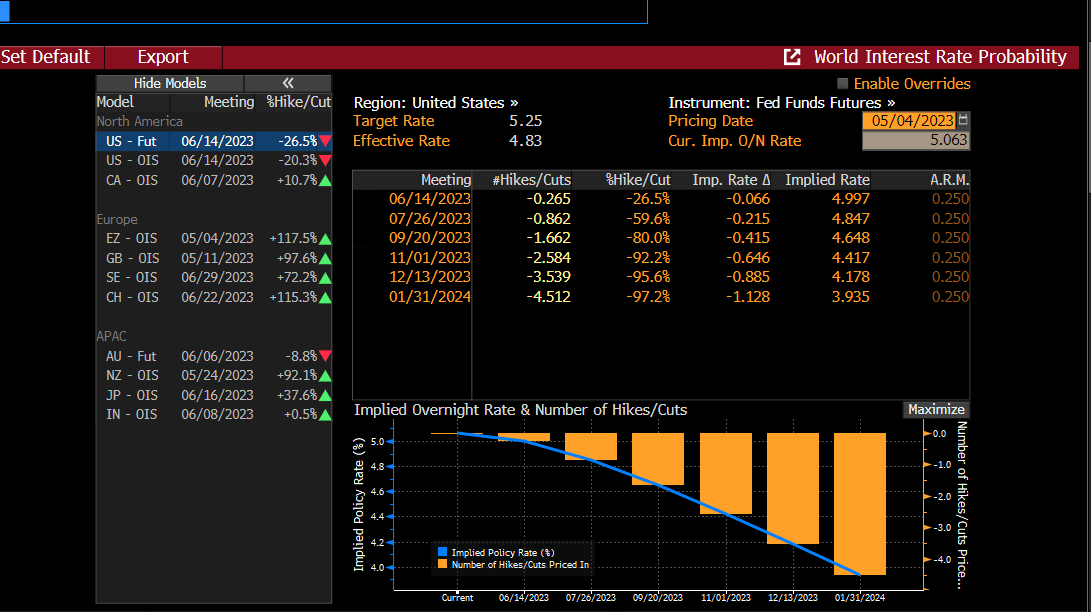

Currently, the Fed Fund Futures are still pricing in at least 3 cuts by the end of the year, which is at odds with Powell’s commentary. Oil and bonds are clearly saying that Powell’s assessment of the economy is wrong, and maybe that’s why most stocks are struggling, as they attempt to price in the Fed being behind the curve, which historically has been the case.