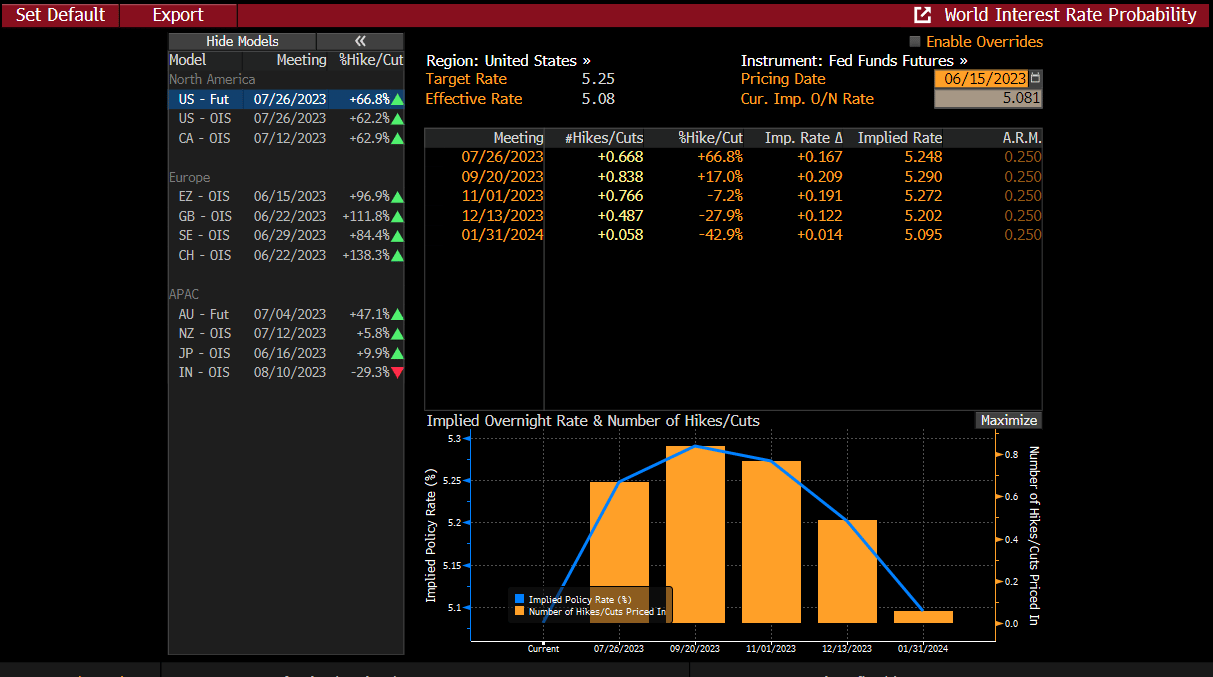

Over the last few weeks, we’ve seen quite a bit of banter back and forth in the media on what the Fed would do this week. Why so much time is wasted on this topic is tough to understand. The Fed rarely veers from their guidance unless something drastic in their forecasts change. And today’s results were consistent with our thinking and consensus, with a widely expected pause in their rate hike campaign after 10 straight hikes. What wasn’t expected was their intention to possibly do 2 more hikes this year vs. one more in July. They also said the meeting for July was “live,” which means it could go either way and will be data dependent.

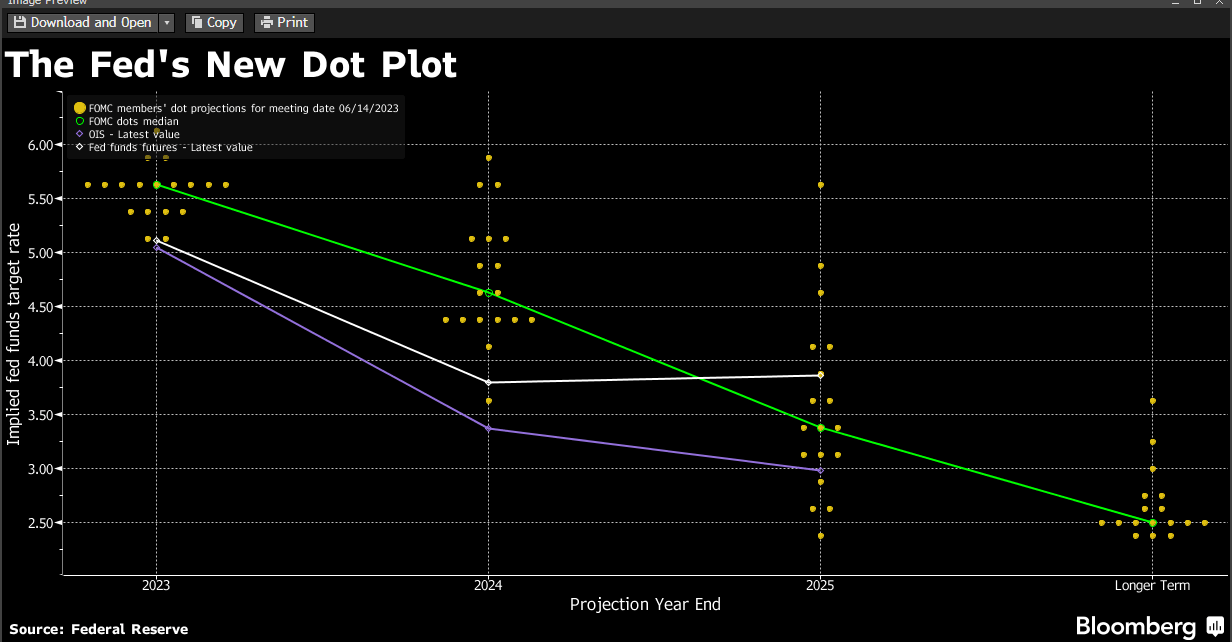

Here is the updated Dot Plot:

This implies the median forecast for the Fed participants is 5.6% by the end of the year, which implies 2 more rate hikes this year. One of the bigger and notable shifts over the last few weeks was the belief the Fed would cut rates this year, which has now been officially pushed back further into ‘24. This about face was clearly the market believing the Fed would break something if they kept pushing the rate cycle rhetoric, i.e. small banks, and since backstopping the crisis, is now fully unwinding that bond trade.

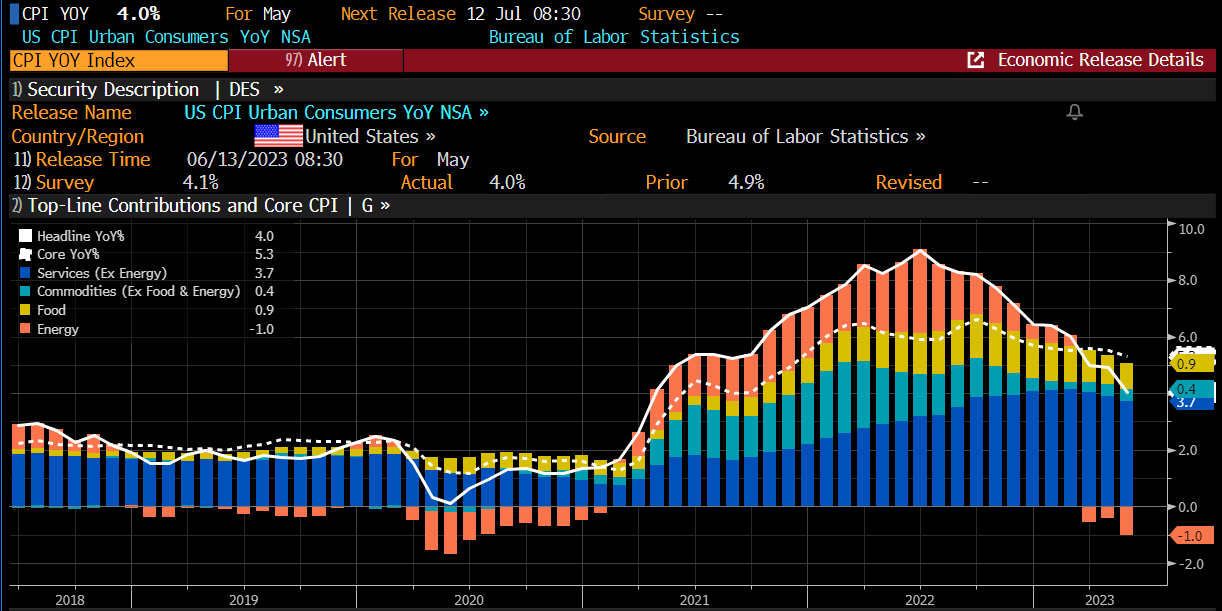

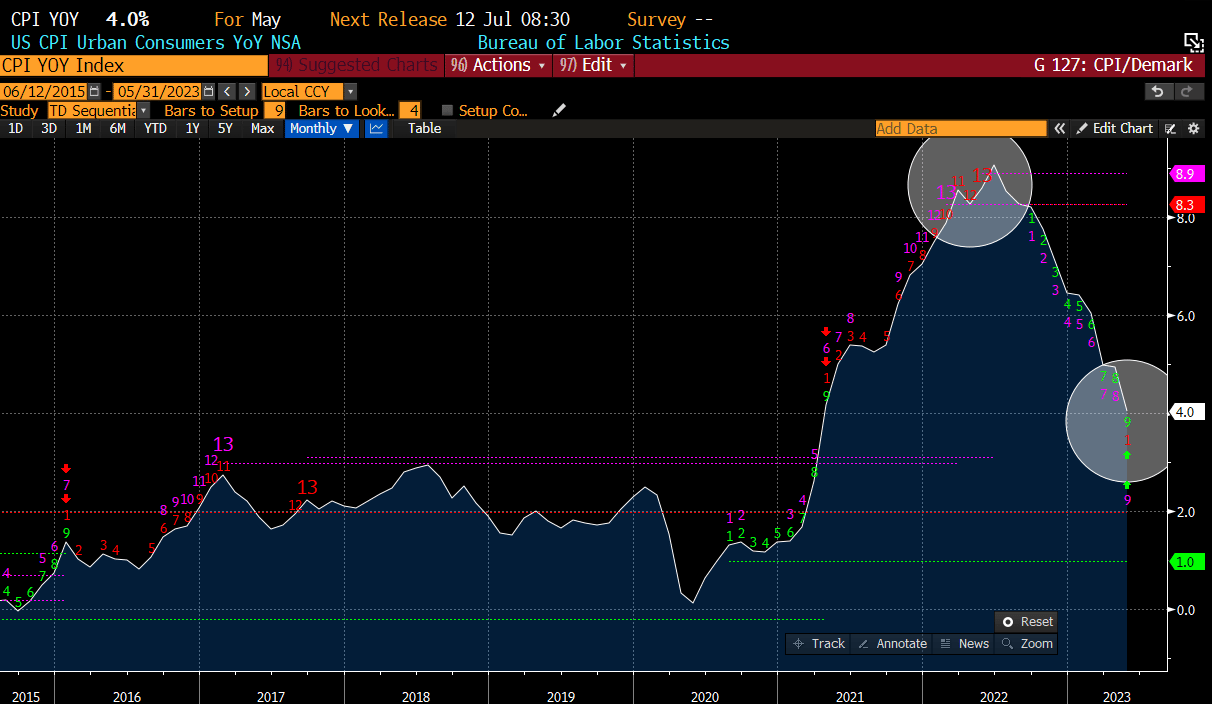

While employment is stubbornly still expanding, inflation has notably cooled. The CPI print form this past week came in at 4% year/year. This is the lowest level since Mar ‘21. Needless to say, the Fed’s policies are working to bring down 40-year high inflation. Energy is clearly the biggest drag but even the core is declining, albeit not as rapidly.

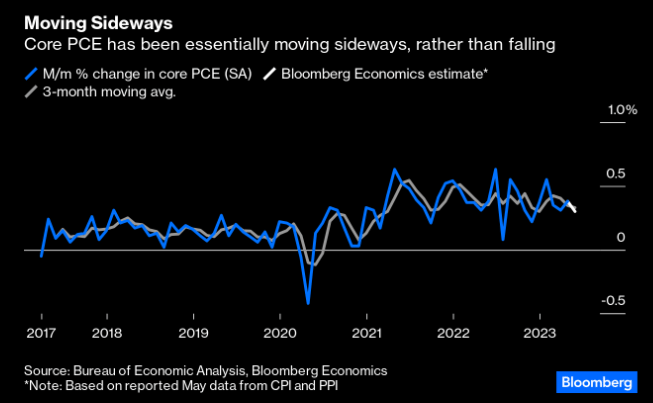

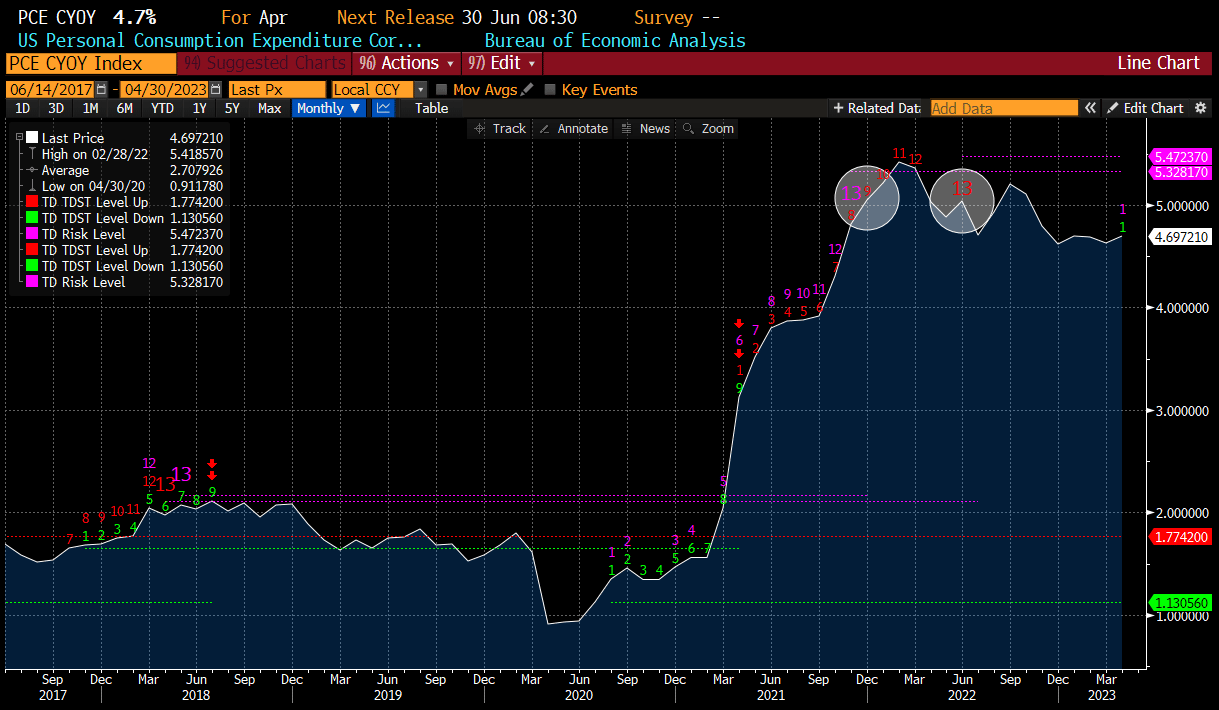

The Fed’s preferred inflation gauge is Core PCE, which has been moving sideways vs. falling.

Despite inflation seemingly cooperating, the Fed still believes they need to do more as evidenced by their hawkish commentary. We are at odds with their jawboning for higher rates. Clearly the trajectory of inflation is down and will likely continue to press lower into the end of the year. We think their hawkish commentary is their attempt to leave the door open for further hikes, if necessary, but the reality is will it be necessary. Unless inflation reaccelerates, we don’t think it will be.

Gundlach (“The Bond King”) seems to agree.

We posted this chart last summer as we thought inflation would be peaking. This is a chart of the CPI overlaid with DeMark counts. Yes, we think DeMark counts are relevant in everything. We can’t explain it, but we see enough of it to not question it. This chart nailed the top in inflation back in Jun ‘22 with its pair of 13 sells and now has a 9 buy signal. Will this mark the turn or possibly just cause a re-acceleration scare? We don’t know and something we need to be mindful of as the next few CPI reports are issued.

The DeMark charts also nailed the peak in PCE. While the 9 signals on the way up didn’t mean much, they have had relevance in the past.

So why is the stock market continuing to defy gravity despite a seemingly hawkish Fed? It’s a good question and we have our views, but as we tell our readers all the time, our opinions are just opinions. We don’t run our vigorous analysis to confirm a specific bias. We run that analysis to poke holes in our fundamental view and to keep us on the right side of the market.

We are not an idea alert service, but we do present ideas from time to time for our readers to consider and manage themselves. Those ideas continue to work wonderfully. We will add a few more ideas at the end of this report to consider.

Here is our last idea we just closed out.

If you would like to read the balance of our analysis, please consider subscribing below.