Huge reversal in the Nasdaq today that will undoubtedly get the bears all excited. Is this the turn the bears have all been waiting for after getting incessantly squeezed for the last month? More on that below.

We have been writing to expect volatility this month. This is from our last weekend report:

And today we finally got smacked with a dose of reality. The market was feeling a bit frothy coming into this week, where giddy traders rejoicing on Fintwit were pervasive. Stocks were starting to act as they do in bull markets, breaking out of key resistance levels and bull flags, and pushing through major MA’s like a hot knife through butter. Even notable bears were reversing their views and buying into the FOMO. Price is a funny thing; it changes the staunchest of opinions.

This past weekly breakout in the SPX certainly caused a brief awakening in the animal spirits that we all long for as traders/investors. But markets don’t move in a straight line and the macro uncertainty is ripe for smacking down any whiff of euphoria. The FOMC is set to meet next week, and a frothy stock market does not help their battle to push down inflation.

The Nasdaq printed a bearish engulfing bar today at the 150% projection from the Dec low. Should we be surprised by the violent reaction? Not really. Since taking out the 12270 pivot in May, one month ago, the Nasdaq has gone up +9% in a straight line, leaving the index quite OB per RSI.

This was also right on schedule with the new sell signals per DeMark. A combo 13 sell printed yesterday with a TD REI down arrow and also printed a new 9 sell today. The last crop of signals only worked for a few days but this round seemingly is a better set up for retracement. Time will tell.

We previewed these signals printing in our weekend report:

“…we will be getting another combo 13 sell this week, and as early as tomorrow. The combo 13 sell that printed last week is still current with the risk level at 13340. A 9 sell could also print in 3 days. The slow stochastic now with a lower high despite the index price rising higher. This is a small negative divergence.”

We also wrote this:

“Weekly RSI is close to hitting the OB threshold so we would certainly be careful adding any large cap tech exposure.”

We have been advocating a rotational trade out of large cap tech and into the Russell and the laggards for weeks now.

Here is our excerpt from our public twitter handle indicating our positioning:

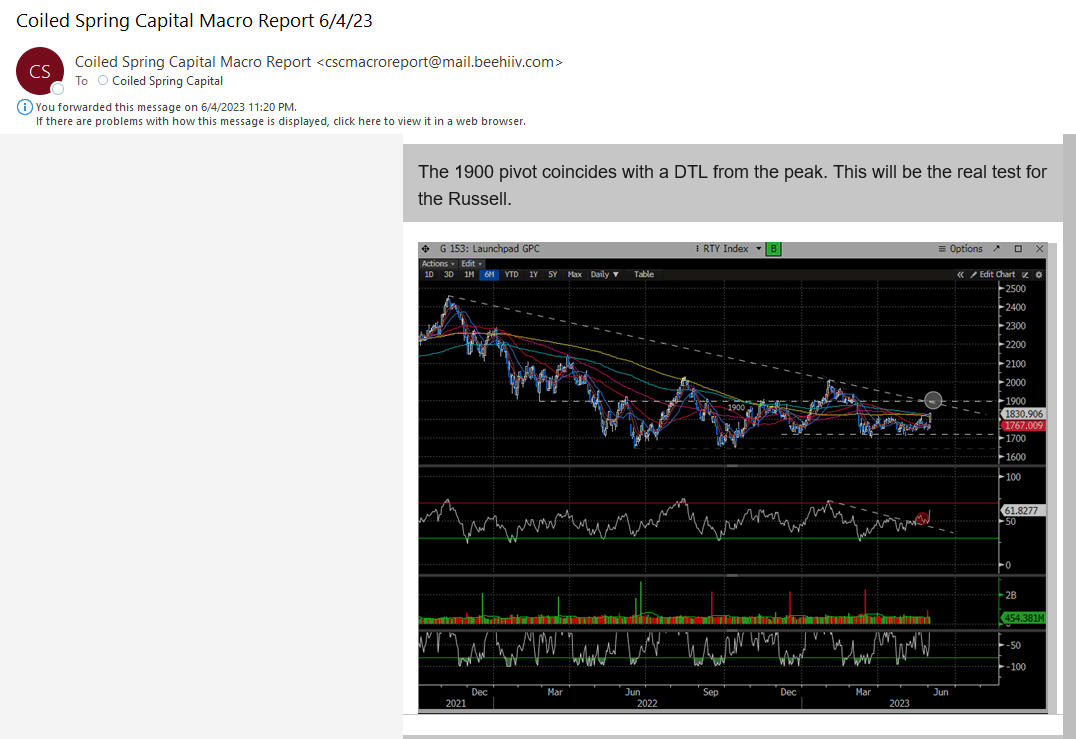

The Russell is now up +8.5% from that post and now coming into our resistance level that we discussed in our last weekend report.

Here is that excerpt:

The Russell’s high today was 1893.

We have also been advocating a long $IWM/ short $QQQ trade. Arguably we were a bit early on this but are now nicely in the green. We made some changes to this position and will highlight below.

We continue to have a banner year. Sidestepping the market when it’s not right to be involved and entering when our signals tell us to get long. This week we suggested exiting one of our recently presented ideas ($NCLH on 4/2) for +21% vs the SPX +4%.

If you would like to read the balance of our analysis, updates to our IWM/QQQ pair trade and other ideas, consider subscribing below for $24.95/month.