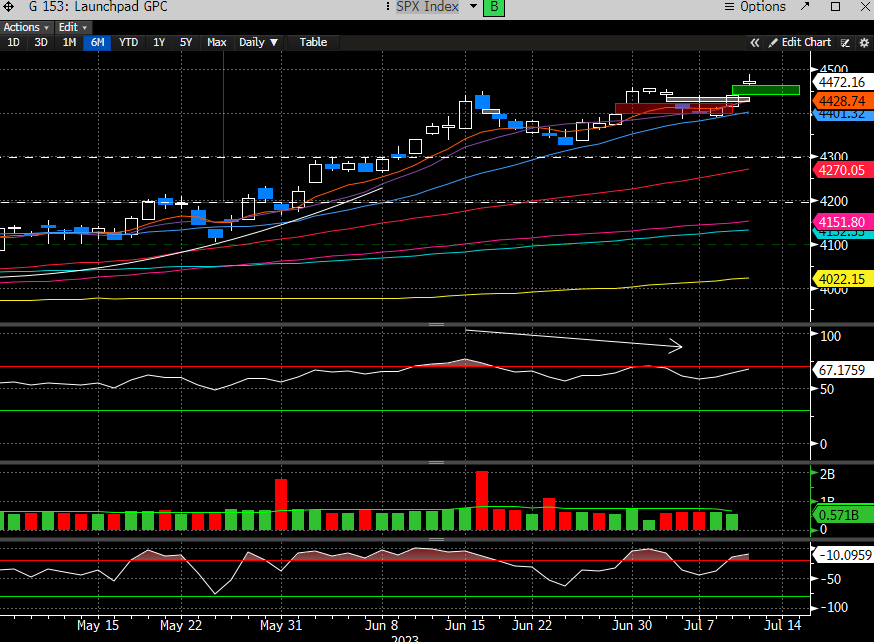

The bears had their chance, again, and whiffed. The gap up on 6/30 was quickly lost with its own gap down on 7/6. Typically, this structure is quite bearish, but the market found its footing at the 20 day SMA and then gapped up today on a lower-than-expected CPI. Thats 3 gaps in the SPX since the end of Jun. We’d love to see a statistic on gap clusters for the SPX.

Gaps are important as they are effectively a repricing. Holding their integrity can tell you a lot about the health of the move. 3 gaps in less than 2 weeks screams confusion and lack of liquidity to us.

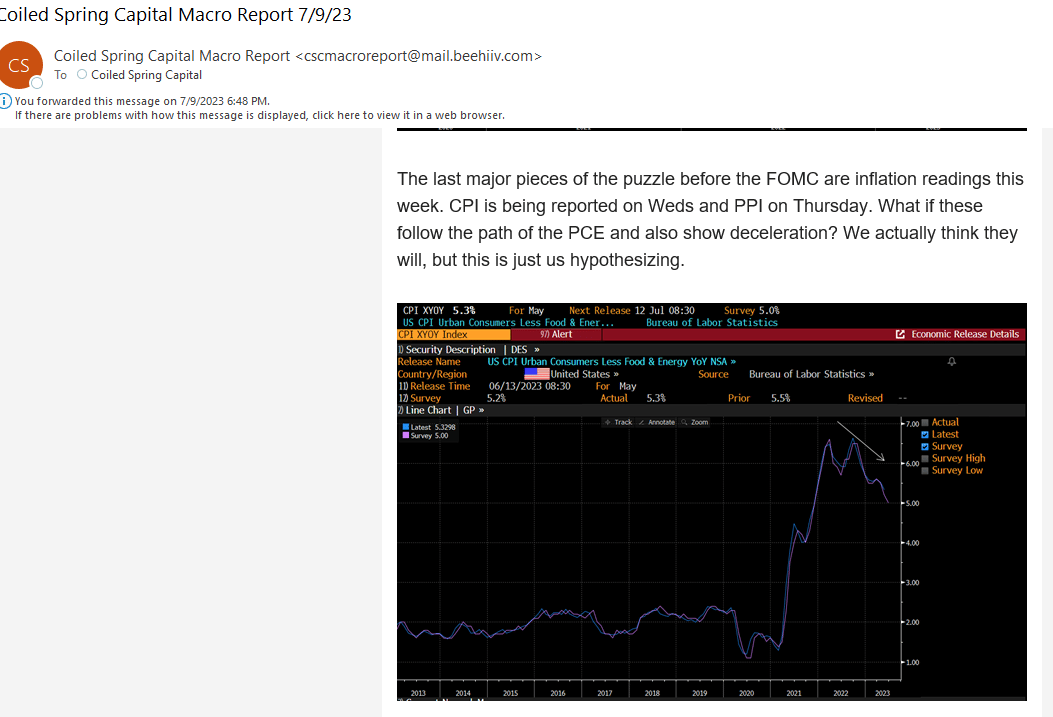

While we are not here to predict the outcome of the CPI, we were leaning towards lower as we wrote in our weekend report.

Here is an excerpt:

And the CPI delivered, coming in lower than forecast.

We also talked about the strength of this week as it pertains to seasonality and that market needed to take a stand if it was to hold the line on the historical trend. So far that has rung true.

But has the easy money already been made in the market this year? We suspect it has and if you missed the first half rally, the next 6 months, we suspect will be a lot harder than the first.

Our job is to find ways to make money in any type of market. We have had some incredible winners in the last few weeks and months. We provide sector calls, commodity ideas, rates set ups, and single stock ideas. We are not an alert service, but we trade ourselves and we don’t mind sharing some of what we see as a courtesy to our loyal subscribers. For $24.95/month, you will be hard pressed to find better value for such accurate market forecasting.

A few recent examples of our idea suggestions:

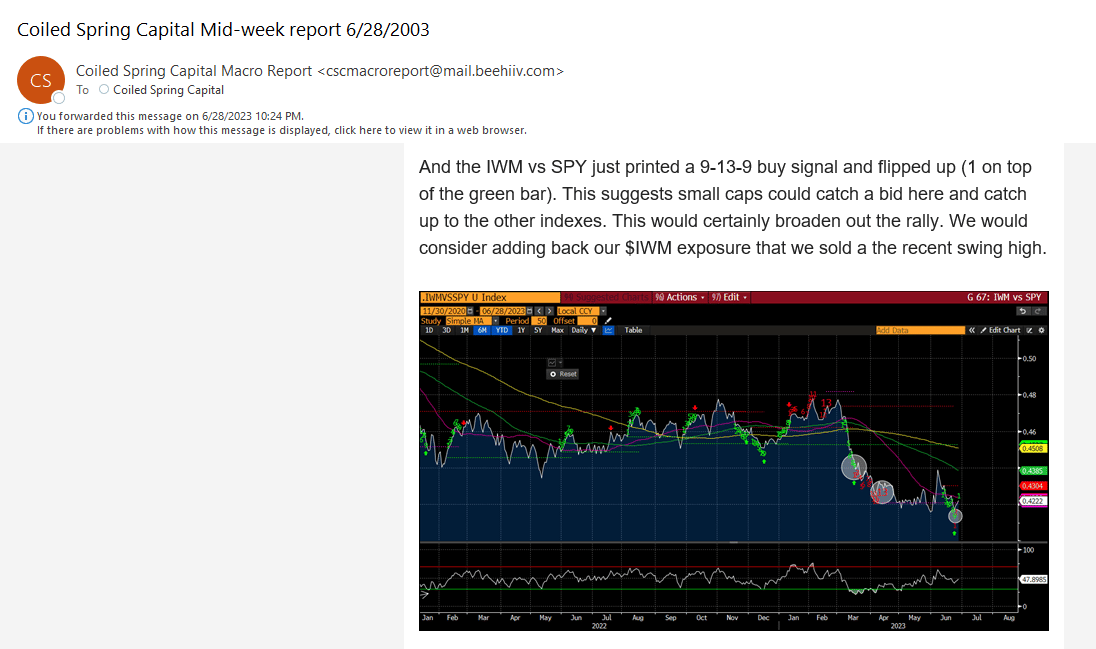

6/28 we presented re-entering IWM’s (Russell 2000 ETF). This trade is now up +5%.

6/28 we presented re-entering $AMD. This trade is currently +4.5%.

7/3 we presented $GLD (gold ETF). This trade is currently up +2%.

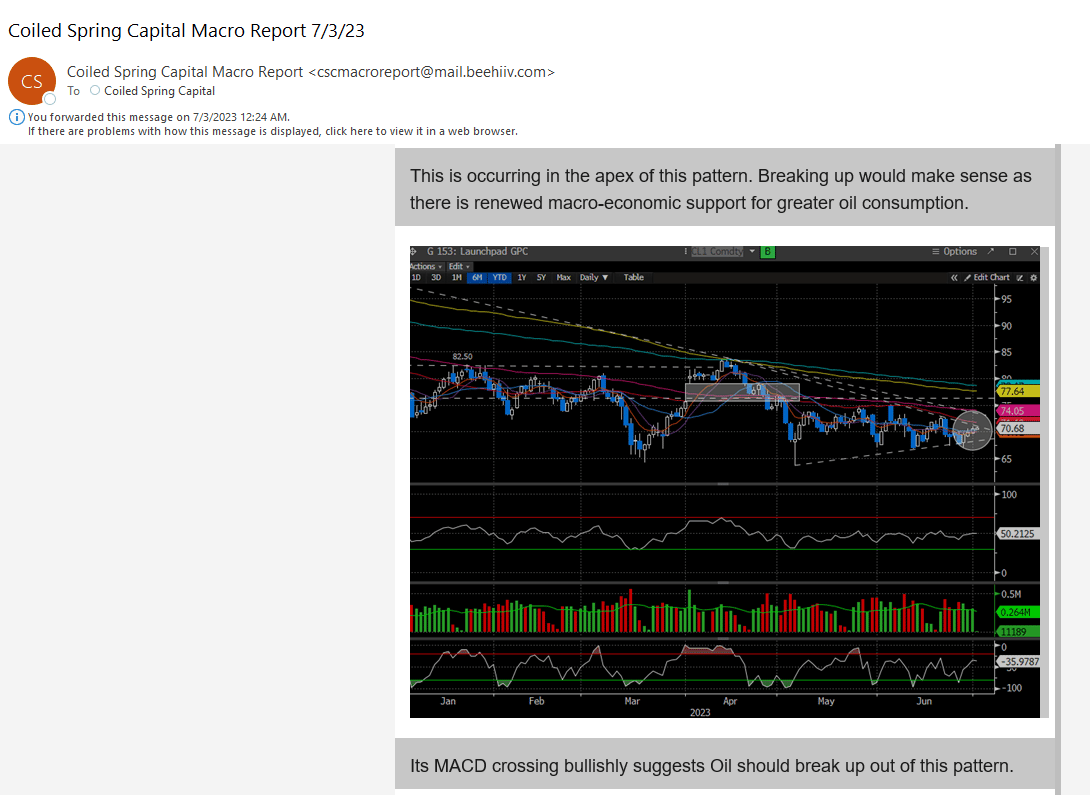

7/3 we presented Oil (CL1). This trade is currently up +8.5%.

7/3 we presented $PYPL. This trade is currently up +5%.

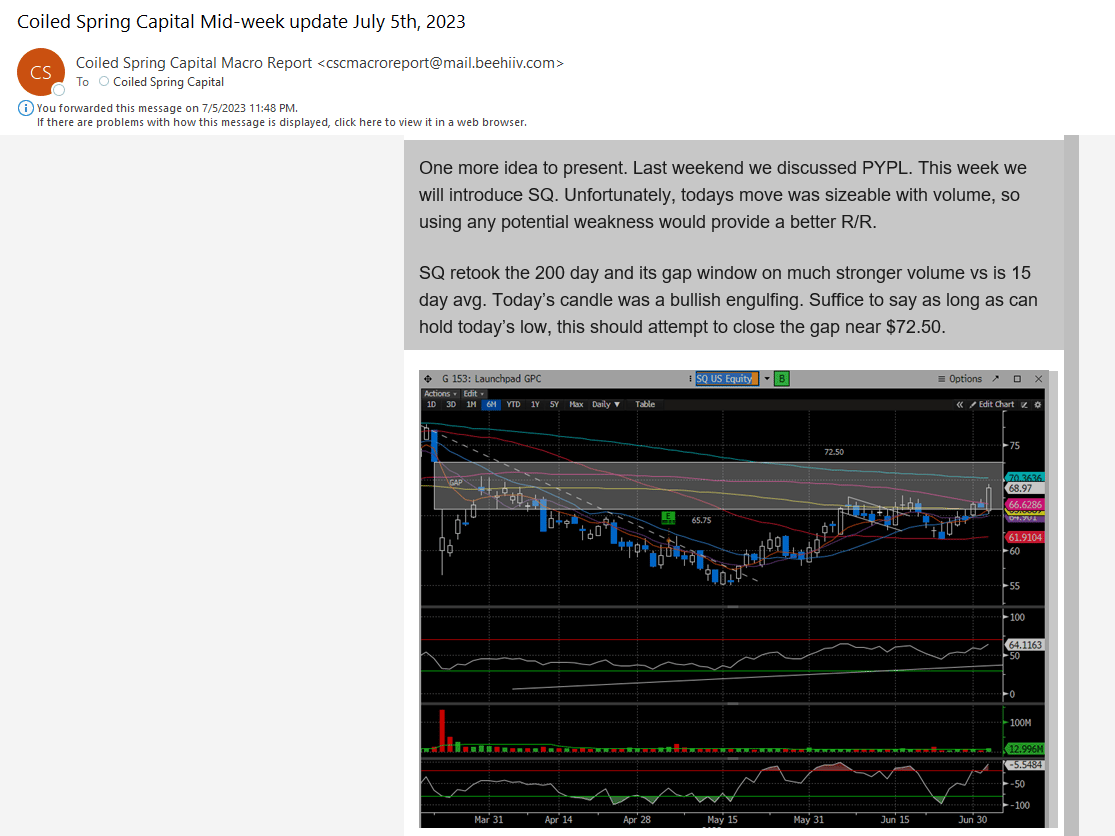

7/5 we presented $SQ as something to consider above the 7/5 low ($65.14). While this trade required some finesse, it reached our first target today at $72.50 for a total yield of +11%.

This past weekend we suggested a number of oil stocks, which have all been humming. Subscribe below to learn what they are.

We have had many more successes, but we will leave it there for brevity's sake. If you want to trade the right side of the market, and stop guessing or hoping for a specific outcome, we suggest becoming a premium member.