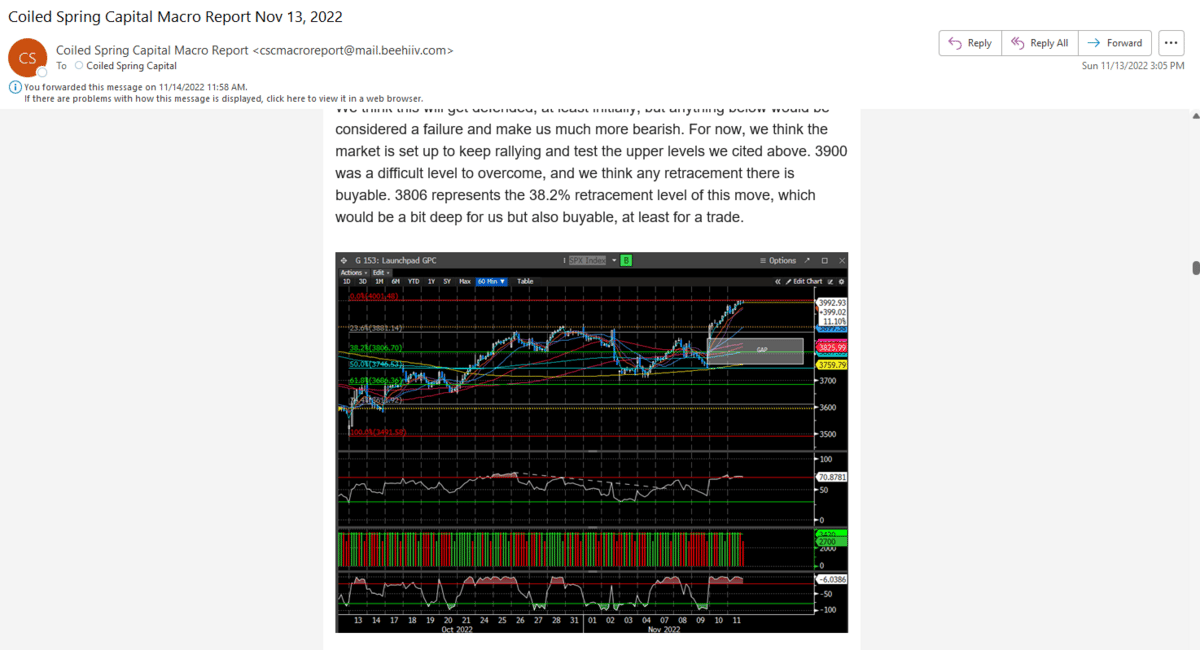

This week's action has played out exactly as we suspected. we expected continuation but we were a bit overbought coming into the week and a few of our indicators were suggesting a pullback would ensue. We mentioned that a pullback in the SPX could take the index to around 3900 and that it would likely get bought at first touch. Here is the excerpt from last weekend's report:

Today's trade saw the SPX bottom at 3906 and then bounce aggressively to close back near the highs of the session. This was an area of confluence and also a shorter-term Fib level, so it made sense to play for a bounce.

Fed speak this week was notably hawkish, but the market seems to have taken it in stride for now, as we closed well off the lows.

But recall, tomorrow is OPEX and some $2.1T of options are set to expire. This should make for some wild swings tomorrow.

What should we expect heading into tomorrow?