As we suggested it might, the stock market this week has already been full of fireworks. From contraction comes expansion and the listless, muted trading that took place last week was likely to end given the slew of earnings and the ensuing macro data.

3 days into the week and the SPX is down almost -2% vs. last weeks -10 bps full week move. In our last 2 weekend reports, we have been cautioning that increased volatility was likely to occur as internal weakness was undeniable.

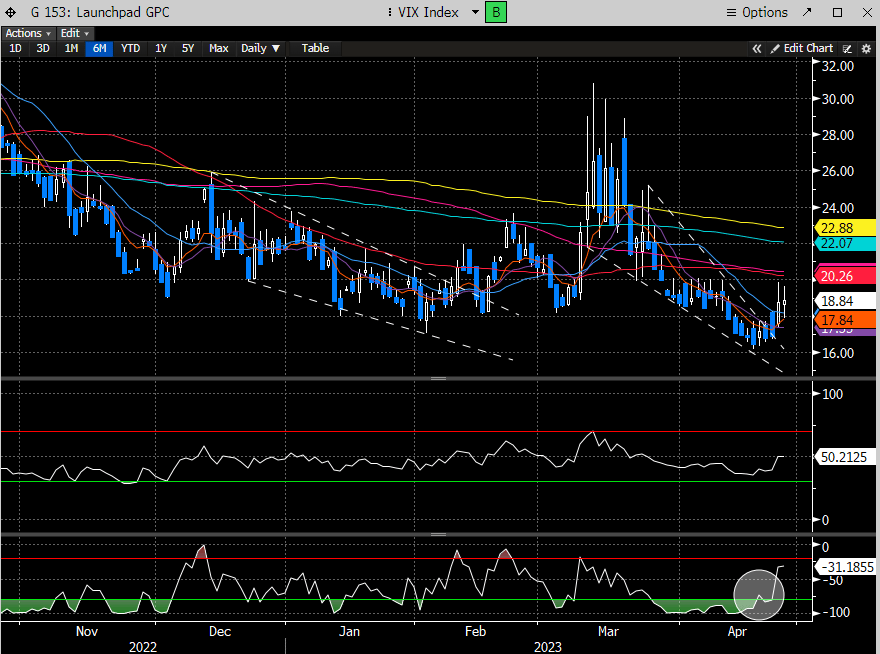

One instrument that was signaling us to be cautious was the $VIX, which was up over +15% at one point since we originally discussed.

We also talked about the importance of Oil and the implications for a breakdown.

Here is that excerpt from last weekend’s report:

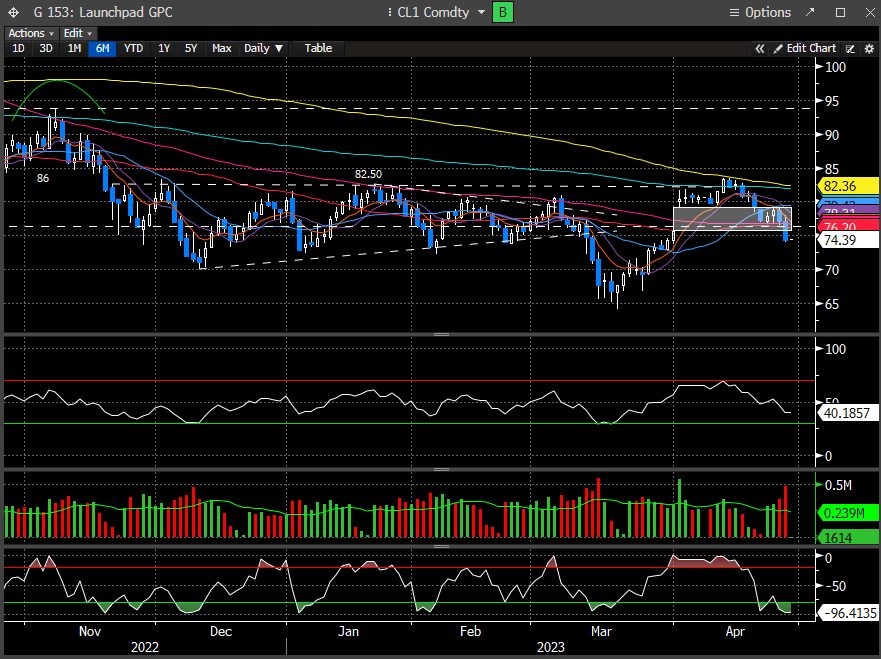

“One instrument that is heavily influenced by changes in global economic activity is Oil. Oil has been very erratic and cannot sustain an advance. It is now testing the gap from the OPEC supply cut, the 50 day MA and the minor UTL from the Dec low. Breaking down further here would be a troublesome sign.”

Since the weekend, Oil has pierced our confluence levels and broken key supports.

The stock market remains heavy, regardless of the recent earnings surprises, especially in large cap. We wrote a few weeks ago about the degradation in earnings cuts into this Q and the bar for beating was quite low. So far that has proven true.

Some will blame the markets downbeat performance on the renewed speculation that the banking crisis is not over with First Republic reporting a miserable Q and a massively reduced deposit base. To be honest, why would anyone suspect otherwise? The large money center banks reported last week, and their deposit bases exploded. Where did people think that money came from? Expect to hear similar stories as we progress through small to regional bank earnings.

We actually highlighted something was amiss last week in our report as the Fed discount window started to tick back recently.

Here is that excerpt:

Our goal is to keep our readers on the right side of the market. Our proprietary and unique analysis undoubtedly offers traders an edge when making trading/investing decisions. Consider subscribing below to read where we think the market is headed next.