The market has continued to defy skeptics since retaking the 50 day SMA in mid July. The SPX closed @ the 100 day last Friday only to see a mild dip and a recapture. Today was a small range day and an inside one at that. All the while the market has ignored the current OB condition and only saw a mild pull back post the shorter term TF DeMark signals printing over the last week.

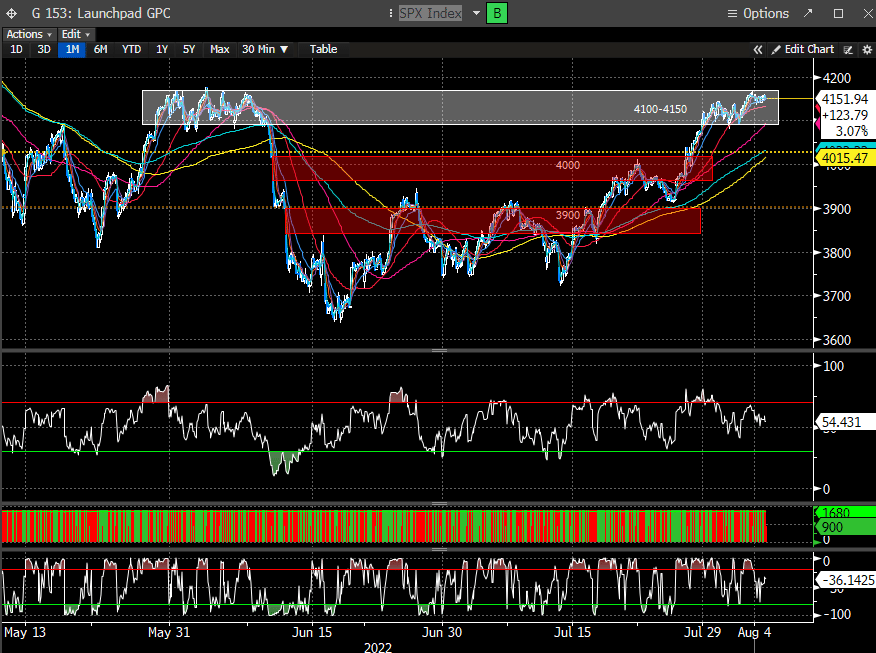

It's no surprise that the market has been struggling at the current level. This was our last upside target (4150) for this move. We have been highlighting this short term chart as these are the levels where resistance was living. Each level was tested, failed and then powered through. If you traded these levels on breaks you did quite well. As you can see we are now in the top band and fighting. This coincides with the May peak for the market and is an important juncture.

Zoom out a bit and you can see why this level is so important. It's actually the neckline from the H&S top on the weekly chart (green band). We wrote in Jan that the 3600-3800 was a likely target for the SPX based on SPX earnings and multiple compression. This also lined up with the measured move target for the H&S break, at the Jun low (which came within 50 or so points of hitting). This level is also the 23.6% Fib retracement level from the Covid crash. Lastly, it does have that bear flag look to it and now resides at the top of the pattern.

You could also say this is looks like a rising wedge. 4204 is the 200 EMA and maybe we can get an overthrow there tomorrow if we break up. But for now, bulls are clearly back in control. Remember, being OB can be resolved by time or price so positioning short on that alone can be dangerous.

We would rather wait for a clear break of the momentum. Earnings have not been very good but as we have written previously, how much of the earnings revisions were already priced in? Apparently, a lot because companies that miss are being bought (see AMD).

The Nasdaq has taken the 12550 pivot. We have been talking about the positive divergences in the Nasdaq for 6 weeks now and the growth stocks have clearly led this rally. 13k is the next pivot and also lines up with the 200 day EMA.

We are also into an important Fib level (61.8% Fib retracement level from the ATH).

This all occurring with possible DeMark sells close to printing.

To read the rest of our premium report, please consider subscribing for $19.95/month.