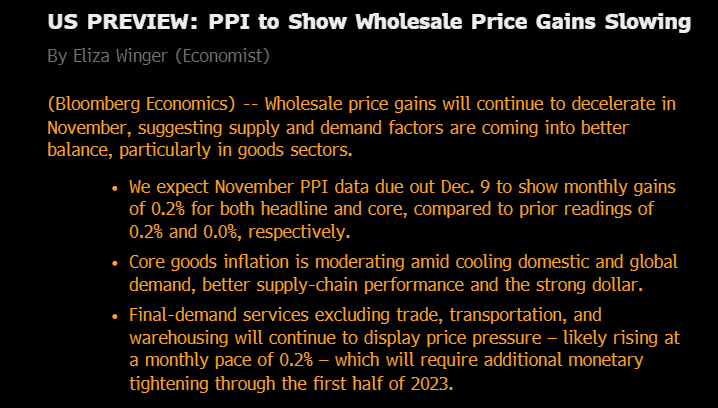

We wrote in our report last weekend that we thought this would be a tricky week in the stock market. While we didn't think there would be a ton of movement given the FOMC and CPI are next week, we didn't expect a complete unwinding of the Powell speech trade. Tomorrow we will also get PPI which could inject some more voaltility should the reading come in too hot. We think the number will be lower than perceived, but that's just a guess and not something we would bank on.

Fortunately for us, we took off the index upside trade last week and we rolled into some VIX calls. That has worked out quite well as the VIX is now up +20% since our entry.

Here is the excerpt from last weekend's report:

"Last week we did mention we would be interested in adding some VIX protection should we hit the propulsion down target. That did occur on Friday, and we started adding VIX calls."

The biggest issue the SPX faces is clearly the event risk into next week. We have discussed that binary events are too difficult to predict and not something where we have interest in participating in and why we approached this week and into next, quite light. Macro news is clearly driving the market direction. Monday it was the weaker ISM and today it was higher jobless claims. This is not an easy market to trade in the short term. These macro readings are strengthening the case for a recession next year.