We will be the first to admit that we didn't see that excessive strength in the market post a mildly lower CPI print. We did mention that we thought inflation was peaking last month, given oil prices are down 29% from our top call back in mid-June. PPI was just reported this AM and that was softer than expected, adding more fuel to an already overheated counter trend rally. Again, this is mainly because of a drop in oil costs. Excluding energy, like the CPI. it still rose month/month by .2%, but still softer than was forecast.

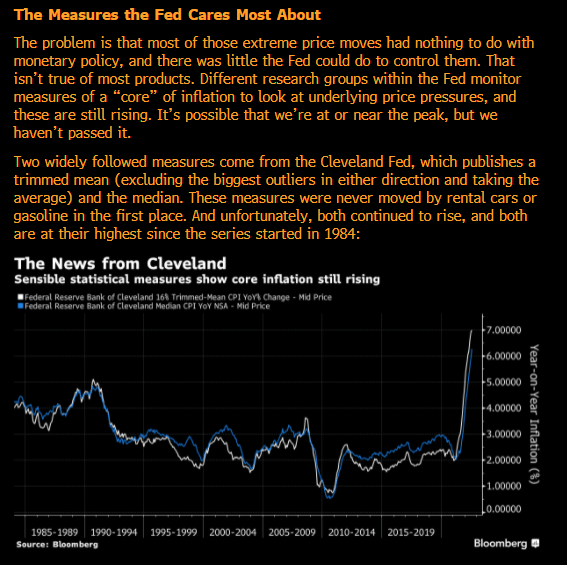

Claiming victory that inflation is transitory, seems premature. Here is what the Fed cares about:

And housing, which is still 1/2 of the CPI index, continues to rise. Rent tends to lag housing prices by 9-12 months. This number is still rising and now the highest since 1990.

This seems to take the intra-meeting rate hike off the table for now but we doubt they take their foot off the gas. During the GFC the Fed started cutting rates in '07, paused for 5 months in '08 before cutting again. The market did not bottom until Mar 2009. So, the prevailing notion that buying the market 6 months before the last rate cut seems a bit misplaced.

The curve is still very inverted and only saw mild reversion post the print. This is still worrisome and suggests the worst is yet to come for the economy.

Markets tend to over-correct in both directions, so it's now apparent after a strong employment number and peaking inflation that the market had over corrected the near-term macro. Does that mean we are off to the races and back to ATH's? We think that's a very tough argument given that most of the rate hikes have not found their way into the economy. It has started to hit the lower end consumer as evidenced by some of the larger big box retailers, but it is not pervasive, yet.

We have written a few times that numbers on the street need to come down before a sustainable rally can take place, and we have seen the beginning of that as earnings guidance this Q had been adjusted lower for many companies. We are in the camp that companies will have a tough time to protect their margins with inflation still raging. Producer prices relative to consumer prices are still one of the highest levels since data going back to 1960. If this persists, it could mean corporate margins could be at risk since the consumer will likely not accept more price increases. Protecting margins means job losses most likely and that numbers still see many more revisions in the months ahead.

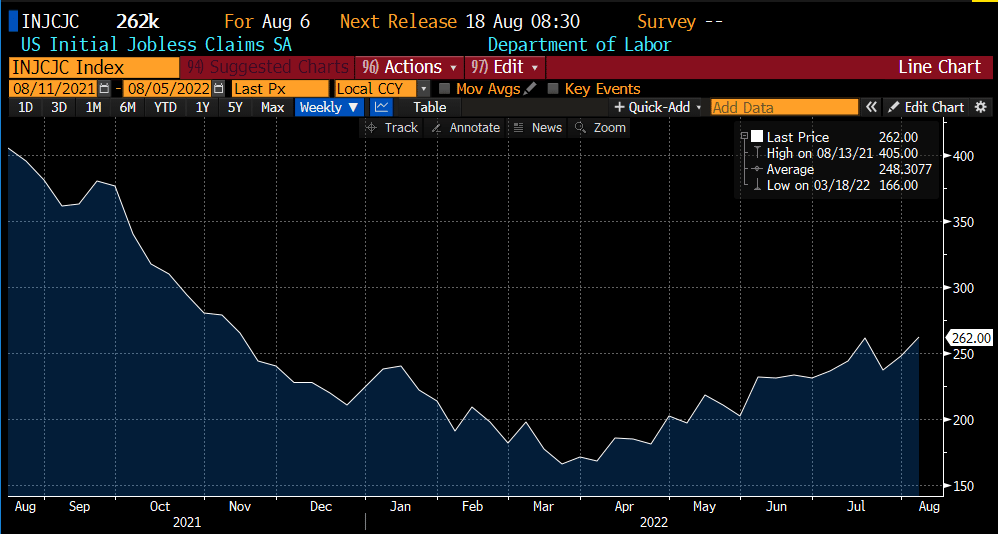

In fact, US jobless claims (leading indicator for employment) is now the highest since Nov.

But we must adhere that the strength in the market as nothing to ignore. We have pointed out the positive divergences in the metrics we track, had been building since June, especially in tech. Our last report we discussed that those divergence are not confirming a potential turn in the market yet and why we were hesitant to get short. Buying the dip momentum recently has simply been too strong.

How should we think about this recent rally and where we are headed?

To read more about our analysis, please consider subscribing to our premium content for $19.95/month.