We spend a good deal of time and energy to understand positioning in the stock market. As we always tell our readers, the stock market is much more complicated than slapping lines on a chart to make predictions. This is a reason why most traders fail and professional investors struggle to outperform over time. Most consider the market as a singular variable machine. Professional investors care most about valuation and P/E ratios, "real" Technicians care about ways to analyze supply and demand, retail follows the news, and Quants are just an enigma. Regardless, there is an art to determining how the stock market trades in the short to intermediate term, and having a multi-factor, multi-variable system only improves the chances of success. If you've been following us and are subscribers of our work, you know that we do this as good as anyone.

Right before the turn of the year we got aggressively long into growth stocks as our indicators were suggesting doing so, despite the reverberating drum beat of recession and expectations for a horrible 1H to the year. In essence the sentiment was in the gutter and positioning was way too lopsided. These factors were part of the mosaic that gave us confidence that our contrarian positioning was correct. We have been reading how many professional investors missed the rally and the excuses they give for doing so is simply laughable. Lots of people pay these professionals ungodly fees to run their wealth, yet they could not recognize the simple market structure changes that were unfolding right in front of their eyes. They ignored the lopsided positioning and overwhelmingly bearish sentiment readings. These bears continue to press their beliefs and have been bringing out every reason they can think of for why they were wrong. If you went to a mechanic to get your brakes fixed and the next day you smashed into a car because your brakes failed, would you go back to that mechanic? We'd venture to say no. These people on TV are selling a product, and that product only works during certain market regimes...which implies most of the time, their approach fails. Suffice to say, most of the professional and trading world has failed in not being positioned correctly this year. The vitriol for missing the rally is palpable.

One of the reasons for their epic failure is the incessant short covering that has driven the market higher - see comment above regarding positioning and why you must understand this aspect of the market if you want to increase the probabilities of success.

Here is a perfect example. The CNN Fear and Greed Index was @ 31 on Dec 31st. Currently it stands @ 75.

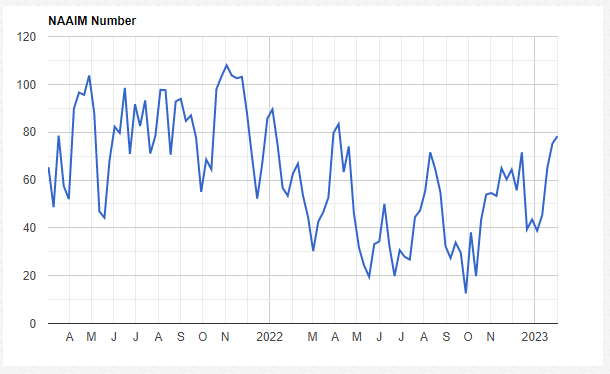

The NAIIM Index measures institutional exposure of the market. This stood at 37% at the end of Dec and now stands at almost 80%.

The AAII bull/bear spread was at .39 vs almost 1 in late Jan.

These are simple ways to measure positioning, but you get the point. JPM has a note out discussing the short covering dynamics that drove the market higher in Jan.

The report goes on to say that most of the bearish bets have been unwound and are now back to neutral positioning. Is this a headwind for more market progress? Definitely, but it only emphasizes our point when considering how to analyze the market and understanding positioning.

But positioning isn't the only variable that must be considered. We examine 100's of indicators to give us edge. Here are 3 of many that increased our conviction that growth was where we wanted to position in late Dec.

Here is a chart of the Goldman Sachs Non-profitable tech basket. We overlay DeMark signals on all instruments to give us edge on when to anticipate and look for a possible trend change. This index posted a 9-13-9 buy signal on 12/28. This was occurring w/ +RSI divergence into the lows.

The Nasdaq itself also posted a combo 13 and 9 buy on the same day, with the Slow Stochastic crossing up from a deeply OS level the next day.

This daily Nasdaq signal fired simultaneously with the weekly sequential 13 buy. Our readers know we like alignment and confluence, and we were seeing a lot of it.

We like asymmetric risk/reward, and late December into Jan provided an enormous amount of opportunity to buy into the market. This is why we were able to capitalize on incredible gains over the last month (+10%-70% on 25+ individual stock ideas). We are not an alert service; we analyze market trends so you can make better decisions on when to allocate and exit your capital from the market. Occasionally we will offer individual stock ideas if the setup is favorable.

If you want to consistently be on the right side of the market, instead of investing with mediocre money managers and traders, please consider subscribing below.