We can hear the sigh of relief for the bear camp after getting clobbered by the +5% SPX move since the start of the year. We're just being nice, since most were shorting tech and the Nasdaq is up almost +9%.

The good news is we were already advocating in our weekend report to lighten up on longs into this week, especially if long the indexes. We were bumping up against some very obvious levels to find sellers. These levels matched almost exactly where we thought the indexes would struggle. Couple that with some egregiously OB metrics, and the market didn't need much of a catalyst to find an excuse to sell off.

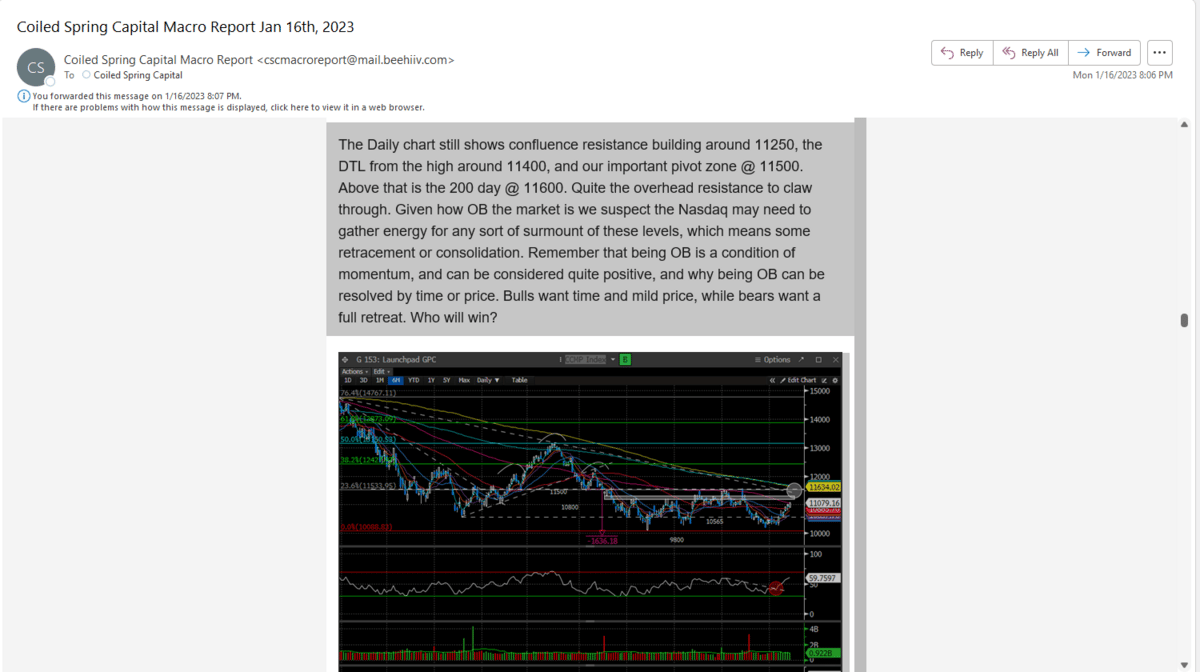

Here is an excerpt from our report talking about the overhead resistance for the Nasdaq.

"The Daily chart still shows confluence resistance building around 11250, the DTL from the high around 11400, and our important pivot zone @ 11500....Given how OB the market is we suspect the Nasdaq may need to gather energy for any sort of surmount of these levels, which means some retracement or consolidation. "

Today's high was 11223.

Our SPX level was 4020 and we topped at 4015.

Today's weakness was born from weaker macro data sprinkled in with some hawkish Fed speak.

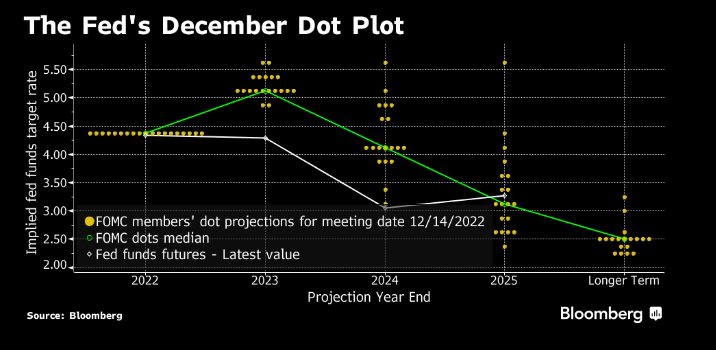

Yet the Fed Fund Futures are still not agreeing with the Fed Dot plot.

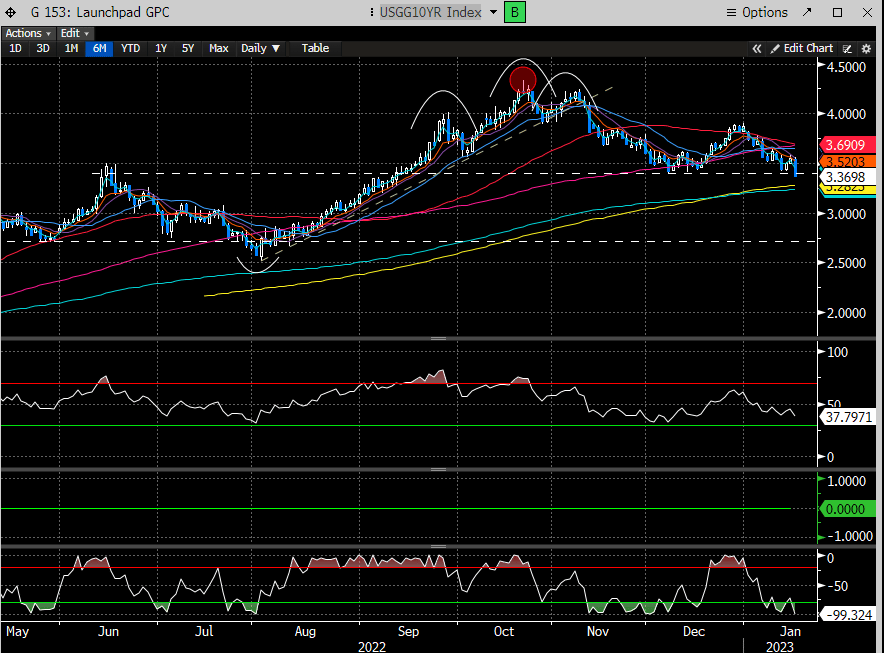

And neither is the bond market. Today's 10 year move was ugly with the 10-year dropping almost 20bps, and now seemingly breaking this support level.

Index volume was quite low for such a red day. Was this real selling or a lack of buyers?

The balance of our analysis is for premium subscribers. To continue reading, please consider subscribing below for $24.95/month. We were in front of this inflection, do you want to miss the next one?