The Santa Claus phenomenon (5 trading days before the end of the year and 2 days after) officially ended today. It looked as if it might fail yesterday and given the hawkish FOMC minutes released today, the market should have been clobbered, but that's not what happened. We actually closed up on the day pushing the 7-trading day period into the green for the SPX.

The old adage goes: "If Santa Claus should fail to call, bears come to Broad and Wall." For those not familiar with NYC, "Broad and Wall" is where the NYSE is located. Since 1950, the SPX has traded higher about 78% of the time during the Santa-rally period for an average gain of +1.3%. So, a bit below average, but positive, nonetheless. According to CFRA, when Santa comes to town, the index posts a greater than average gain in the New Year.

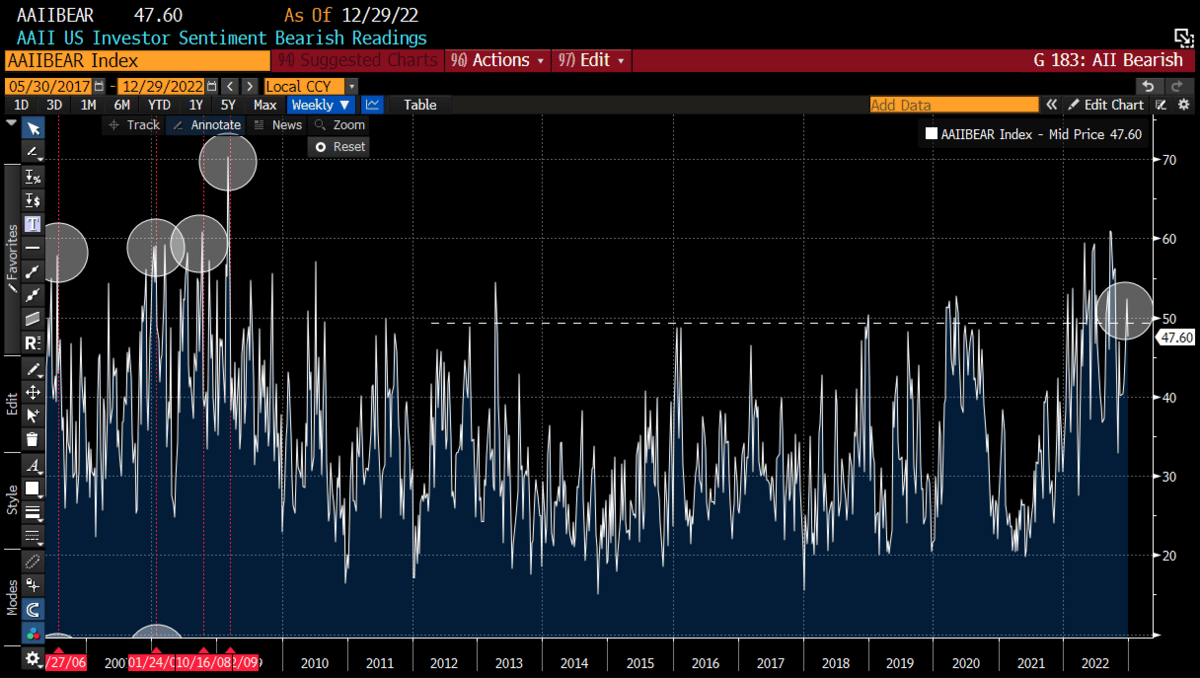

While we are not statistical analysts, this is sure a feather in the cap for the bulls. Sentiment remains abysmal, and most wall street strategists are bearish for the 1H of the year, as are most market participants, as evidenced by the AAII. The pain trade still seems higher.

The FOMC minutes that were released today were supposed to give the bears the fuel to break this very obvious SPX bear pennant formation.

Instead, it pushed higher, creating an inside day.

The JOLTS release this morning were also stronger than expected but slipped month to month. ISM also slipped. ISM<50 means contraction.

In some respects, the Fed is seeing pockets of things slowing, but is it enough to ward off persistently sticky inflation? That remains to be seen, but maybe the market is looking past the next few rate hikes as it sees a pause on the horizon? It's hard to argue that the Fed isn't seeing evidence that their policies are having the desired effect. How this plays out for the market is the $million question - See our top 3 questions for the stock market in our previous weekend report.

Consider subscribing below for more analysis.