We hope everyone had a wonderful July 4th (if you celebrate of course), if not we hope you enjoyed a day away from the market.

There is very little data for us to make any changes to what we wrote about in the weekend report but the alignment we are looking for is on track. We will update in our premium discussion below. We will also highlight a new potential single stock idea to consider.

The 3 most notable changes were the disappointing ISM data, China’s macro data and the Fed Minutes.

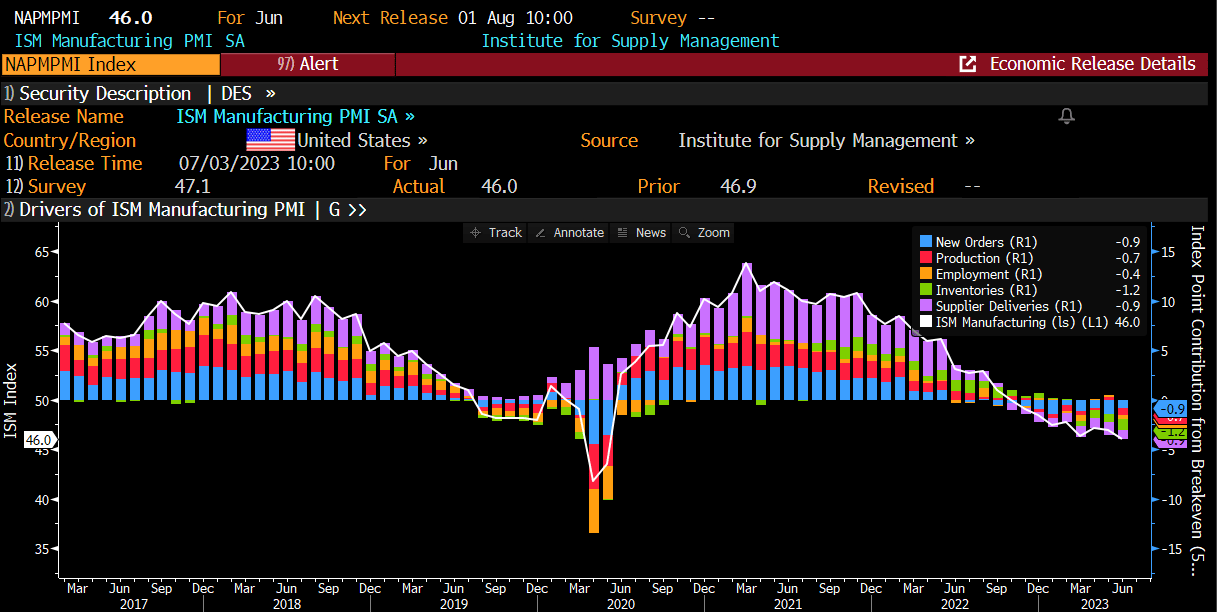

The ISM actually contracted again and is somewhat recessionary. Why this hasn’t caught the eye of the Fed is a bit puzzling but nonetheless, not a great read. This is now the lowest reading since the Covid crash. The current streak of readings below 50 is the longest since ‘08/’09.

China continues to report dismal macro data as the once thought red-hot recovery post Covid is sputtering. Consumption continues to struggle, although has been improving sequentially. The biggest question mark is the magnitude of any stimulus injection which so far has been insignificant.

This is evidenced in the negative returns for both the Shenzen and the Hang Seng, after being up significantly to start the year. We still remain hopeful that the government will rescue their economy so picking spots in some of the company’s leveraged to any recovery seems to make sense.

The Fed minutes that were released today didn’t offer much in the way of new news but only hammered home what the market already knew…that the Fed wants to do more rate hikes.

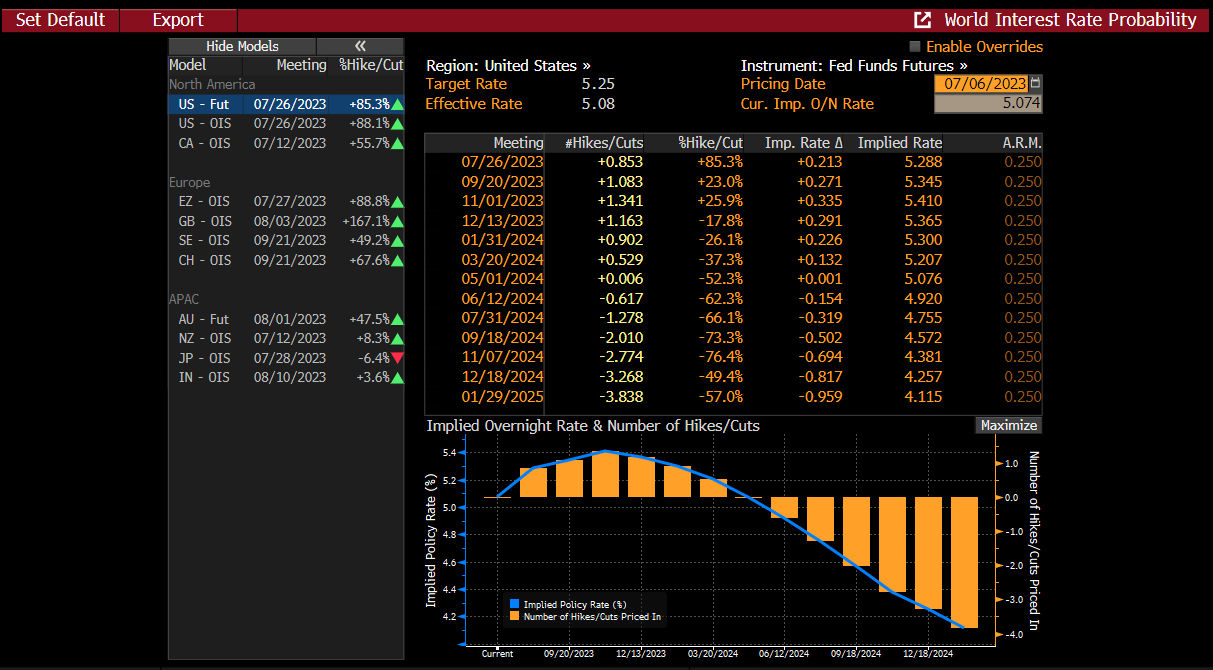

The new Dot Plot shows the median forecast for >5.50% by the end of the year, which implies at least 1 more hike, possibly 2.

The odds for a July hike now stand at 85% and over 100% by Sept. Cuts have now been pushed out to Jun of ‘24. That is a far cry from what was being forecasted back in March.

Given the volatility around futures, it’s hard to know with any certainty how this will eventually play out. More detail over the weekend.

To get a better read on how to trade the stock market, we would highly consider signing up for our premium analysis below. We issue single stock ideas from time to time, and another one to go with this weekend’s idea, is at the end of the report.