We wanted to issue a quick post with a few more set ups to consider. We also think if you have interest in the core of our methodology and current market thoughts, this article recently posted on Marketwatch, sums it up.

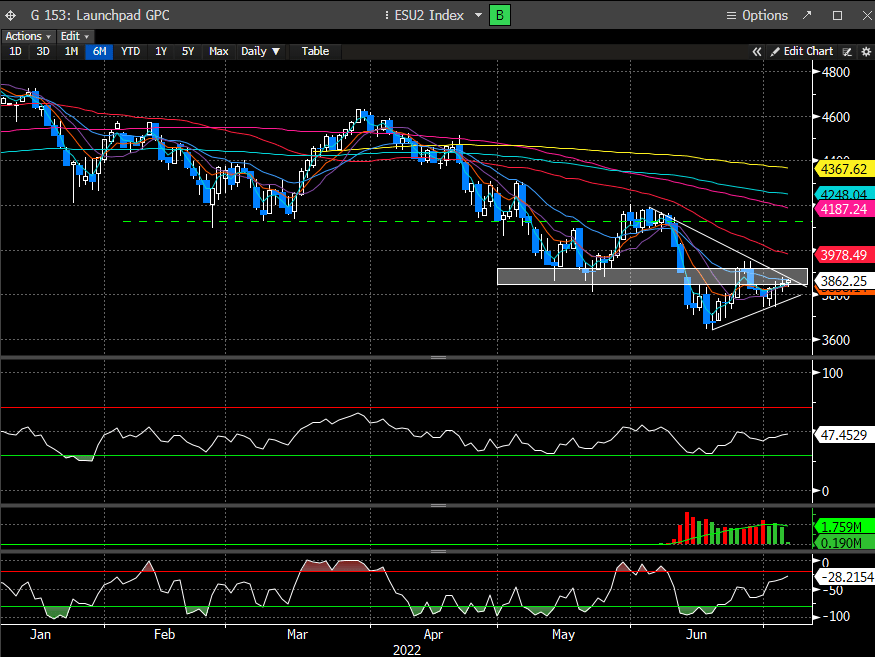

Regarding the SPX - quite a simple pattern brewing here. Here is the $SPY futures - coiling into a resistance band. Clearing higher would argue for at least a test of the 50 day @ 3980ish. Above that is 4K, then 4150ish.

Keep in mind that the SPX has gaps to contend with @ 4K as well.

Currently we are on Day 2 of a price flip for the SPX and testing the 20 day SMA (blue), where it failed last week.

Nasdaq futures has the same chart.

Coinciding Nasdaq shows DTL resistance failed yesterday and now with a Doji candle. Breaking up out of this pattern, argues for a test of the 50 day @ 11700, then 12100, 12500 next. Obviously a break to the downside on both would argue for at least a retest of the lows.

The Nasdaq is also on Day 2 of a price flip or sell set up.

There are still quite a bit of landmines to contend with over the next few weeks: Jobs # Friday, CPI/PPI next week, and then earnings season. If we are thinking the market can trade in line with DeMark's views, then this set up into the FOMC at the end of the month is probably the trigger. Trading direction in front of big macro data is very difficult so better to let price decide if can break these resistance points w/ targets into the pivots. Volume has also been light on this up move. This is a tough market which means if you are playing for a countertrend bounces, its imperative to control your R (stops as close to your entry as possible).

A few more ideas to consider long if the market breaks up...