Never a dull moment in the stock market. We entered the week with bulls on their heels with the stock market trying to price in the risk of contagion. Then the Fed comes to the rescue, putting in a back stop on deposits and the market starts to price the potential for the end of Fed tightening and quasi-QE. How this ends is anyone’s guess. Today we have First Republic being rescued by their larger brethren and the bulls are seemingly signaling all clear.

Last week we wrote the Fed being data dependent has been pushed aside with the whiff of a banking crisis. They now see the resulting destruction of their rate hike campaign and they now know they cannot push things too far for fear of what’s lurking behind curtain #2.

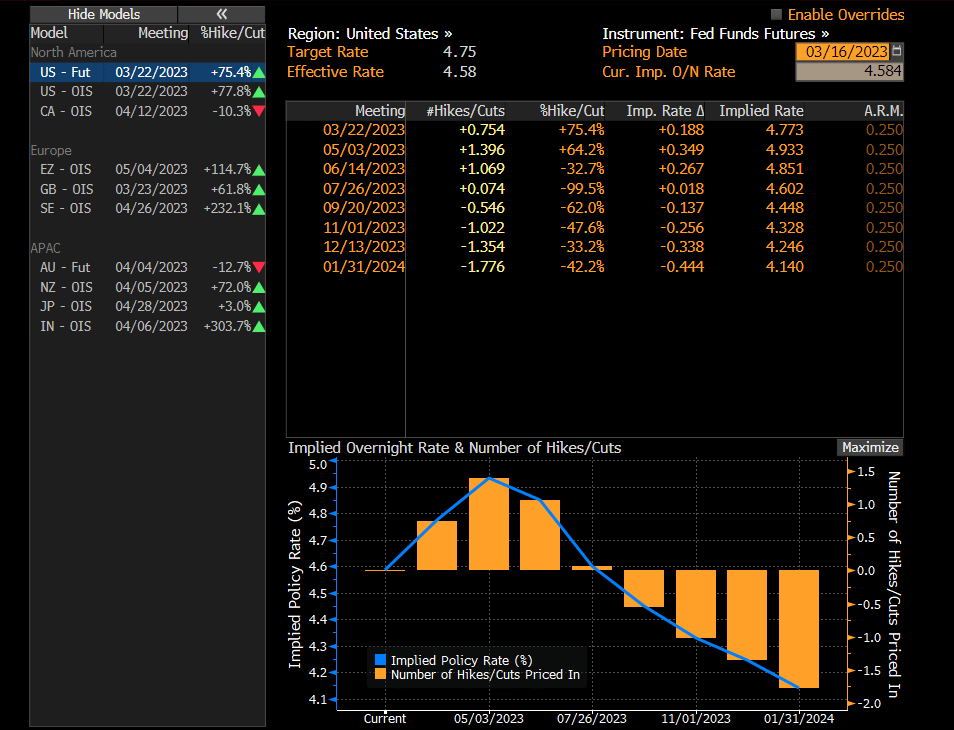

As we mentioned in our weekend report, the Fed Fund Futures were pricing in last Weds, a 74% chance of a 50 bps hike for their meeting next week. Now there is only a 75% chance of a 25 bps hike. Fed cuts had been extended to Nov and now the bond market is pricing in almost >50 bps bps cuts by Jan.

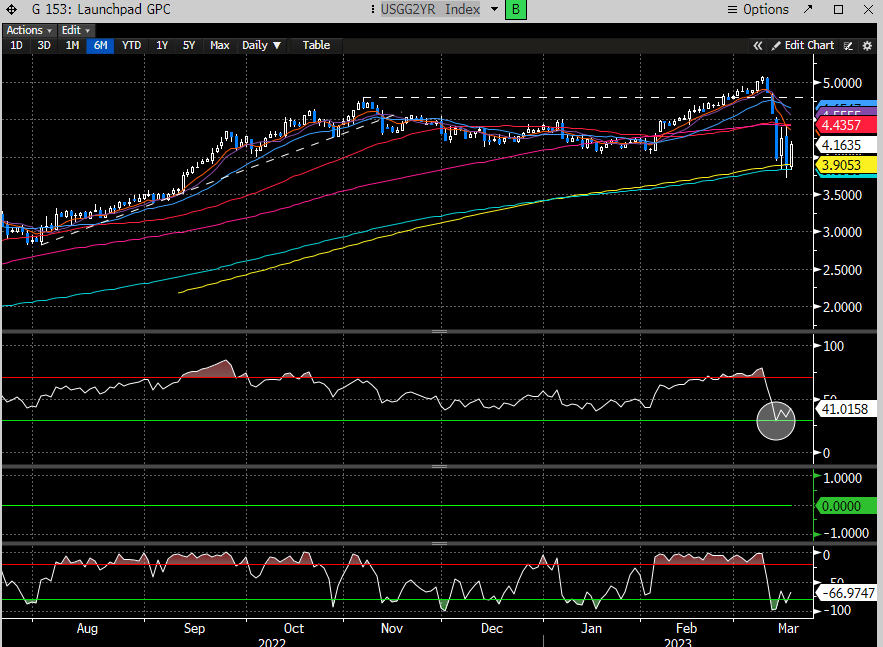

What a difference a week makes. We wrote a week ago that we thought ST rates would top. That was purely a technical call, and was not founded on the belief that the banking sector would be under duress. Sometimes better to be lucky than good.

Since that call the 2-yr yield has dropped over -20% and now finding some footing at the 200 day (yellow).

No shortage of more landmines over the next few days, with quarterly OPEX tomorrow and the FOMC meeting next week. The Feds job has become increasingly more difficult as it tries to thread the needle with stubbornly high inflation, but now needs to tread carefully not to further disrupt the fragile bank ecosystem. We don’t envy their task. Last weekend we thought they would only do 25bps, and we stick by that view.

This means we should probably expect more issues at the bank level as higher rates are the reason the banks are having issues. We should also expect some fallout from the recent crisis to spill over into bank lending. Lending standards will undoubtedly tighten up in the short term as banks opt for risk aversion to protect their businesses. This should lead to some more economic contraction on the margin. At the very least this should invite more volatility as we move through the spring and summer.

To read the rest of our analysis, please consider subscribing below. We added a few ideas below for premium subs.