As we wrote last weekend, this week had the ability to cause the market to stumble.

From last week: “This week is going to be interesting but fraught with risk. Powell is testifying on Tuesday on Capitol Hill, in his biannual monetary policy report to the US Senate Banking Committee. He will undoubtedly echo his recent commentary on inflation being too high and that interest rates will need to go higher. None of this is new news, but if he is more aggressive and signals a move back to jumbo rate hikes, the market could certainly falter.”

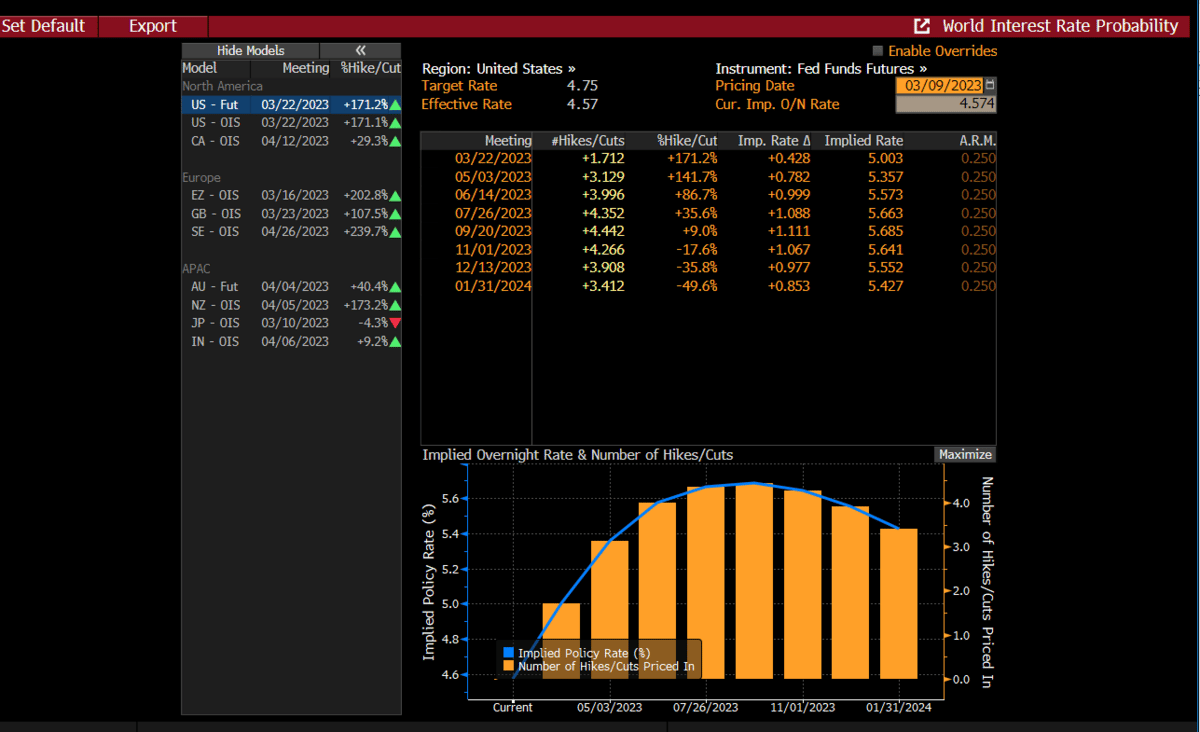

“Currently, the market is expecting another 25 bps raise in March, but these key events could push that to 50bps. That could create a volatility event.”

And after Powell delivered his speech, the bond market started pricing in a 50 bps increase in March. There was a 24% chance last weekend and now there is a 71% chance.

Bond market adjustments are one of the factors we have been writing about that could cause an equity market repricing. A 5% risk free rate is quite attractive, which makes owning risk assets less attractive. Couple that with an expensive market and it’s easy to understand why the market dislocates after these events.

We wrote last weekend that we thought the market would have trouble getting over SPX 4100 without the help of Powell or some macro data. Tuesday’s high was 4078. The SPX broke above the UTL from the low last week, but post Powell has unraveled, and now back below.

One day later Powell seemed to walk back his statement for reaccelerating hikes and suggested the FOMC will remain data dependent. That means Friday’s payroll number and CPI next week will be key determinants of market direction as they will signal what to expect at the March FOMC meeting. This also means those events could be rather binary and typically not something we like to be involved in.