Last month the perma-bear community said the stock market would collapse with horrific earnings and outlooks. When that didn’t play out, they shifted their collapse narrative to the Fed not backing down off the rate hike rhetoric. When that didn’t work, they pivoted their reasoning around the payroll number. Despite reaccelerating employment, the stock market confounded the bears again and closed the week right near the Feb peak. Today we got a CPI report that was expectedly sticky, but the market didn’t budge, and the Nasdaq took out the Feb peak. I guess tomorrow must be the day where the bears are vindicated, and the PPI sends the market screaming lower?

The thing is we don’t really care how it plays out. Instead of making predictions about price and changing the goalposts every time we are proven wrong to fit some biased narrative, we simply follow the bouncing ball. The bouncing ball being our process and our proprietary signals. We are not here to tell you that the market is doomed to go down because the unfolding bank crisis will undoubtedly impact the economy, unemployment will spike, consumer spending will dry up, credit delinquencies and defaults will explode, and earnings numbers will inevitably sink. We actually think all of these things will happen to various degrees. And while any economic fallout would be tragic, our main goal is to help you stay on the right side of the market. Remember, the economy is not the stock market.

Over the weekend, we discussed that the market structure was quite constructive, despite internals that were not confirming. The Nasdaq actually looked the most constructive coming into this week.

Here is an excerpt:

“The Nasdaq looks like it wants to break out….Now we are testing this 12270 pivot for the 6th time. The more we test a level the weaker it becomes.”

Fast forward 3 days and the Nasdaq has now closed above the Feb peak. I can hear the perma-bears now: but todays candle is hammer reversal. They would be correct, but candle formations require confirmation and closing above an area that has failed the 5 previous attempts, is not nothing. Failing back below would be more meaningful to analyze and something we will do should it occur.

We also posted this on Twitter over the weekend, implying to bears that these sorts of patterns are typically not bearish.

And 3 days later? Breakout.

If you are adhering to advice from biased experts, strategists, CNBC, twitter furus, etc, and they maintain a bearish NT posture when simple analysis suggests otherwise, then that’s on you.

If you want to learn how to be on the right side of the market, or at least not on the wrong side, we advise subscribing to our premium content.

Regardless of your fundamental bias, at the very least you will have opportunities to make profitable trades while the market chops up both perma-bear and perma-bulls.

Below are 2 more ideas we proposed recently and closed this week:

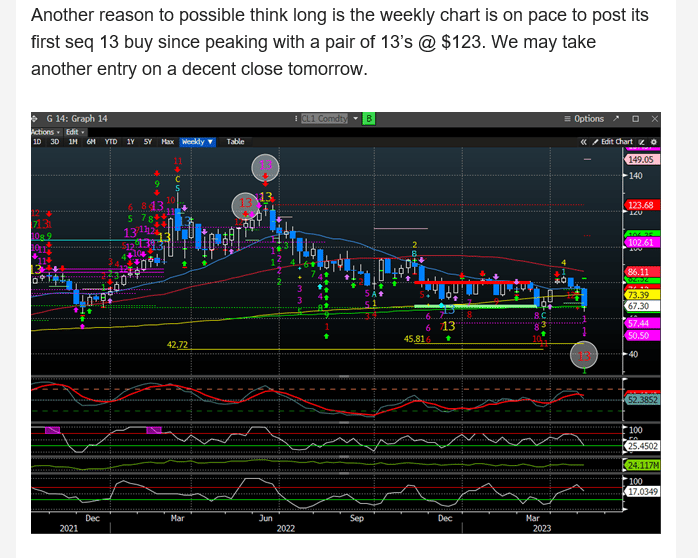

Oil for +8%. Our original entry was stopped for -2.5%, but we took another entry quickly to net out the loss and post a nice win.

Here is an excerpt from our 5/3 mid-week report:

And in our weekend report we highlighted a target where we would exit.

“Last week in our mid-week report we discussed re-entering the long oil position, that we were originally stopped out on (-2.5% loss) and it paid off. Oil traded up north of +5% on Friday. Tonight’s actin is producing a TD REI up arrow (indicating more short-term upside). There is also a propulsion up target of $73.35. Our target is $75 but should we get anything north of $73, we would call that a victory.”

In our 4/2 weekend report we presented a number of ideas. One being $DDOG.

Today we exited that trade for +22%. Here is our exit alert on Twitter.

If you are sick of losing in the market, our premium analysis below can help.