The bears just keep getting pounded. The amount of rhetoric I have read over the last few days that Powell was going to be hawkish in his speech today was mind numbing. Professional investors alike were pounding puts into the event. This is a lesson to all those who think they know what's going to happen; well, you don't. And neither do we.

We honestly didn't think much going into the event and thought tomorrow's PCE and payroll numbers on Friday were going to be more important. Why the masses assumed Powell would change his tone from 4 weeks ago is a bit perplexing. Not much has changed outside of the stock market going up.

We've talked incessantly about the powers of seasonality and cyclicality, and to ignore them is foolish. Since the start of the post CPI Oct rally, the market has done extremely well. You didn't even have to postulate what and how the events would unfold, you only had to recognize the massive reversal candle post CPI could be the start of something meaningful. This was a market structure change and something we called out to our readers. Being on the right side of the market can save you a lot of heartache and anguish.

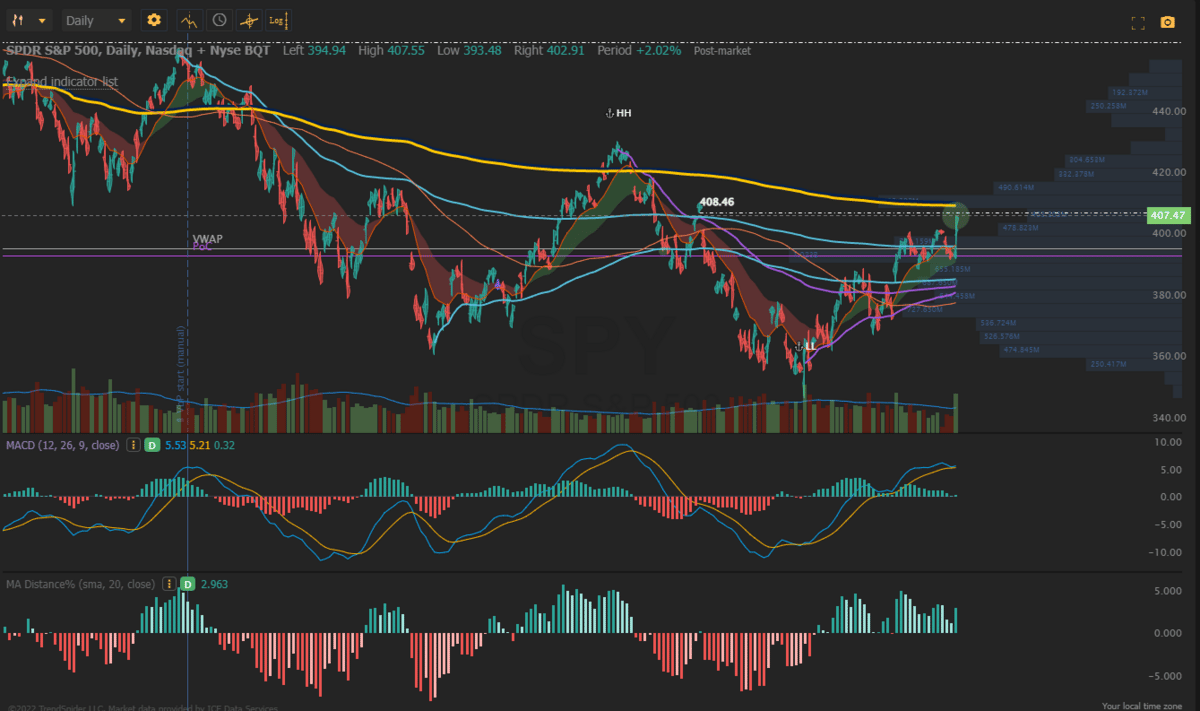

The SPX is now up +17% since the CPI low print. Even the Nasdaq is up +13%. The standout is the Dow up +20%.

We posted this publicly on Twitter last week and in our report over the weekend as a level to target for upside SPY continuation.

Fast forward to today.... Target achieved.

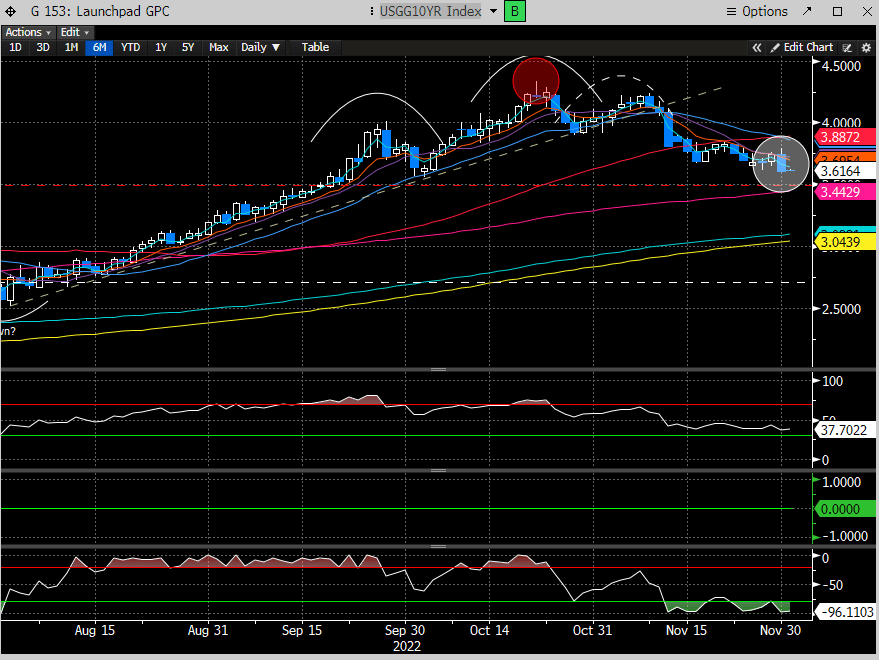

We were the only one's as far as I have seen that called the top in yields into Nov. We also wrote over the weekend to expect more weakness.

"(10 yr) ...looking quite vulnerable to another step down"

Today the 10 yr yield with a bearish engulfing candle.

The amusing thing about all this prognosticating about the end of crypto, is that Bitcoin is breaking UP out of this bearish consolidation.

What does Bitcoin say about risk assets in the near term in the face of such a negative backdrop?