We have been a bit out of pocket this week but wanted to briefly opine on the market action. As we stated in our weekend report, sentiment and being heavily OS, are powerful combinations. This is why we have been advocating to cover shorts and position long, but only if the SPX can remain above last week's low. The SPX peeked below that low 2 days ago but recovered intraday. False breakdowns can be powerful, and since, we have seen the SPX move higher to test the 50 day SMA region.

It doesn't take much to see a bout of short covering. In this case, it seems the collapse of oil below a key threshold is sparking enthusiasm around inflation receding.

And our weekly chart is showing signs of life around the "potential" right shoulder area. Friday's trade will be important.

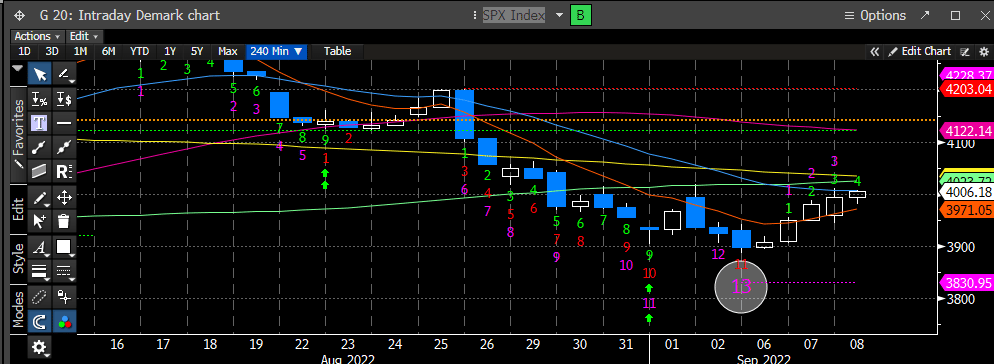

In our report last weekend, we discussed the ST DeMark signals lining up and supporting a possible counter trend move. Here is that combo 13 buy on the 4 hour chart that printed at the low.

And here is the Nasdaq with the same signal.

But is this a head fake before an eventual turn down?

To read the rest of our analysis, please consider subscribing below for $19.95/month. We have nailed every major swing in the market since the June low. We are challenged to find a more accurate newsletter at this price. We will be raising our prices soon, so we suggest subscribing now to lock in the low rate.